Rare earth elements—a group of minerals critical to modern technology—have become a focal point in global strategic competition. From electric vehicle (EV) motors and wind turbines to smartphones and precision navigation systems, advanced industries rely heavily on these unique resources.

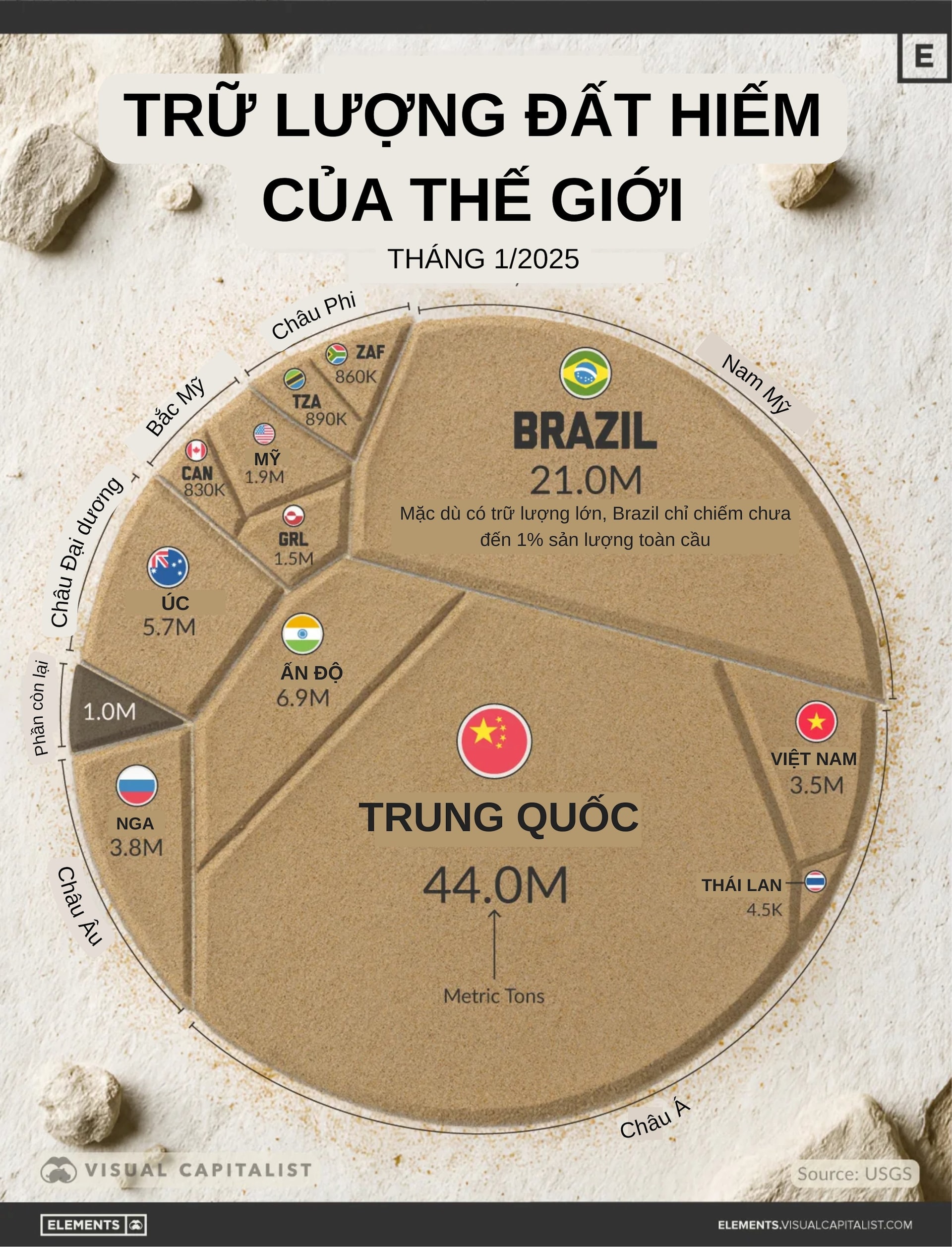

The 2025 rare earth reserves map, based on data from the United States Geological Survey (USGS), highlights the unusually high concentration of these resources, often referred to as the “backbone” of energy transition and digital industrialization.

China Controls Nearly Half of Global Reserves

The global distribution of rare earths is highly uneven. China leads with 44 million tons, accounting for approximately 48% of the world’s known reserves, totaling 91.9 million tons. This strategic advantage positions Beijing prominently in the intensifying competition for technology and renewable energy.

Brazil follows with 21 million tons, or 23% of global reserves. Much of its resources come from ion-clay and hard-rock deposits, still in early stages of extraction and processing. India (6.9 million tons) and Australia (5.7 million tons) rank next, while Russia (3.8 million tons) and Vietnam (3.5 million tons) hold larger reserves than the United States. Collectively, the top six nations control roughly 80% of known rare earth reserves.

This supply imbalance underscores global competition: a handful of countries dominate resource ownership, while others with high demand lack significant domestic supplies.

Advanced Economies: High Demand, Limited Resources

The United States, with significant needs for defense, semiconductors, and clean energy, holds only 1.9 million tons of rare earths—just 2% of global reserves. This reliance on imports, particularly from China, spans mining, refining, and intermediate processing.

In recent months, the Trump administration has announced measures to reduce this dependency: funding new domestic mining projects, streamlining permitting processes, and fostering alliances to diversify supply chains.

In October, President Donald Trump and Chinese President Xi Jinping agreed to reduce tariffs in exchange for stable rare earth exports to the U.S., highlighting the resource’s strategic importance.

Emerging Players in the Arctic and Africa

Beyond traditional rare earth powers, new regions are emerging as potential suppliers. Canada holds approximately 0.83 million tons, while Greenland—strategically located near the European Union (EU)—possesses about 1.5 million tons. With infrastructure investment, Greenland could become pivotal to Europe’s resource autonomy.

In Africa, Tanzania (0.89 million tons) and South Africa (0.86 million tons) are emerging growth hubs, with projects aimed at enhancing processing capabilities rather than raw exports.

As the world accelerates its shift to clean energy and digital infrastructure, rare earth demand is expected to surge. Any shifts in supply—from trade tensions to policies in reserve-rich nations—could significantly impact global supply chains.

The 2025 rare earth reserves map thus reflects not only natural resource distribution but also the geopolitical standing of nations in the 21st-century technology race.

Unveiling Rare Earth Alternatives: A Global Lifeline for the Electric Vehicle Industry Amidst China’s Supply Crunch?

Global automakers are actively diversifying their rare earth supply chains beyond China while simultaneously advancing technologies that reduce or eliminate the need for these critical materials.