Over a month after Decree 232/2025 (amending and supplementing certain provisions of Decree 24/2012 on gold trading management) took effect—notably abolishing the state monopoly on gold production and import/export—the domestic gold market remains largely unchanged. SJC gold prices still exceed VND 150 million per tael, VND 20 million higher than global rates.

Potential Import of Up to 20 Tons of Gold

Amid this, the State Bank of Vietnam (SBV) has released a draft circular on gold positions for credit institutions, replacing Circular 38/2012/TT-NHNN, for public feedback.

The draft proposes raising the end-of-day gold position limit for institutions permitted to produce and trade gold bars and raw gold to 5% of equity. For those only allowed to trade gold bars, the limit is 2%, with no institution permitted to hold a negative gold position.

The SBV explains this adjustment aims to prepare institutions for deeper involvement in the gold supply chain, thereby increasing official market supply.

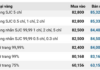

To date, eight commercial banks meet the required charter capital conditions: Vietcombank, VietinBank, BIDV, Agribank, Techcombank, MB, VPBank, and ACB. If licensed for gold production and import/export, these banks could significantly boost market supply.

Based on September 2025 equity data, and assuming a global gold price of USD 4,000/ounce and an exchange rate of VND 26,135/USD, the SBV estimates 5% of these banks’ equity equals USD 2.56 billion, or approximately 20 tons of gold.

When gold access becomes difficult, “fear of missing out” can drive panic buying, potentially disrupting the market. Photo: HOÀNG TRIỀU

Drafters argue this position scale is “manageable for eligible banks,” sufficient to boost domestic supply, narrow price gaps, and ease investor anxiety. This would reduce market dependence on a few enterprises and enhance transparency.

The draft aligns with Article 19 of Circular 34/2025 (guiding Decree 24/2012, amended by Decree 232/2025). Annually, the SBV will set gold import/export quotas based on monetary policy, supply-demand dynamics, and market conditions. Quotas will be allocated to enterprises and banks based on capital, risk management, and market stability needs.

Gold expert Trần Duy Phương views the SBV’s expansion of market participants and 5% position limit as timely, given strong public gold demand. He believes 20 tons of additional gold “meets basic needs and eases scarcity concerns.”

Stable supply will align domestic prices more closely with global rates, reducing short-term speculation. “Investors will see controlled prices, not ‘buy and win’ opportunities. With stable imports, speculation will decline, shifting capital to stocks or production,” says Phương.

Reducing Gold Rush Mentality

Dr. Cấn Văn Lực, a government policy advisor, told Người Lao Động that stabilizing the gold market requires reassessing Vietnam’s “gold-based economy” and accurately estimating private gold holdings.

He stresses the need for transparency, ending gold-based lending to reduce systemic risk, and addressing the market chaos caused by over-reliance on this precious metal.

Dr. Lực emphasizes increasing legal supply to narrow price gaps. Scarcity fuels panic buying.

“Market transparency and alternative investments are needed to shift capital from gold speculation to production. Fully implementing Decree 232/2025 will increase legal gold supply,” he notes.

The SBV is also working with ministries on a national gold trading platform to address market fragmentation and opacity.

Economist Ngô Trí Long sees this pilot as essential, as gold pressures exchange rates and interest rates. With Decree 232/2025 ending production monopolies, the platform will transparently distribute imported raw gold to enterprises and banks.

“This will end supply shortages, explain price gaps, and establish a domestic-global price benchmark,” says Long.

For effective platform operation, Dr. Lực recommends clarifying its model: independent, integrated with commodity exchanges, or based in HCMC’s financial center. Pricing, fees, trade processes, and inter-ministerial coordination must be meticulously designed.

Experts highlight real-time transaction reporting as key, enabling informed market management and reducing speculation. Market dynamics will then reflect true supply and demand.

Need for Dedicated Gold Market Regulator

Nguyễn Thế Hùng of the Vietnam Gold Traders Association urges a transparent management mechanism, not just for compliance but for national monetary security. He proposes a centralized SBV body for market data, standards, and operations.

“Vietnam can develop a modern gold platform with careful planning. Beyond trading, it must modernize transactions, provide transparent data for governance, and support future gold-linked financial products,” says Hùng.

Governor of the State Bank of Vietnam Nguyễn Thị Hồng and Deputy Governor Phạm Thanh Hà Awarded First-Class Labor Orders

On November 24, 2025, the State Bank of Vietnam (SBV) will host the 9th National Emulation Congress of the Banking Sector and the Conference to Review the 5-Year Implementation of the National Strategy on Gender Equality, Women’s Advancement, and the “Proficient in Banking, Exemplary at Home” Movement (2021–2025) in Hanoi. This prestigious event underscores the sector’s commitment to fostering excellence, equality, and progress within the banking industry and beyond.

“Hanoi Tax Deputy Director: Gold Shops Must Record Citizen ID or Tax Code of Buyers and Maintain Detailed Seller Information Logs”

At the “Vietnam Gold Market: Opportunities and Challenges in the New Phase” forum, Mr. Nguyen Tien Minh, Deputy Director of Hanoi Tax Department, revealed insightful information regarding the current state and future prospects of the gold market in Vietnam.

Central Bank Maintains Net Injection Pace in Open Market Operations

Amidst heightened overnight interbank transaction volumes from November 10–17, the State Bank of Vietnam (SBV) sustained its fifth consecutive week of net injections into the open market operations (OMO) arena.