CEO Le Bao Anh has signed a decision for CC1 Investment Corporation not to participate in purchasing additional shares during the capital increase of its subsidiary, CC1 Investment JSC, from VND 200 billion to VND 800 billion. Currently, CC1 holds 65% of the charter capital, equivalent to VND 130 billion in original capital.

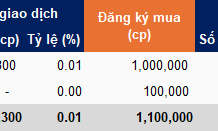

In the decision, CC1 confirms it will neither exercise its preemptive rights nor transfer these rights to another party. The unregistered shares will be offered to existing shareholders or new investors as arranged by the subsidiary’s Board of Directors.

CC1 Investment is a relatively new name in the ecosystem, established only in mid-2023, yet its capital injection ranks among the largest within the CC1 group.

Earlier in November, CC1 made a similar decision regarding Material and Agricultural Product No. 1 JSC, another newly capitalized subsidiary established in early 2023.

According to the resolution, Material and Agricultural Product No. 1 will be renamed Southern Infrastructure and Energy JSC and increase its charter capital from VND 200 billion to VND 600 billion. However, CC1 opted not to subscribe to the new shares and will not sell its preemptive rights. Its original investment here stands at VND 47 billion, representing 23.5% of the current charter capital.

In September, CC1 also declined to inject additional capital into CC1 Asset Management and Services LLC when the latter increased its capital from VND 450 billion to VND 1.15 trillion. The parent company maintained its original investment of VND 220 billion, reducing its ownership stake from 48.8% to 19.1%.

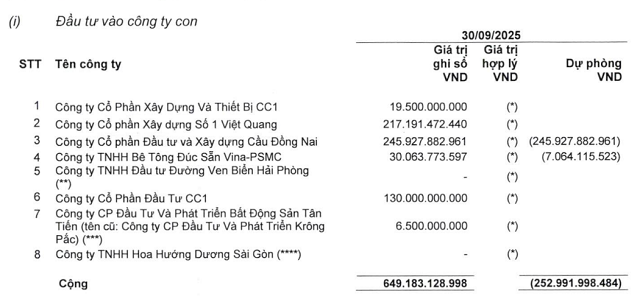

CC1’s portfolio of subsidiaries and affiliates is expected to undergo significant changes compared to the beginning of the year. Source: CC1’s Q3/2025 standalone financial report.

|

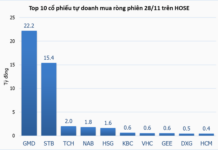

These consecutive moves indicate a strategic shift rather than random decisions. Since the start of the year, CC1 has actively reduced its financial investment portfolio through share divestments. The company sold its entire 23.7% stake in Chuong Duong JSC (HOSE: CDC), generating an estimated VND 140 billion. This was a long-held investment in its portfolio.

At Hai Phong Coastal Road Investment LLC, CC1 significantly reduced its ownership from 75% to 15% in Q3, with original capital of VND 675 billion. Additionally, its stake in Sai Gon Sunflower LLC was partially divested since the beginning of the year, reducing its holding to 49%, reclassifying the company from a “subsidiary” to an “associate.”

Over the years, CC1 has pursued a multi-sector strategy, expanding beyond its traditional construction segment to enhance profit margins through financial investments. Consequently, the company established numerous legal entities, some with majority control and others as associates.

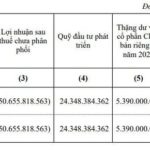

Divestment activities have significantly bolstered profitability amid rising interest expenses. In the first nine months, CC1 recorded VND 90 billion in divestment income, 2.7 times higher than the same period last year, while paying VND 243 billion in interest, up 50%.

Thanks to this income and other profits from asset revaluation, CC1 reported a net profit of VND 175 billion, three times higher than the same period last year.

| CC1’s core business profits showed robust growth |

While no official reason has been disclosed, these capital restraint decisions suggest CC1 may be prioritizing resources for its core construction segment. At the 2025 Annual General Meeting, the leadership identified public investment as a key growth driver for the next three years. Major projects like the North-South Expressway Phase 2, expansions of Tan Son Nhat and Long Thanh airports, and metro networks in Ho Chi Minh City and Hanoi are expected to provide substantial opportunities for infrastructure developers.

The first nine months of 2025 reflect this outlook, with construction revenue exceeding VND 5.5 trillion, up approximately 32% year-on-year. Compared to the same period in 2023, the scale has nearly tripled.

However, debt levels have also surged. The cash flow statement shows that in the first nine months of 2025, borrowing exceeded VND 6 trillion, up about 17% year-on-year and more than double the 2023 figure, causing interest expenses to spike by 50%.

CC1 is a well-established brand, founded in 1979 through the consolidation of several units under the Ministry of Construction, with a mandate to develop urban areas and industrial zones. Since 2006, it has operated under a parent-subsidiary model, went public in 2016, and became a public company in 2017.

CC1’s core business is infrastructure construction, power plants, and civil works. In recent years, the company has ventured into investment projects such as Sailing Tower, Hanh Phuc Residential Area, and the DaKr’Tih Hydropower Plant in Dak Nong, alongside various financial investments.

Among its major shareholders, Nguyen Van Huan, a Board member, holds approximately 11% of the capital. CC1 – Holdings JSC owns around 10%.

– 12:37 28/11/2025

Vietravel and Vietravel Airlines Part Ways

Vietravel’s Board of Directors has approved a resolution to divest its entire stake in Vietravel Airlines, marking the end of a tumultuous investment journey in the aviation sector.

Dual Momentum: SHB’s Capital Raise Strategy and Foreign Investment Attraction Opportunities

SHB’s upcoming capital increase strategy is poised to propel the bank into the top 4 private banks by charter capital, solidifying its competitive edge through enhanced financial strength. Additionally, SHB is anticipated to join the FTSE Russell global equity index basket once Vietnam achieves its upgrade to emerging market status. These dual catalysts collectively fuel SHB’s potential for exceptional growth in the foreseeable future.