TNG Viet Duc Branch – Son Cam 1 Industrial Cluster, Thai Nguyen City

|

The Board of Directors of TNG has approved a credit limit of VND 500 billion from BIDV – Thai Nguyen Branch to implement the infrastructure project for the Son Cam 1 Industrial Cluster. The loan has a term of 84 months, with a 12-month grace period on principal repayment. The company will secure the loan by mortgaging all assets formed from the project and pledging deposit contracts.

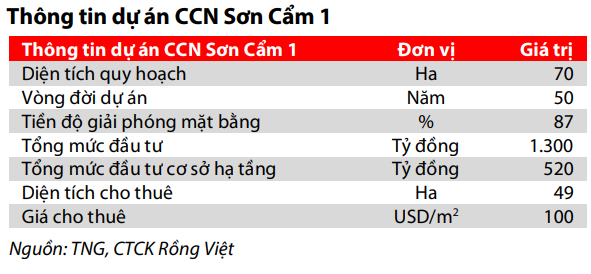

According to the 2024 year-end update report by Rong Viet Securities (VDSC), TNG aims to attract textile and garment auxiliary enterprises to invest in Thai Nguyen, developing Son Cam 1 Industrial Cluster as an eco-industrial park. The project spans nearly 70 hectares with an estimated total investment of VND 1,300 billion, comprising two main components: factory construction on over 21 hectares and land development for lease on over 49 hectares.

|

TNG commenced operations at the Viet Duc factory in April 2024 and plans to complete the relocation of the Viet Thai factory by December 2024. The Viet Duc factory has a total investment of over VND 400 billion. For the leaseable area, TNG is developing infrastructure at an expected rate of USD 100/m², while TNG Land handles the leasing of factory workshops.

TNG has completed 87% of land clearance, with compensation costs totaling VND 553 billion. The company is currently constructing infrastructure on the allocated land, with a total investment of VND 520 billion. VDSC assumes the remaining 47 hectares will be fully occupied between 2025 and 2034, with rental prices growing at an average annual rate of 1%, reaching USD 110/m² by 2034.

High capital demand and debt pressure

From 2018 to 2023, TNG invested VND 2,800 billion in factory construction and real estate projects, along with annual equipment upgrades costing VND 70-80 billion. VDSC projects that TNG will require an additional VND 300 billion to complete the Son Cam 1 Industrial Cluster between 2024 and 2028, in addition to maintaining a 1% revenue investment in machinery replacement.

TNG currently has the highest leverage ratio among domestic textile companies. By the end of Q3/2025, total liabilities reached over VND 4,748 billion, a 21% increase from the beginning of the year. Financial debt exceeds VND 2,600 billion, with long-term debt accounting for over VND 2,200 billion, up 38%.

In recent times, TNG has continuously expanded its borrowing scale and increased capital to meet working capital and investment needs. In September 2025, the company issued over 6.1 million ESOP shares at VND 10,000 per share, raising over VND 61 billion. In August 2025, the Board approved a maximum credit limit of VND 650 billion with VietinBank Thai Nguyen.

Previously, in June 2025, TNG approved a credit limit of VND 1,200 billion with BIDV Thai Nguyen. In late 2024, the company also issued VND 400 billion in bonds to institutional investors.

– 14:58 27/11/2025

Tấn Đức Eastern Park – JSC: Elevating Excellence in a Premium Project

Tấn Đức Eastern Park – JSC is rapidly emerging as the focal point of the Vạn Xuân – Phổ Yên real estate market, thanks to its unique combination of three rare attributes: a prime central location, cohesive planning, and fully completed products. The project is poised to become a new landmark in the Vạn Xuân – Phổ Yên property market following the merger.

New Orchard Thai Nguyen: Prime Location in 6 Industrial Zones, Priced at Just Over 5 Billion VND

In the wake of its consolidation, Thai Nguyen has emerged as a new FDI hub in the North, boasting a dense network of industrial zones. Amid this transformative landscape, New Orchard Thai Nguyen is poised to become the region’s premier commercial and service epicenter.