At the 2025 Autumn Economic Forum, Prime Minister Pham Minh Chinh tasked Ho Chi Minh City (HCMC) with promptly issuing a detailed action plan to fulfill the forum’s commitments. The city is also to pioneer a “sandbox” model for green economy, green finance, and smart urban development, aligned with the launch of the International Financial Center.

As the nation’s economic leader, HCMC faces a significant responsibility, requiring robust legal frameworks, rule of law, and effective implementation.

A Clear, Monitorable Action Plan is Essential

From a legal and economic perspective, the “sandbox” concept does not imply operating outside the law. Instead, it demands a flexible, open yet transparent legal framework with clear accountability. For green economy and finance sandboxes to gain public trust, citizens’, businesses’, and investors’ rights and interests must be central, protected by specific, enforceable, and controllable rules.

HCMC is well-positioned to lead. It contributes significantly to national GDP, budget, and trade; hosts dynamic private and foreign-invested enterprises; and is home to financial institutions, research organizations, and universities. Emerging trends—from digital and sharing economies to fintech—have consistently originated here before spreading nationwide.

However, without timely legal mechanisms for green economy and finance, HCMC risks falling behind as regional financial hubs race to attract capital and technology aligned with net-zero emissions goals.

The International Financial Center is integral to HCMC’s vision. Photo: N.TIẾN |

To become a true “sandbox,” HCMC must first develop a structured action plan outlining pilot areas, legal objectives, tools, timelines, and monitoring mechanisms.

Five priority areas could be: Green infrastructure and urban development (clean public transport, green logistics, energy-efficient buildings); green financial products (green bonds, credits, infrastructure funds, carbon market services); fintech and digital services for green transactions; data-driven smart urban management; and administrative reforms emphasizing digitization, reduced physical contact, and enhanced oversight.

Each area requires a defined “legal sandbox”: specifying pilot scope, participants, and risk limits. For green bonds, HCMC could propose standards for “green” criteria, disclosure, capital monitoring, issuer accountability, and penalties for misuse.

For green credits in energy-efficient or renewable urban projects, co-financing, guarantees, and risk-sharing between banks, funds, and local development agencies could be proposed, with strict appraisal standards to prevent greenwashing.

Transparency: The Cornerstone of Sandboxes

Policy sandboxes cannot operate in secrecy. To gain consensus, all mechanisms must publicly outline participation criteria, pilot conditions, timelines, monitoring, and evaluation metrics.

Participant selection must be based on clear criteria, avoiding favoritism. The City Council, Fatherland Front, professional associations, and media play a critical role in ensuring fair competition, not backroom deals for special interests.

Developing legal frameworks for green economy and finance cannot be siloed. These areas intersect multiple legal systems: investment, business, environment, land, housing, securities, banking, energy, data, and cybersecurity.

Without unified coordination, regulations may overlap or conflict, complicating enforcement. HCMC needs a strong institutional focal point—a task force or steering committee under the People’s Committee—to synthesize, advise, coordinate with central ministries, and ensure accountability to the City Council and citizens.

The International Financial Center is a critical component. If green economy is the direction and green finance the tool, the Center is the “soft infrastructure” connecting investors to high-value, environmentally positive projects.

However, the Center can only operate to international standards with compatible legal mechanisms: disclosure rules, anti-money laundering, fraud prevention in green finance, dispute resolution, and commercial arbitration. Sandbox development and Center operations must progress in tandem.

HCMC must implement a series of solutions to meet its mandate. Photo: N.TIẾN |

Legal frameworks must also protect citizens’ rights. In green finance, fintech, and digital services, oversight is critical to prevent risks: insufficient information, complex contracts, knowledge gaps, and prolonged disputes.

Consumer protection laws and e-transaction regulations must be integrated into pilots. Clear complaint, mediation, arbitration, litigation, and compensation mechanisms are essential.

Data governance is non-negotiable. Smart cities and green finance rely on big data: transactions, behavior, environment, energy, planning, and credit. Rules must define data collection, storage, sharing, access rights, and breach penalties.

Without these, privacy violations are inevitable. As a smart city leader, HCMC must balance data utilization with human rights protection.

Perfecting legal frameworks for HCMC’s green economy and finance sandbox is crucial for its pioneering role. Challenges are significant, but so are opportunities. With timely, transparent action plans, HCMC can set a national benchmark for dynamic, equitable, and sustainable development.

|

Media: A Driver of Oversight and Critique Media and civil society are vital to this process. Legal publications like HCMC Law Newspaper must inform, critique, and safeguard justice. As HCMC implements its sandbox, media can educate citizens, clarify rights, expose implementation gaps, and highlight misuse or loopholes. |

Assoc. Prof., Dr. Ngo Tri Long, Economic Expert

– 06:14 28/11/2025

Ho Chi Minh City Achieves 63% Compensation Fund Disbursement in 2025

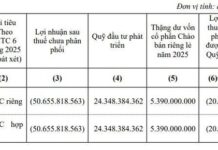

In 2025, Ho Chi Minh City was allocated a compensation budget of 56.562 trillion VND across 284 projects. To date, the city has successfully disbursed 35.806 trillion VND of this funding.

Contrasting Scenes at Ho Chi Minh City’s Iconic Twin Towers: One Bustling, the Other Desolate

If Landmark 81 is bustling with high rental prices, Bitexco Tower is increasingly deserted, with many shops withdrawing over the years.