Following a robust rally, market sentiment turned positive, propelling the VNINDEX to a modest gap-up at the opening of the November 27 session. However, trading volume waned as selling pressure intensified near resistance levels, particularly in the afternoon session. Despite this, the VN-Index closed with a gain of 3.96 points (+0.24%), settling at 1,684.32 points. Foreign investors, after a net buying spree, reversed course to net sell VND 6 billion across the market.

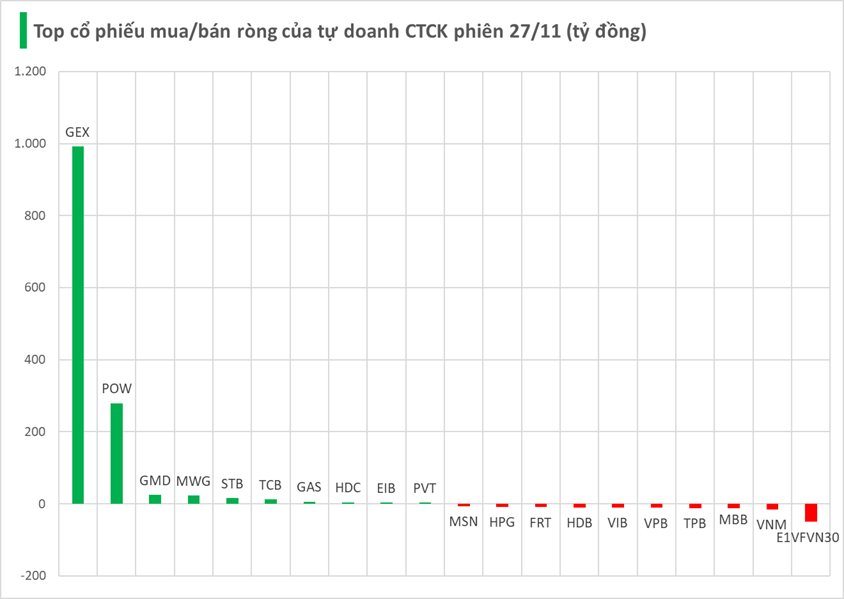

Securities firms’ proprietary trading desks net bought VND 671 billion on HOSE.

Specifically, GEX led the net buying activity with VND 992 billion, followed by POW (VND 279 billion), GMD (VND 25 billion), MWG (VND 23 billion), STB (VND 16 billion), TCB (VND 12 billion), GAS (VND 6 billion), HDC (VND 4 billion), EIB (VND 3 billion), and PVT (VND 3 billion) – all prominently featured in securities firms’ net buying lists.

Conversely, the most significant net selling was observed in E1VFVN30, totaling VND -50 billion, trailed by VNM (VND -16 billion), TPB (VND -12 billion), MBB (VND -12 billion), and VPB (VND -11 billion). Other notable net sells included VIB (VND -10 billion), HDB (VND -10 billion), HPG (VND -9 billion), FRT (VND -9 billion), and MSN (VND -6 billion).

Stock Market Update November 27: Widespread Stock Declines, One Bank Stock Surges to a Striking Purple

The stock market session on November 27th closed in the green, yet underlying dynamics painted a less optimistic picture.

Vietstock Daily 28/11/2025: Is Market Polarization Returning?

The VN-Index trimmed its gains, forming a Long Upper Shadow candlestick pattern, signaling heightened profit-taking pressure as the index tests its September 2025 peak (around 1,695-1,711 points). Nevertheless, the short-term outlook remains positive, supported by the MACD indicator’s continued upward trajectory and its recent crossover above the zero line.