Over the past period, THACO has adjusted its charter capital in accordance with regulations and plans to increase capital in December 2025 to bolster financial resources for upcoming investment projects and development plans.

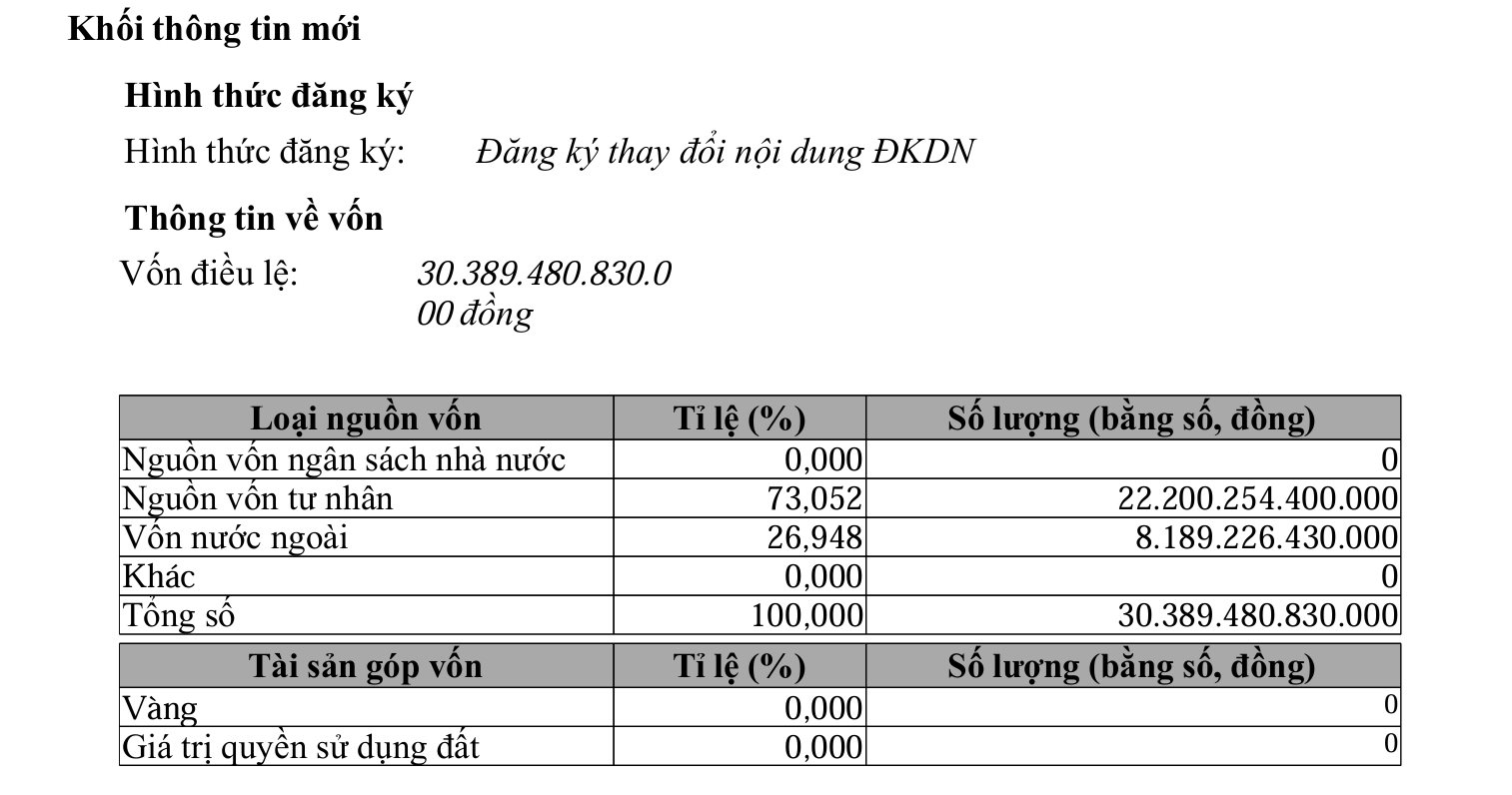

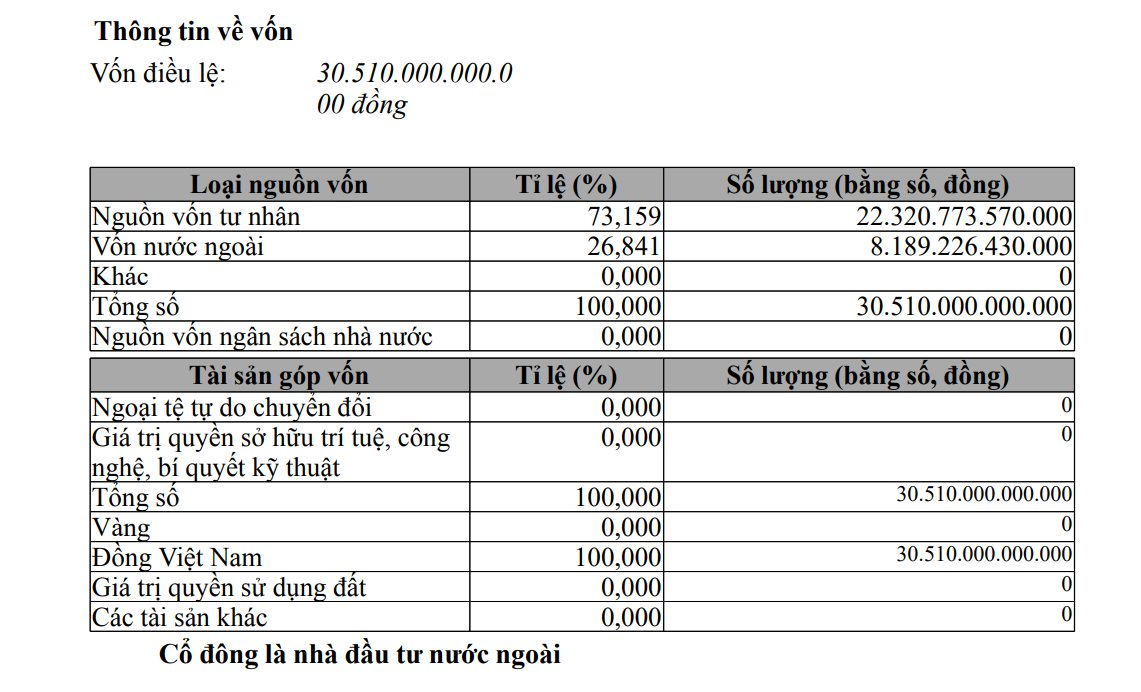

Accordingly, the corporation’s charter capital was adjusted from VND 30,510 billion to VND 30,389 billion. This reduction occurred when employee shareholders holding ESOP 2018 shares agreed to sell their shares back to the corporation. THACO repurchased these shares at market price, and as of November 18, 2025, completed the registration procedures to reduce the charter capital in line with the Enterprise Law.

This action aligns with the ESOP 2018 issuance regulations and the resolutions approved by the General Meeting of Shareholders. All procedures comply with legal requirements and do not impact ongoing business operations or project timelines.

In November, THACO announced 108 foreign investors, with Jardine Cycle & Carriage Limited (JC&C) of Singapore leading at VND 8,127 billion (26.6%). Mr. Cheah Kim Teck is authorized for JC&C’s entire contribution.

Of the 108 foreign investors, 107 are primarily linked to South Korea, as evidenced by their registered addresses.

In December 2025, THACO plans to increase its charter capital to VND 40,519 billion by issuing bonus shares to existing shareholders at a 3:1 ratio (3 existing shares for 1 new share). The total capital increase amounts to VND 10,130 billion.

This capital increase aims to recognize shareholder rights, strengthen financial capabilities, and support key investment projects across manufacturing, agriculture, infrastructure, services, and logistics. It also reinforces THACO’s foundation for strategic expansion.

Founded in 1997 in Dong Nai by Mr. Tran Ba Duong, THACO evolved from an auto importer and repair parts supplier into a diversified conglomerate with six subsidiaries: Thaco Auto (automotive), Thaco Industries (mechanics and supporting industries), Thaco Agri (agriculture), Thadico (investment and construction), Thiso (trade and services), and Thilogi (logistics).

In 2024, THACO reported consolidated after-tax profit of VND 3,228 billion, primarily driven by Thaco Auto (VND 4,410 billion). Other contributors included Thaco Industries (VND 312 billion), Thilogi (VND 251 billion), Thadico (VND 242 billion), Thiso (VND 76 billion), and Thaco Agri (VND 3 billion).

Stock Market Week 24-28/11/2025: A Deceptive Rally

The VN-Index closed in the green for the final session of the week, marking its third consecutive week of recovery. However, the upward momentum remains unconvincing, as liquidity stayed low and buying demand failed to broaden. Without significant improvement, the market is likely to continue experiencing sideways movement and volatility, particularly as the index approaches the psychological threshold of 1,700 points.

Tracking the Shark Money Flow on November 28: Proprietary Traders and Foreign Investors Diverge, VNM Grabs Attention

In the final trading session of November, foreign investors demonstrated a strong appetite for Vietnamese equities, recording a net purchase of nearly VND 320 billion. Conversely, securities firms’ proprietary trading desks took a contrasting approach, offloading a net VND 360 billion worth of stocks. Notably, VNM shares captured significant attention, featuring prominently in both foreign investors’ top net buys and proprietary trading desks’ top net sells.