As part of Mobile World Investment Corporation’s (MWG) 2030 strategy, Bach Hoa Xanh (BHX) stands as a key growth driver and is slated for an independent listing at an opportune time.

The rapid rise of a new consumer generation with evolving shopping behaviors is reshaping the market. Customers now prioritize convenience, speed, and health safety, driving a shift from traditional to modern retail channels. MWG’s leadership sees this as the moment for BHX to accelerate its 2030 vision.

However, achieving this goal is no small feat. A recent analysis by Mirae Asset highlights the challenges ahead for BHX’s IPO. While store operations have improved, profitability remains slim and heavily reliant on the success of expansion efforts. Plans to open more stores further heighten profit risks.

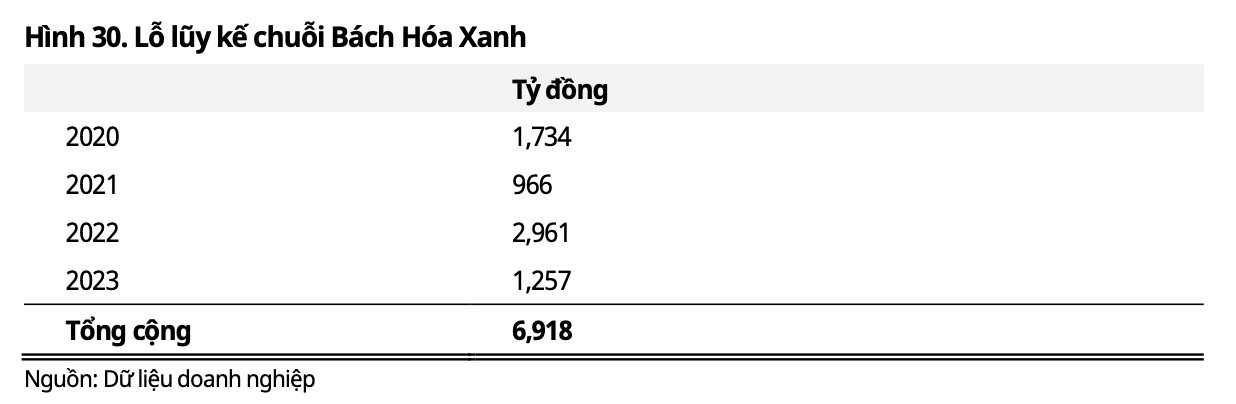

Another critical factor is BHX’s accumulated losses of approximately VND 6.9 trillion as of Q3/2025. To prepare for a 2028 IPO, the company must demonstrate a clear path to reducing these losses and sustaining stable profits.

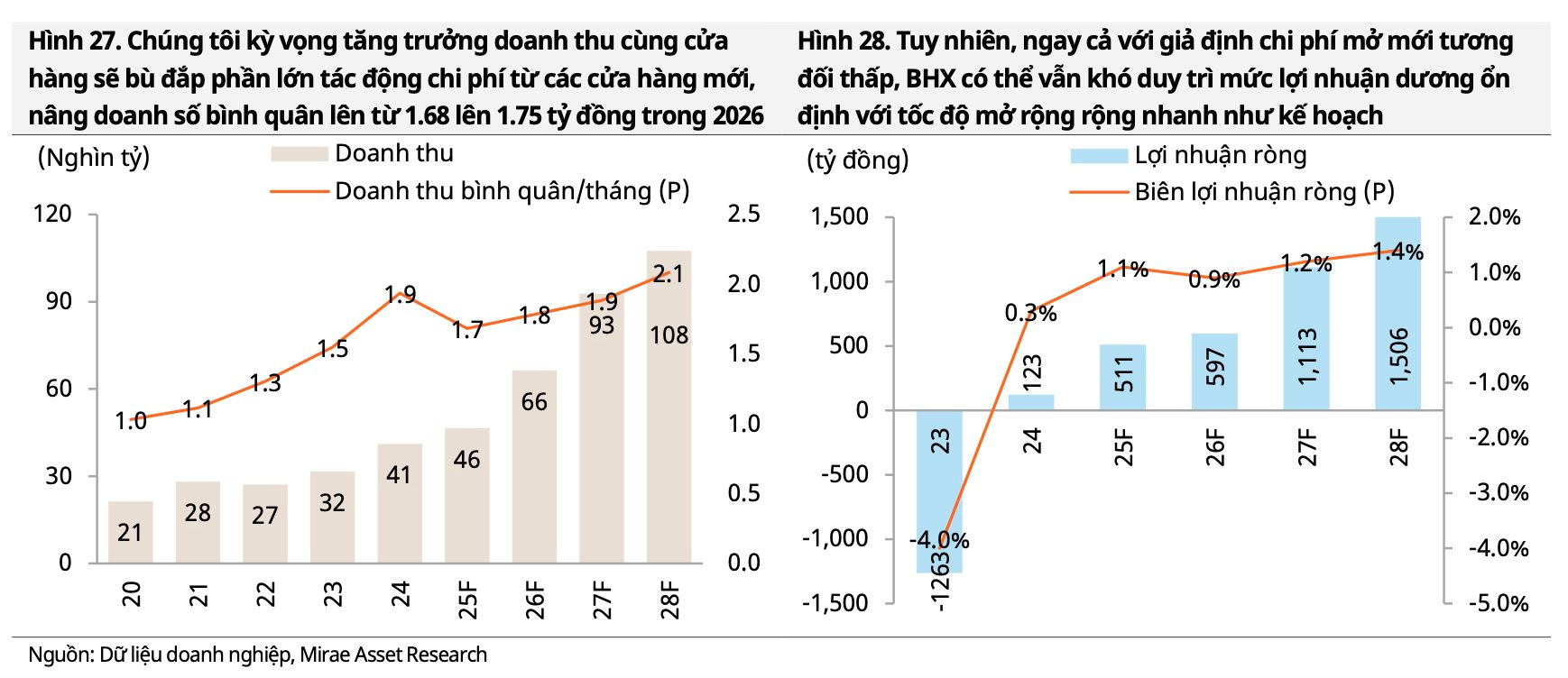

Mirae Asset estimates that even under optimistic scenarios, net profit margins will remain low and vulnerable to costs associated with rapid store expansion.

Given current conditions, Mirae Asset suggests that the most viable timeframe for BHX to prove sustainable profitability is 2027–28F. By then, the new network should stabilize, cost structures will be fixed, and revenue growth will sufficiently offset fixed costs.

Operations in Southern Vietnam continue to show efficiency improvements, with profit margins rising to 3.5–4.5% in 3Q25. This reflects stores moving past initial investment phases, optimizing costs, and leveraging fixed costs as revenue grows steadily. Since food demand normalized in 2022, BHX has maintained high single- to low double-digit growth, gradually improving profitability.

Since the year’s start, BHX has opened 600 new stores, half of which are in Central Vietnam, where foot traffic is lower. As a result, average store revenue hasn’t yet matched the scale of new store growth. Positively, investment costs in this region are lower, with breakeven points at just VND 1.3–1.4 billion per month. Stores opened in the first half of 2025 have already turned profitable at the store level, according to MWG’s recent earnings disclosures.

Looking ahead, BHX plans to expand into Northern Vietnam, aiming to add approximately 1,000 stores by 2026. Mirae Asset’s forecast projects 800 new stores in 2026F and 1,000 in 2027F.

While MWG targets average monthly revenue of VND 2.1–2.5 billion per store, Mirae Asset is more conservative, forecasting VND 1.7 billion in 2025, rising to VND 1.8/1.9 billion in 2026F/2027F. These projections account for dilution from new stores, partially offset by stable consumer habits in the North compared to the Central region, where WinMart has a strong customer base. Rapid expansion will keep profit pressures high.

Even with optimistic assumptions about initial investment costs in the North—where breakeven points are estimated at VND 2.2 billion per month due to higher rental and DC expenses—Mirae Asset believes BHX will struggle to achieve sustainable net profit margins in FY25 to FY26F. During this period, the chain’s performance will hinge on expansion speed and investment efficiency in the North.

Mirae Asset projects BHX’s revenue to grow at a CAGR of 24.8% through 2028, with net profits remaining positive but margins staying minimal.

Seizing Opportunities Amid Regulatory Scrutiny: MWG CEO on Tax, Counterfeit, and Substandard Goods Crackdown

The MWG Group’s mini-supermarket chain is set to launch its first store in Ninh Binh this November. According to MWG’s CEO, Mr. Vu Dang Linh, this food retail system has the potential to open over 1,000 stores annually in the upcoming period.