Mr. Nguyen Duc Lenh, Deputy Director of the State Bank of Vietnam (SBV) Branch in Region 2, assesses that from a market perspective, considering the supply-demand relationship for capital, an increase in credit demand will lead to a rise in capital mobilization needs. This directly impacts interest rates and the capital utilization process of commercial banks (CBs). However, with the monetary policy goal of supporting and promoting economic growth in 2025, coupled with the continued growth of mobilized capital among credit institutions, interest rates are expected to remain stable. This stability aims to facilitate production, business, trade, and service development, particularly during the year-end and Tet holiday season.

In the current context, maintaining stable interest rates is supported by three key factors:

First, macroeconomic stability persists, with inflation under control (the CPI index increased by 3.27% in the first 10 months compared to the same period last year; core inflation rose by 3.2%). Exchange rates and interest rates continue to align with the central bank’s management directives, ensuring a favorable business environment to support enterprises and drive economic growth.

Second, the inherent nature of capital mobilization and payment services, which are increasingly efficient, enables credit institutions to reduce costs and maintain stable interest rates (both for deposits and loans). The structure of mobilized capital has shifted toward a higher proportion of demand deposits. In Ho Chi Minh City and Dong Nai Province, demand deposits increased by over 9% in the first 10 months, outpacing the overall growth rate of mobilized capital in these areas.

According to Mr. Lenh, this trend not only reflects the growth of non-cash payment activities but also enhances the efficiency of capital utilization by commercial banks. It allows credit institutions to maintain stable lending rates by controlling deposit interest costs and reducing input expenses, thereby sustainably lowering lending rates.

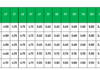

Third, banking activities remain stable and continue to grow, ensuring the best possible capital supply for businesses and the economy in line with established goals. Specifically, in Ho Chi Minh City and Dong Nai Province, total capital mobilization by credit institutions reached 5,485 trillion VND by the end of October 2025, an 8.9% increase compared to the end of the previous year. The capital structure is reasonable, and growth rates have been maintained in recent months (0.76% in August 2025, 1.4% in September 2025, and 0.26% in October 2025), ensuring optimal capital availability for businesses to expand and boost production during the year-end period.

High-quality banking services and effective capital management play a crucial role in attracting deposits from economic organizations and individuals at the best possible cost, thereby stabilizing interest rates. However, capital absorption from the economy, coupled with economic growth and business efficiency, will remain a key factor positively influencing capital utilization and credit growth expansion by credit institutions. This, in turn, will enhance the role and effectiveness of the central bank’s monetary and credit policies, particularly interest rate policies, ensuring both macroeconomic stability and economic growth promotion.

– 10:47 28/11/2025

New Bank Card Regulations: Mandatory In-Person Verification and Cash Withdrawal Limits

The State Bank has recently issued Circular 45, introducing stricter regulations for bank card issuance. These measures include mandatory in-person meetings, biometric verification, and cash withdrawal limits for credit cards.

Proposed Regulation for Re-Evaluation of Assets in EVN’s Subsidiary Companies

The Ministry of Finance has drafted a Decree outlining the operational and financial management mechanisms specific to Vietnam Electricity (EVN). This includes a proposal to re-evaluate assets of fully EVN-owned subsidiaries, specifically power projects that have reached the end of their depreciation period.

F88 Launches First-Ever Public Bond Offering with 10% Annual Interest Rate

As a leading bond issuer with an impeccable track record of on-time payments and offering yields of up to 10% per annum, F88 Investment Corporation (UPCoM: F88) is now recognized for its highly attractive retail bonds. This positions the company to capture the attention of investors seeking both stability and competitive returns.

Striving for Disbursement to Fuel Growth

This morning, November 27th, Deputy Prime Minister Le Thanh Long chaired a meeting at the Government Office to discuss the disbursement of public investment capital for the Ministry of Health and the Ministry of Education and Training. The meeting also addressed An Giang province’s production and business activities, public investment capital disbursement, import-export, infrastructure development, social housing, national target programs, and the implementation of the two-tier local government system.