According to regulations, a company must meet two fundamental criteria to be classified as a “public company.” First, both its paid-up capital and equity must be at least VND 30 billion. Second, a minimum of 10% of voting shares must be held by at least 100 investors who are not major shareholders.

In terms of capital, VBG faces no obstacles. The company’s chartered capital stands at VND 86 billion, significantly exceeding the regulatory minimum of VND 30 billion.

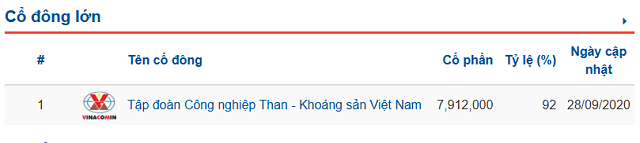

The challenge lies in its ownership structure. As of the shareholder list finalized on August 26, 2025, the Vietnam National Coal and Mineral Industries Group (TKV) holds 92% of VBG’s chartered capital. The remaining 8% is distributed among 389 voting shareholders, falling short of the required 10% threshold.

TKV controls 92% of VBG‘s capital

|

If VBG fails to meet these conditions, particularly the requirement for external investor ownership, by January 1, 2026, it risks losing its public company status. Alternatively, the General Meeting of Shareholders may proactively resolve to relinquish this status before the deadline, rather than awaiting regulatory action.

Vietnam Northern Geology – TKV, a geological exploration unit within the Vietnam Coal and Mineral Industries Group, was established in 2010 through the consolidation of multiple specialized units. Renamed in 2014, it underwent corporatization as part of TKV’s restructuring plan. The corporatization decision, issued in 2015, transitioned the company to a joint-stock model, allowing external shareholder participation while maintaining state control through TKV.

VBG’s shares have been traded on the UPCoM since 2017. However, liquidity remains virtually non-existent. The share price hovers around VND 4,800, unchanged since 2023. This indicates that despite its public company designation, VBG’s shares see minimal market activity, with limited external investor engagement.

The company’s primary revenue source is its parent group. While revenue has shown recent signs of recovery after a decline, profitability remains modest. In 2024, VBG reported revenue of VND 196 billion and a net profit of VND 2.1 billion, a humble return on its capital scale.

Profitability further dwindled in the first half of 2025. Despite six-month revenue of approximately VND 50 billion, pre-tax profit stood at a mere VND 45 million, falling far short of the annual target of VND 2.5 billion.

| VBG shares have lacked liquidity for an extended period |

– 18:28 28/11/2025

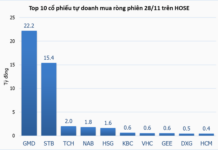

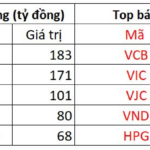

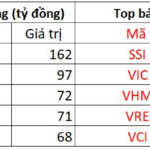

Foreign Investors Reduce Net Selling, Counter-Trend with Hundreds of Billions Invested in a Banking Stock

Foreign investors’ trading activity remains a drag on the market, with a net sell-off of approximately VND 400 billion. However, this figure marks a significant decrease compared to the net selling of thousands of billions of dong witnessed in the early sessions of the week.