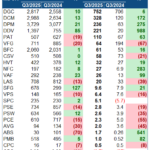

According to data from VietstockFinance, as of November 7, 2025, 1,032 companies listed on the HOSE, HNX, and UPCoM recorded a net revenue of nearly 1.1 trillion VND in Q3 2025, a 5% increase compared to the same period last year. Meanwhile, net profit surged by over 25%, reaching more than 80.06 trillion VND. A total of 876 companies reported profits, significantly outnumbering the 156 companies that reported losses.

Source: VietstockFinance

|

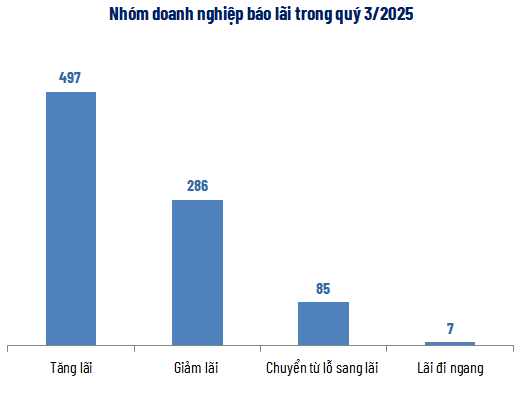

Among the profitable companies, 497 experienced growth, 286 saw profit declines, and 85 turned losses into profits. Only 7 companies remained unchanged, and one company, CTCP Vận tải Đường sắt – TRV, had no comparable data.

Source: VietstockFinance

|

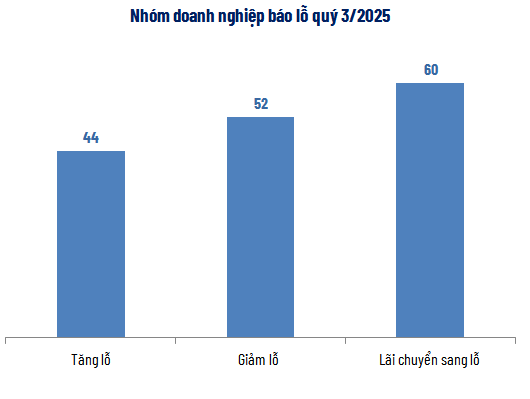

On the other hand, 52 companies reduced their losses, 44 reported heavier losses, and 60 shifted from profit to loss.

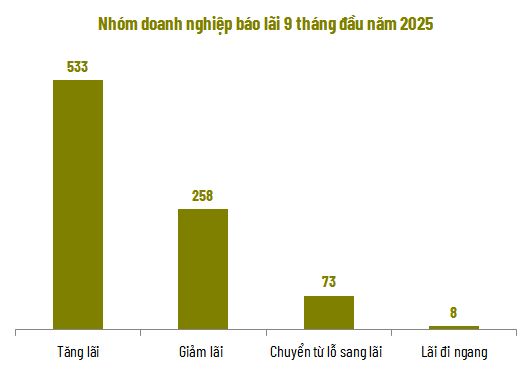

For the first nine months of 2025, 1,034 listed companies achieved a cumulative net revenue of nearly 3.2 trillion VND, an 11% increase year-on-year. Net profit soared by 33%, reaching almost 240 trillion VND. Overall, 873 companies were profitable, while 161 reported losses.

Source: VietstockFinance

|

Of these, 533 companies grew, 258 saw profit declines, 73 turned losses into profits, and 8 remained unchanged. CTCP Vận tải Đường sắt – TRV again had no comparable data.

Source: VietstockFinance

|

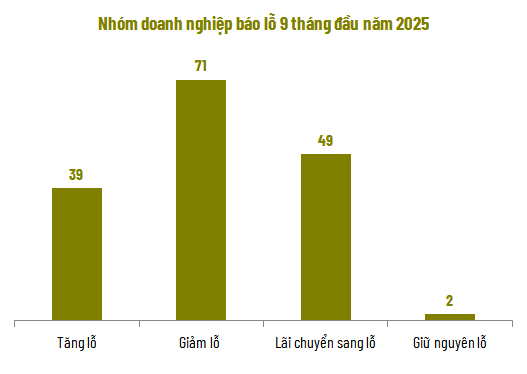

Among the loss-making companies, 71 reduced their losses, 39 reported heavier losses, 49 shifted from profit to loss, and 2 maintained their loss levels.

Profit Leaders: VEF Surpasses Many Giants

Source: VietstockFinance

|

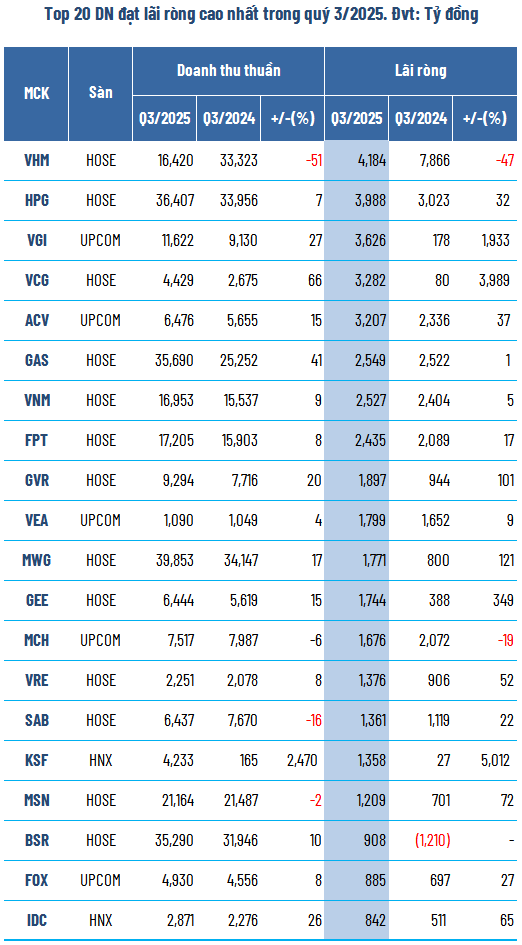

Similar to the previous quarter, Vinhomes (HOSE: VHM) retained its position as the most profitable company in Q3 2025, with a net profit of over 4.184 trillion VND, despite a decline due to reduced net revenue.

In second place, Hòa Phát (HOSE: HPG) reported a net profit of nearly 4 trillion VND, a 32% increase year-on-year, thanks to an improved gross profit margin from 14% to 17% as cost of goods sold rose more slowly than revenue.

Source: VietstockFinance

|

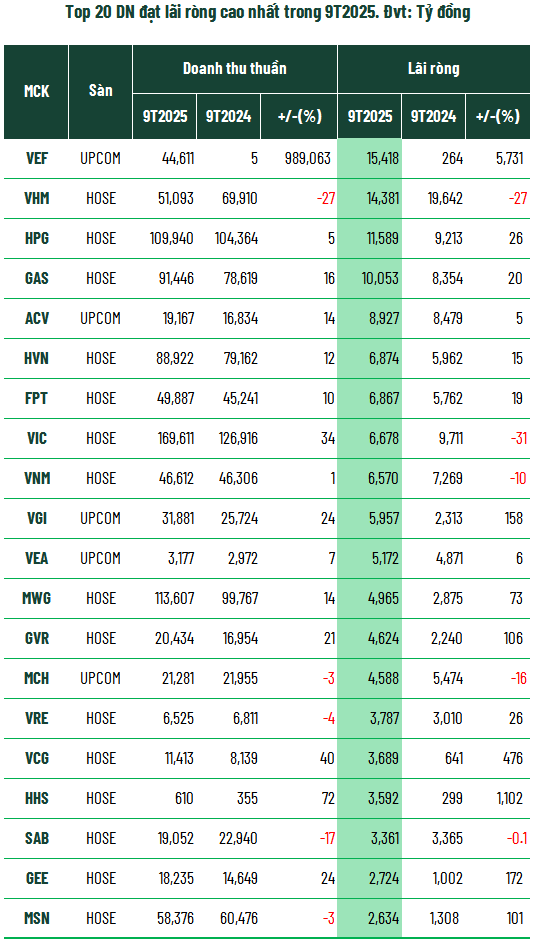

Although not in the top 20 most profitable companies in Q3 2025, CTCP Trung tâm Hội chợ Triển lãm Việt Nam (UPCoM: VEF), a Vingroup subsidiary, topped the market in net profit for the first nine months, reaching 15.418 trillion VND, 58 times higher than the same period last year.

In Q1 2025 alone, VEF recorded a record profit of nearly 14.9 trillion VND, surpassing the combined profits of many years and equivalent to 93% of the annual plan. This remarkable result was primarily driven by revenue from transferring part of the Vinhomes Global Gate project and a significant increase in financial revenue from business collaborations.

Companies with Extreme Profit Growth: What Sets Them Apart?

Source: VietstockFinance

|

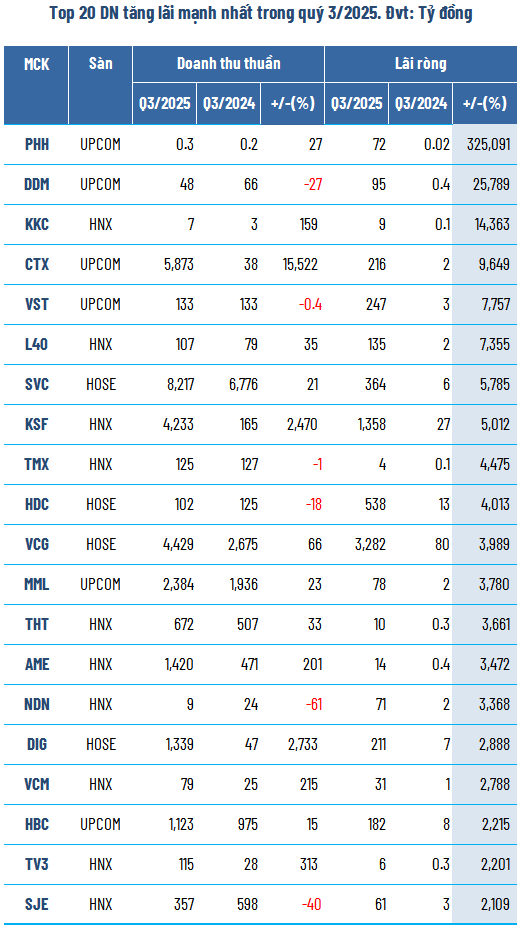

CTCP Hồng Hà Việt Nam (UPCoM: PHH) led the market in profit growth in Q3 2025, with a net profit of nearly 72 billion VND, over 3,250 times higher than the modest 22 million VND in the same period last year.

Notably, this surge was not from core business operations but primarily from an 889-fold increase in financial revenue, reaching nearly 85 billion VND, due to the transfer of shares in CTCP Tứ Hiệp Hồng Hà.

Source: VietstockFinance

|

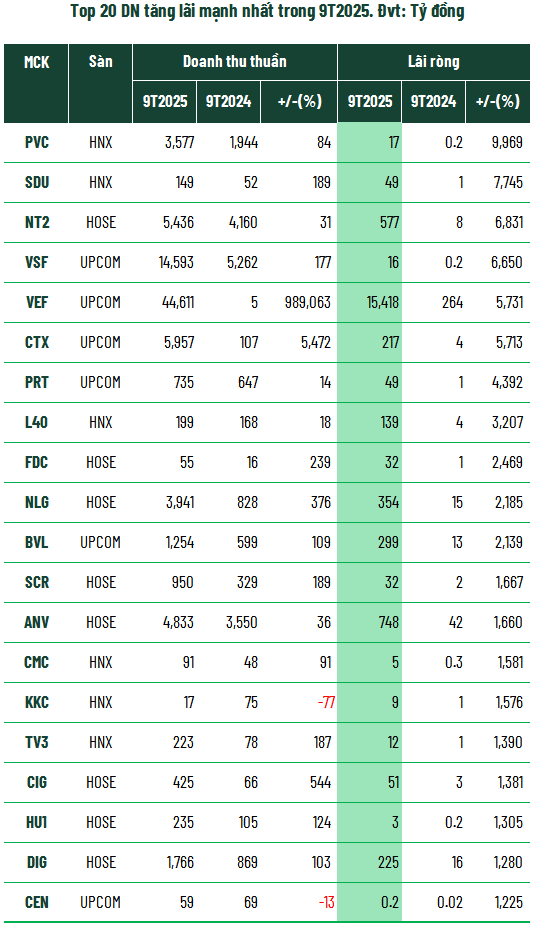

For the first nine months of 2025, Tổng Công ty Hóa chất và Dịch vụ Dầu khí – CTCP (HNX: PVC) achieved the highest profit growth in the market, with a net profit of nearly 17 billion VND, over 100 times higher than the same period last year.

Unlike many cases of profit growth due to unusual factors, PVC recorded growth from its core operations, with net revenue exceeding 3.5 trillion VND, an 84% increase year-on-year. The company attributed this positive result to strong growth in its high-margin drilling fluid and chemical extraction supply segment.

Turning Losses into Profits

Source: VietstockFinance

|

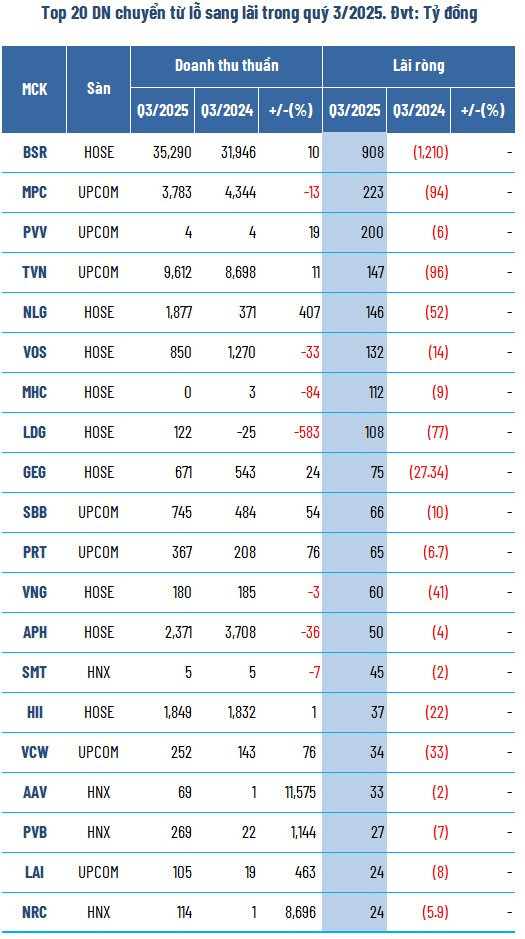

In Q3 2025, CTCP Lọc hóa Dầu Bình Sơn (HOSE: BSR) stood out by not only escaping losses but also ranking among the top 20 most profitable companies, with a net profit of over 900 billion VND, a remarkable turnaround from a loss of over 1.2 trillion VND in the same period last year.

According to BSR, this positive result was mainly due to a significant improvement in the crack spread between crude oil and refined product prices. Specifically, the price of Dated Brent crude oil fell from $70.99 per barrel in July 2025 to $68.02 per barrel in September 2025, while in Q3 2024, the price dropped more sharply, from $85.31 per barrel to $74.33 per barrel.

Additionally, sales volume in Q3 2025 reached 1.95 million tons, higher than the 1.72 million tons in the same period last year, significantly contributing to BSR‘s return to profitability.

Source: VietstockFinance

|

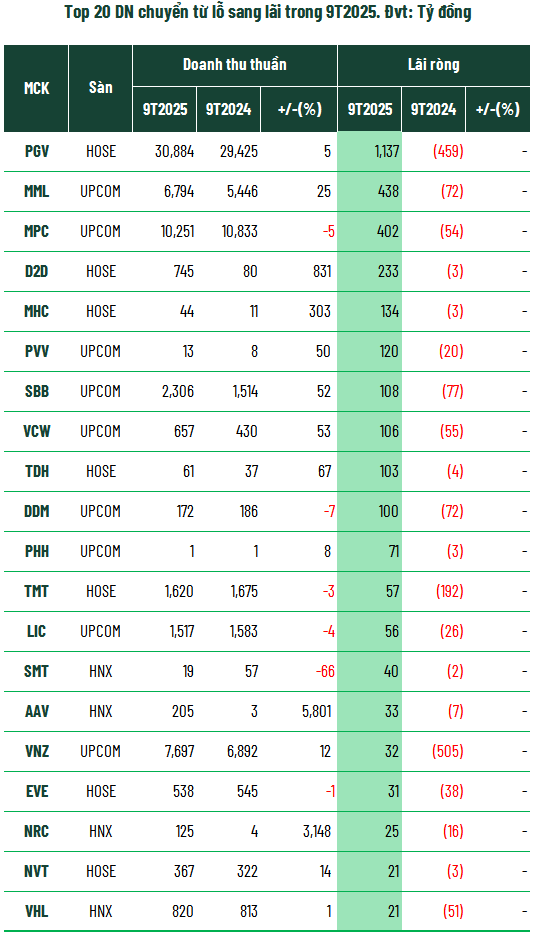

In the first nine months, Tổng Công ty Phát điện 3 – CTCP (HOSE: PGV) was another notable “comeback” story. The company escaped losses from the same period last year and recorded a net profit of over 1 trillion VND, primarily due to a significant reduction in electricity production costs and an increase in electricity sales revenue.

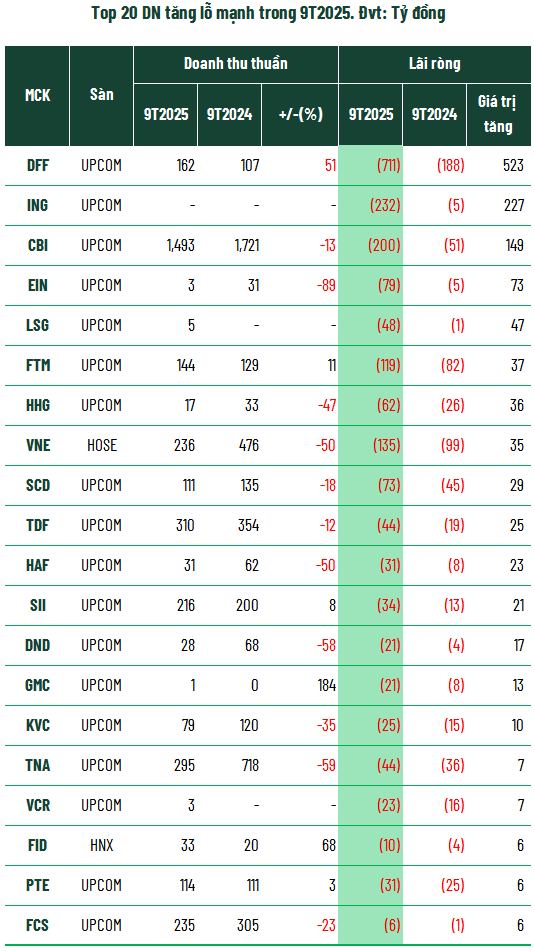

Deepening Losses

Source: VietstockFinance

|

Source: VietstockFinance

|

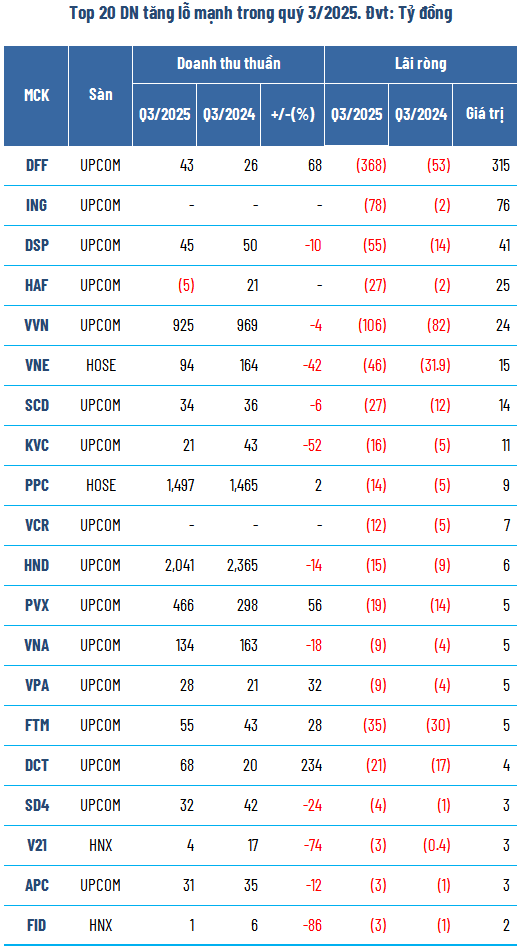

With the most significant loss increase in both Q2 and Q3 2025, CTCP Tập đoàn Đua Fat (UPCoM: DFF) continued to sink deeper into losses. In the first nine months, DFF reported a net loss of 711 billion VND, an increase of over 500 billion VND compared to the same period last year, primarily due to selling below cost and high interest expenses.

Source: VietstockFinance

|

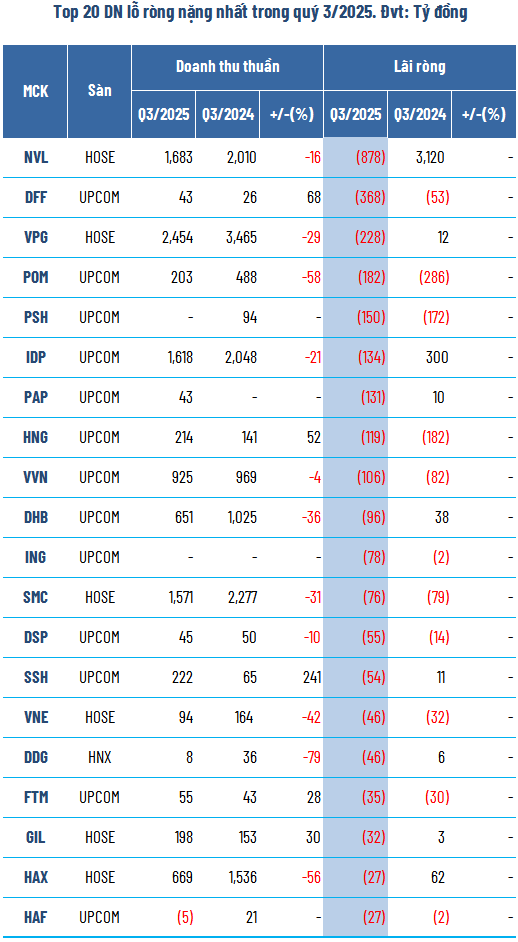

Many companies also shifted from profit to loss. Notably, Tập đoàn Đầu tư Địa ốc No Va (Novaland, HOSE: NVL), which recorded a net profit of over 3.1 trillion VND in Q3 2024, reported a net loss of 878 billion VND in Q3 2025, mainly due to a 712 billion VND increase in foreign exchange losses compared to the same period last year.

Source: VietstockFinance

|

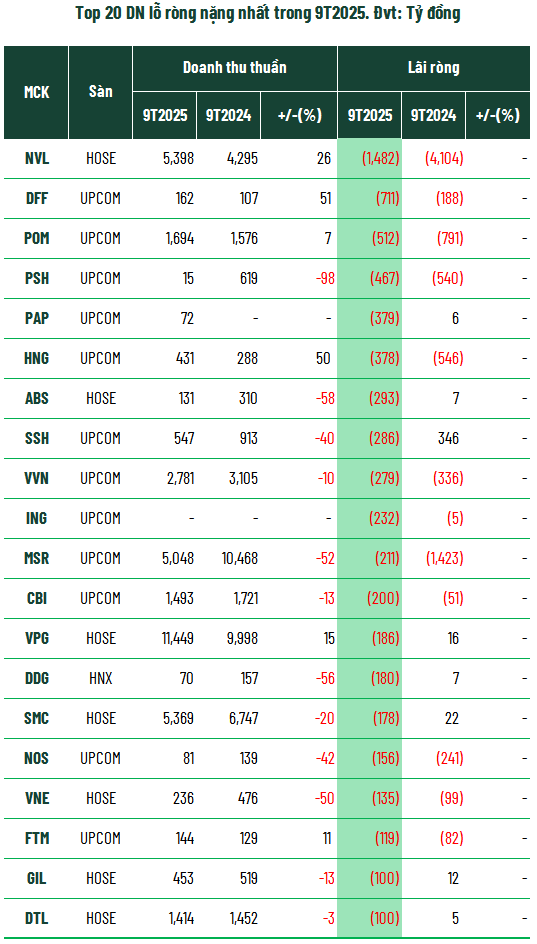

For the first nine months of 2025, NVL reported a net loss of nearly 1.5 trillion VND, the highest in the market.

However, this result was a significant improvement from the loss of over 4.1 trillion VND in the same period last year, thanks to a 26% increase in net revenue to nearly 5.4 trillion VND, primarily from product deliveries at projects such as NovaWorld Phan Thiết, NovaWorld Hồ Tràm, Aqua City, Sunrise Riverside, and Palm City.

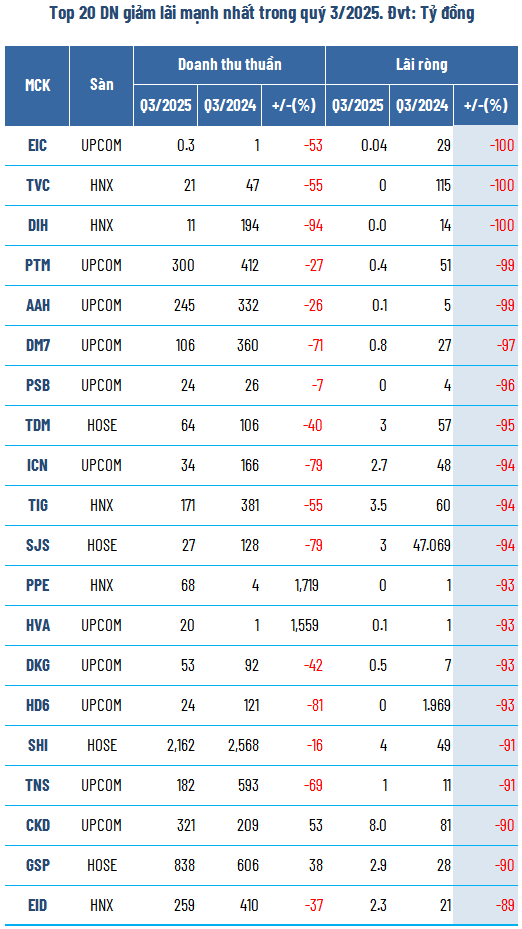

Profits Nearing Zero

While not in losses, many companies saw their profits plummet in Q3 2025.

Source: VietstockFinance

|

A notable example is CTCP EVN Quốc tế (UPCoM: EIC), which recorded a net profit of only 41 million VND, less than 0.2% of the over 29 billion VND in the same period last year—a near-absolute decline.

The main reason was that EIC did not record a $1.5 million dividend from Công ty TNHH Hạ Sê San 2 in Q3 2025, as it did in Q3 2024.

Source: VietstockFinance

|

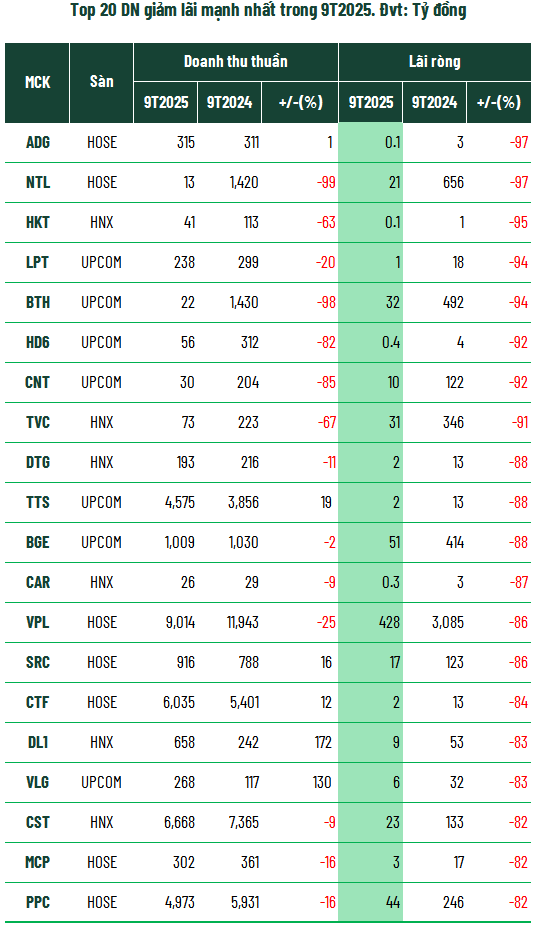

For the first nine months, CTCP Clever Group (HOSE: ADG) and CTCP Phát triển Đô thị Từ Liêm (HOSE: NTL) were the two companies with the most significant profit declines in the market, both falling by 97% compared to the same period last year.

However, the stories behind each company differ. For ADG, profit contraction was due to high costs and operating expenses. In contrast, NTL‘s profit decline was because it had almost no revenue from core business activities, as the company is in the process of completing investment and construction procedures for real estate projects.

– 12:00 28/11/2025

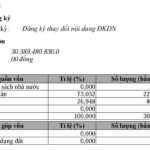

THACO Unexpectedly Reduces Charter Capital, Foreign Investors Unchanged

THACO Group, led by Tran Ba Duong, has announced a reduction in its chartered capital from VND 30,510 billion to VND 30,389.5 billion, marking a decrease of over VND 120 billion.