Closing the trading session on November 27, the VN-Index rose nearly 4 points to 1,684.32, with a “green shell, red core” status. The matching value on HoSE remained low, reaching approximately 17.6 trillion VND.

Regarding foreign trading, after a positive net buying session, foreign investors turned to net selling 6 billion VND across the market. Specifically:

On HoSE, foreign investors net sold approximately 11 billion VND

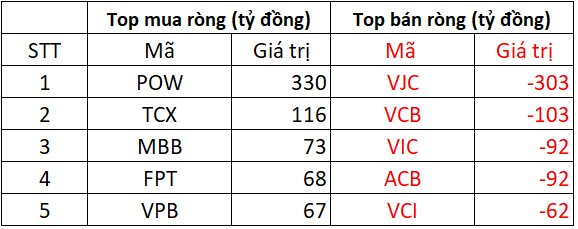

On the buying side, POW led with a surge of 330 billion VND. TCX followed, with foreign investors accumulating 116 billion VND. Banking stocks like MBB and VPB also attracted foreign capital, reaching 73 billion VND and 67 billion VND, respectively. Additionally, FPT recorded a net buying value of around 68 billion VND.

Conversely, selling pressure concentrated on large-cap stocks. VJC led with a net selling value of 303 billion VND. VCB followed with 103 billion VND net sold. VIC and ACB both recorded net selling of 92 billion VND each, while VCI was also offloaded by foreign investors for approximately 62 billion VND.

On HNX, foreign investors net bought approximately 7 billion VND

On the buying side, foreign investors focused on SHS with a value of around 8 billion VND. CEO followed with 3 billion VND, and MST with 1 billion VND. VC3 and PSI also saw slight net buying, at approximately 0.5 billion VND and 0.2 billion VND, respectively.

On the selling side, PVS was the most heavily sold stock with around 2 billion VND. VFS followed with 1 billion VND offloaded. MBS, C69, and DTD also recorded net selling values of 0.6 billion VND, 0.5 billion VND, and 0.4 billion VND, respectively.

On UPCOM, foreign investors net sold approximately 2 billion VND

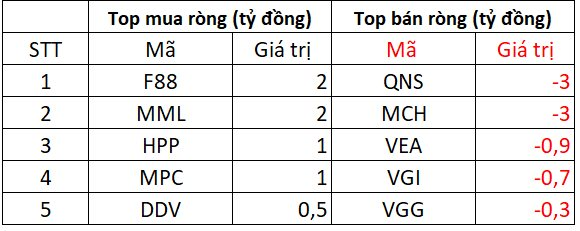

On the buying side, foreign investors heavily invested in F88 and MML, with each stock seeing around 2 billion VND. HPP and MPC followed, both with 1 billion VND net bought. DDV also saw slight buying interest, at approximately 0.5 billion VND.

On the selling side, QNS and MCH faced the most pressure, with each stock offloaded for around 3 billion VND. VEA, VGI, and VGG were also net sold, for 0.9 billion VND, 0.7 billion VND, and 0.3 billion VND, respectively.

Stock Market Week 24-28/11/2025: A Deceptive Rally

The VN-Index closed in the green for the final session of the week, marking its third consecutive week of recovery. However, the upward momentum remains unconvincing, as liquidity stayed low and buying demand failed to broaden. Without significant improvement, the market is likely to continue experiencing sideways movement and volatility, particularly as the index approaches the psychological threshold of 1,700 points.

Tracking the Shark Money Flow on November 28: Proprietary Traders and Foreign Investors Diverge, VNM Grabs Attention

In the final trading session of November, foreign investors demonstrated a strong appetite for Vietnamese equities, recording a net purchase of nearly VND 320 billion. Conversely, securities firms’ proprietary trading desks took a contrasting approach, offloading a net VND 360 billion worth of stocks. Notably, VNM shares captured significant attention, featuring prominently in both foreign investors’ top net buys and proprietary trading desks’ top net sells.

GELEX’s Market Cap Nears $3 Billion After Three Consecutive Circuit Breakers, Delivering 7x Returns to Shareholders Since Year-Start

Robust demand propelled GEE shares to their third consecutive ceiling-hitting session, pushing the stock price above the 200,000 VND mark. This upward momentum coincides with the company’s impressive nine-month business performance.