On November 26th, foreign investors net bought VND 579 billion, marking the first net buying day after three consecutive days of net selling. However, it’s premature to celebrate this as a trend reversal. The broader pattern of foreign divestment persisted throughout November 2025, unaffected by market fluctuations.

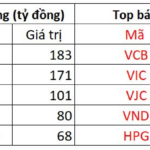

During the same day, the strongest net selling pressure was observed in VCB and VIC, with values of VND 201 billion and VND 196 billion, respectively. Conversely, the banking stocks SHB and VPB led net buying, with values of VND 183 billion and VND 172 billion. Additionally, VIX saw net buying of VND 101 billion, while its market price hit the upper limit.

| Foreign Trading Trends in November 2025 |

| Top Stocks with Highest Net Foreign Trading on November 26th |

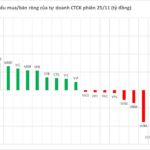

| Proprietary Trading Trends on HOSE in November |

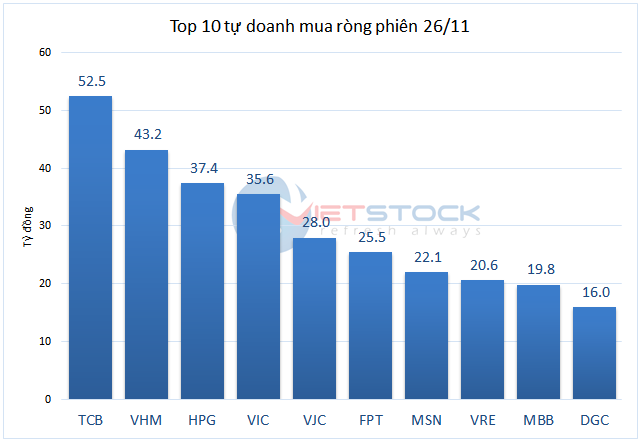

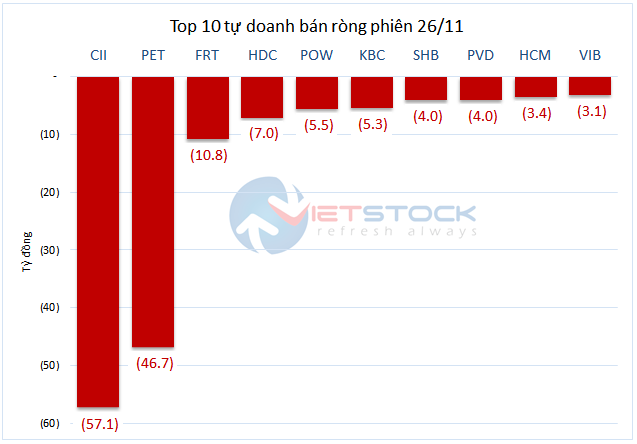

Similarly, securities companies’ proprietary trading desks net bought nearly VND 252 billion on HOSE.

Among these, TCB saw the strongest net buying at nearly VND 53 billion, while CII experienced the heaviest net selling at over VND 57 billion.

– 18:23 26/11/2025

Vietstock Daily 28/11/2025: Is Market Polarization Returning?

The VN-Index trimmed its gains, forming a Long Upper Shadow candlestick pattern, signaling heightened profit-taking pressure as the index tests its September 2025 peak (around 1,695-1,711 points). Nevertheless, the short-term outlook remains positive, supported by the MACD indicator’s continued upward trajectory and its recent crossover above the zero line.

Foreign Block Buys Nearly VND 600 Billion as VN-Index Surges: Which Stocks Were Scooped Up the Most?

Foreign investors’ trading activity has been a significant boost to the market, with a net buying value of approximately 579 billion VND. This influx of investment highlights their confidence in the market’s potential and serves as a positive indicator for future growth.

Vietstock Daily 27/11/2025: Is Buying Momentum Making a Strong Comeback?

The VN-Index surged powerfully, decisively breaking through the 50-day SMA resistance. However, trading volume must surpass the 20-day average to solidify the short-term uptrend. The MACD indicator maintains a strong buy signal and is approaching the zero line. Should it cross above this threshold in upcoming sessions, the short-term outlook will become even more optimistic.