The banking outlook remains Stable, reflecting expectations that MSB’s credit fundamentals will stay robust over the next 12–18 months.

Moody’s assigns a Stable outlook to MSB (Image: MSB)

|

According to Moody’s updated report, under the new methodology, several positive factors support MSB’s credit rating. These include: Moody’s emphasis on long-term solvency and stable profitability over liquidity size, as seen in the previous methodology; strengthened capital buffers to mitigate credit institution risks; consideration of diversified revenue streams in risk assessment; and the inclusion of qualitative criteria in the new rating model.

MSB’s Capital score has improved due to recent stock dividend payments, bolstering its capital buffer. The bank’s tangible common equity to risk-weighted assets (TCE/RWA) ratio stood at 12.7% as of June 30, 2025, among the highest in the industry. High-liquidity assets, such as government bonds, positively impact MSB’s liquidity rating. Additionally, MSB’s ESG (Environmental, Social, and Governance) considerations are rated at CIS-3, indicating minimal impact on its current credit rating.

In an environment of stricter evaluation standards, MSB’s simultaneous improvement across multiple rating categories demonstrates its financial foundation not only meets new standards but also excels in several areas compared to industry averages.

Over recent years, MSB has focused on strengthening capital safety and liquidity, ensuring resilience amid economic fluctuations. The capital adequacy ratio (CAR) has consistently exceeded 12%, surpassing the State Bank’s 8% requirement. As of September 30, MSB’s non-performing loans (NPL) were at 1.9%; the loan-to-deposit ratio (LDR) decreased from 73.91% in Q2 to 71.31% in Q3; and the ratio of short-term funding to medium- and long-term loans (MTLT) was controlled at 27.03%, all in line with regulatory criteria.

MSB focuses on enhancing capital safety and liquidity (Image: MSB)

|

In the first nine months, customer deposits reached nearly VND 183.4 trillion, a 19% increase from 2024. Non-term deposits (CASA) exceeded VND 51 trillion, marking the fourth consecutive quarterly rise and accounting for 27.83% of total deposits, ranking among the industry’s top. Term deposits grew by 16% to nearly VND 132.36 trillion. Issuance of securities reached nearly VND 26.1 trillion, up 23% from 2024. These results highlight MSB’s diverse deposit base and optimized funding costs amid intense market competition.

Moody’s upgraded ratings are significant as MSB expands its medium- to long-term funding sources, particularly from international capital markets. Higher ratings enhance MSB’s credibility with partners, enabling access to more cost-effective capital and broader global financial institution collaborations. This also strengthens customer and investor confidence, driving MSB’s growth strategy toward a safer, more efficient, and internationally compliant operational model.

An MSB representative stated, “Moody’s assessment objectively recognizes MSB’s continuous efforts to enhance financial capabilities. We view this as a crucial step and a motivator to further improve operational quality and business efficiency, ensuring utmost trust and reliability for our customers and partners.”

With a strengthened foundation, MSB pursues a cautious growth strategy, emphasizing quality, sustainability, and maintaining its position among Vietnam’s leading joint-stock commercial banks.

|

Assessment |

Previous Rating |

Updated Rating as of November 26, 2025 |

|

Outlook |

Stable |

Stable |

|

Counterparty Risk Rating |

Ba3 |

Ba3 |

|

Bank Deposits |

B1 |

Ba3 |

|

Baseline Credit Assessment |

b2 |

b1 |

|

Adjusted Baseline Credit Assessment |

b2 |

b1 |

|

Counterparty Risk Assessment |

Ba3(cr) |

Ba3(cr) |

|

Issuer Rating |

B1 |

Ba3 |

Services

– 13:30 28/11/2025

TNI Nam Quang Successfully Raises VND 1.5 Trillion in Bond Issuance Within Two Weeks

Nam Quang Infrastructure Investment and Development Joint Stock Company (TNI Nam Quang), the developer of Gia Lộc Industrial Park, has successfully issued VND 1,500 billion in bonds within just two weeks.

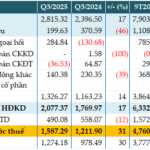

MSB’s Q3 Pre-Tax Profit Surges 31% on Strong Forex Gains

The Q3/2025 consolidated financial report reveals that Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) achieved pre-tax profits exceeding VND 1.587 trillion, marking a 31% year-on-year increase. This impressive growth is attributed to the bank’s robust core income expansion and successful foreign exchange operations.

MSB Achieves ACCA Approved Employer Certification: Committed to Sustainable Talent Development

Maritime Bank (MSB) has been officially recognized as an ACCA Approved Employer by the Association of Chartered Certified Accountants (ACCA), marking a significant milestone in its strategic partnership with the global accounting body. This achievement underscores MSB’s commitment to human resource development, a cornerstone of its sustainable growth strategy.

Maritime Bank (MSB) has officially been recognized as an ACCA Approved Employer by the Association of Chartered Certified Accountants (ACCA), solidifying its strategic partnership with the organization. This milestone underscores MSB’s dedication to human resource development, a core pillar of its sustainable growth strategy.