2025 Milestone: Realizing the Goal of Market Upgrade

After years of institutional reforms and legal framework enhancements guided by the Government’s Decision No. 1726/QĐ-TTg, Vietnam’s stock market has successfully achieved its goal of “reaching the global stage.” FTSE Russell’s decision not only acknowledges technical compliance but also signals Vietnam’s new position on the global financial map.

The reclassification from Frontier to Emerging market is expected to have a dual impact: expanding capital inflows and enhancing market valuation.

Quantitative analyses reveal a highly optimistic capital inflow outlook. According to the World Bank , this upgrade could attract up to $25 billion in new international investment by 2030, provided that critical reforms continue and the investment environment remains stable.

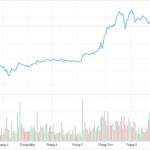

Beyond capital inflows, the upgrade creates significant potential for asset re-rating. VinaCapital has projected that the VN-Index could rise by 15-20% post-upgrade. This is crucial for businesses as higher valuations reduce the cost of capital, enabling cheaper and easier access to funds for expansion, R&D, and M&A activities.

New Institutional Investor Preferences: Rigorous and Sustainable

However, the excitement of the upgrade should not overshadow a harsh reality: Emerging market capital is not easily obtained. Institutional investors, the true “sharks” of developed markets, apply stringent screening criteria.

Nguyễn Hoài Thu , CFA, Deputy CEO of VinaCapital, has repeatedly emphasized: “Institutional investors demand market depth and sustainable development.” Unlike individual or speculative investors driven by short-term emotions, institutional investors prioritize long-term safety and growth.

They seek companies committed to international corporate governance standards (e.g., OECD principles), not just short-term financial metrics like quarterly revenue or profit. For them, a high-profit company with weak governance is a “value trap.” Thus, the market’s upgrade does not guarantee capital inflows to specific stocks unless companies meet governance standards.

Corporate Governance Reality: Gap Between Commitment and Execution

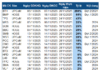

Despite significant progress in governance awareness over the past decade, Vietnam still lags regional standards. The 2024 ASEAN Corporate Governance Scorecard (ACGS) reveals Vietnam’s scores are notably lower than Thailand, Malaysia, and Singapore. While peers adopt ESG standards and standardized English reporting, many Vietnamese firms focus on minimal compliance.

This gap is evident in PwC Vietnam reports: 80% of surveyed companies have ESG commitments, but execution, especially in Governance (G), is hindered by opaque structures, lack of independent board members, and inconsistent risk management and reporting systems.

This deficiency creates an invisible but strong barrier to foreign capital. Dominic Scriven , Chairman of Dragon Capital, notes: “You can’t lose with a portfolio of ESG-compliant companies.”

Financial institutions increasingly allocate capital to sustainable assets, exposing non-compliant companies to exclusion risk . Capital may bypass weaker firms for more reliable options.

Shifting Mindset: From “Compliance” to “Breakthrough”

In the context of global financial integration, corporate governance must be redefined. It should not be seen as a compliance burden but as a value driver.

The upcoming AF8 Annual Forum , organized by the Vietnam Institute of Directors (VIOD), focuses on “Breakthrough Boards,” emphasizing “Trust and Reputation” as critical non-financial assets.

In a volatile global business environment, investor trust is a core competitive advantage. Breakthrough boards transform transparency into trust and trust into long-term shareholder value. “Trust” is now as important as traditional financial metrics, determining long-term capital access.

Conclusion: The Ticket and Prerequisites

By 2025, Vietnam’s market upgrade provides a “ticket” to the global financial arena. However, to participate in the “billion-dollar capital feast,” companies must prove their capabilities.

Corporate governance is now a must-have for competitiveness. The AF8 Forum, with participation from regulators (SSC), international organizations (OECD, IFC), and major funds, aims to redefine governance standards for this new phase.

The formation of the ACGS 20 pioneer group, committed to regional standards, is a crucial step. These “lead geese” will help close the governance gap, realizing the potential of our new Emerging market status.

BlackRock’s Aggressive Silver Acquisition Sparks Expert Predictions of Prices Doubling

Since the beginning of 2025, the world’s largest silver fund, managed by BlackRock, has invested $1.7 billion to acquire approximately 32 million ounces of silver (1,000 metric tons), bringing its total holdings to over 500 million ounces (roughly 15,600 metric tons).