Ho Chi Minh City Development Commercial Joint Stock Bank (HDBank, Stock Code: HDB) has recently submitted a document to the Hanoi Stock Exchange (HNX) announcing the results of its domestic private bond issuance.

Accordingly, HDBank issued 1,000 bonds under the code HDB12508, with a face value of 1 billion VND per bond, totaling 1,000 billion VND. The bonds have a 3-year term and were issued in the domestic market.

The bond issuance was completed on November 26, 2025, with a maturity date expected on November 26, 2028.

This marks the 8th bond issuance by HDBank since the beginning of the year, as per HNX announcements.

Illustrative image

Most recently, on November 18, 2025, HDBank issued 800 bonds under the code HDB12507, with a face value of 1 billion VND per bond, totaling 800 billion VND. These bonds also have a 3-year term and are expected to mature on November 18, 2028.

In other developments, HDBank has released the Minutes of the Vote Counting for resolutions within the authority of the Annual General Meeting of Shareholders (AGM).

Specifically, HDBank’s shareholders approved resolutions related to selecting an independent auditing firm for the 2026 financial statements, dividend distribution plans, bonus share issuance from equity, capital increase, and more.

Based on the proposals and shareholder feedback, HDBank’s Board of Directors issued Resolution No. 25/2025/NQ-ĐHĐCĐ, approving a 25% stock dividend for 2024 (equivalent to 25 additional shares for every 100 shares held). The source of funding is from 2024’s undistributed profits, after fulfilling tax obligations and statutory reserve requirements.

Additionally, the Board approved a plan to issue 5% bonus shares from the equity reserve fund.

If both plans are executed, HDBank’s charter capital will increase by up to 11,578 billion VND, reaching over 50,172 billion VND.

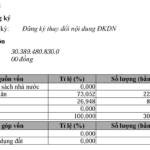

Following the capital increase, the ownership structure of major shareholders is expected to shift. Sovico Group’s stake will decrease from 11.693% to 9.992%. The holdings of related individuals—Mrs. Nguyen Thi Phuong Thao (3.388%), Mr. Pham Khac Dung (1.088%), and Mr. Nguyen Canh Son (0.028%)—will remain unchanged.

THACO Announces ₫120 Billion Capital Reduction, Prepares for ₫10.13 Trillion Capital Increase

THACO emphasizes that capital adjustments, including both reductions and increases in charter capital, are integral to its strategy for refining governance models and optimizing capital efficiency. The corporation remains committed to sustainable development, leveraging its financial strength, streamlined management, and long-term investment vision to actively contribute to the nation’s economic growth.

HDBank’s Deputy CEO Trần Hoài Nam: Aiming to Become an “ASEAN Asset”

As one of the top five Vietnamese enterprises with the highest ACGS (ASEAN Corporate Governance Scorecard) ratings in 2024, HDBank is entering a new phase of acceleration. With a bold ambition to elevate its governance standards to regional best practices, the bank is strategically preparing for the next evaluation cycle. HDBank’s ultimate goal is to position itself as a premier “ASEAN asset,” setting a benchmark for excellence in the region.