Vietnam’s stock market kicked off the new week (November 24) with a highly enthusiastic trading session in terms of indices, yet it revealed profound underlying divergences.

At the close, the VN-Index surged by 13.05 points, equivalent to 0.79%, ending at 1,667.98 points. This gain propelled the benchmark index close to the psychological resistance level of 1,680 points.

VN-Index nears 1,670 points as blue-chip stocks rally

The index’s upward momentum was almost entirely driven by large-cap stocks, often referred to as the “pillars.” This is evident as the VN30 basket outperformed the broader market, climbing 16.47 points (0.87%) to close at 1,916.36 points.

Smart money appeared to flow into leading blue-chip stocks, particularly those with sustainable profit growth narratives and high expectations for market upgrade stories.

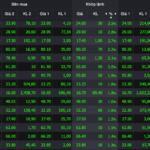

However, this enthusiasm failed to permeate the entire market. On the HoSE, declining stocks (186) outnumbered advancing ones (123), reinforcing the “green shell, red core” scenario. This suggests that despite the index’s rise, most mid-cap and penny stocks are still under correction pressure or experiencing capital outflows.

The financial and banking sectors traded weakly, with stocks like SHB, VND, and STB continuing to edge lower. In contrast, real estate stocks took center stage, with VRE, NVL, KHG, and VHM all rallying, including a nearly 7% jump in VRE, significantly contributing to the VN-Index’s gains. Some technology, seafood, and livestock stocks also attracted capital, reflecting a shift toward sectors less affected by international volatility.

This contrast was most evident on the Hanoi Stock Exchange. While HoSE was awash with green, the HNX-Index recorded a notable decline of 1.91 points, or 0.73%. This signals that investor sentiment toward small-cap stocks is becoming more cautious, possibly due to profit-taking or capital shifting to safer VN30 stocks.

In terms of liquidity, total trading value on the HoSE exceeded VND 17,217 billion. This liquidity level is considered moderate, sufficient to sustain the index’s upward trend but not enough to spark a breakout session confirming a broad-based uptrend.

Analysts suggest that today’s session indicates the market is in an accumulation phase at higher price levels, driven by the leadership of heavyweights like VIC and VNM (based on intraday market information), helping the market overcome technical fluctuations.

However, with the index approaching the critical 1,700-point resistance level and increasing divergence, investors should remain cautious. The lack of widespread capital flow is the biggest risk, signaling that profit-taking pressure on pillar stocks could emerge at any time, potentially triggering sudden corrections in the VN-Index in upcoming sessions.

Stock Market Week 24-28/11/2025: A Deceptive Rally

The VN-Index closed in the green for the final session of the week, marking its third consecutive week of recovery. However, the upward momentum remains unconvincing, as liquidity stayed low and buying demand failed to broaden. Without significant improvement, the market is likely to continue experiencing sideways movement and volatility, particularly as the index approaches the psychological threshold of 1,700 points.

Stock Market Update November 27: Widespread Stock Declines, One Bank Stock Surges to a Striking Purple

The stock market session on November 27th closed in the green, yet underlying dynamics painted a less optimistic picture.