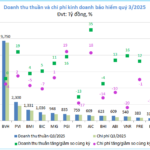

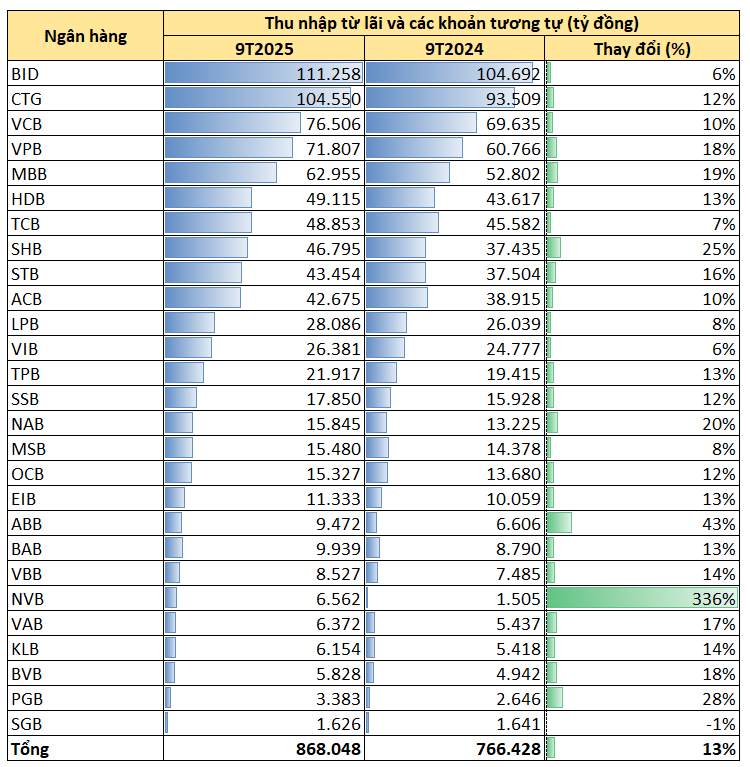

In the first nine months of the year, 27 listed banks recorded over VND 868 trillion in interest income and similar revenues, a 13% increase compared to the same period in 2024. Except for Saigonbank, which saw a decline, all other banks experienced growth in interest income, with many showing significant increases.

Specifically, BIDV maintained its lead in revenue from lending interest, recording VND 111.258 trillion in the first nine months. Despite a modest 6% growth rate—lower than the industry average—BIDV’s interest income dwarfs that of its competitors, showcasing the strength of its large corporate and key project loan portfolios.

Another major player, VietinBank, reported VND 104.550 trillion in interest income and similar revenues in the first nine months, a 12% increase year-on-year. This growth is attributed to robust credit expansion in the SME, manufacturing-export, and retail sectors.

In third place, Vietcombank achieved VND 76.506 trillion, a 10% increase. While this figure is significantly lower than the two state-owned banks mentioned above, it underscores Vietcombank’s position as a bank renowned for its high net interest margin and superior asset quality. With a conservative strategy, Vietcombank focuses on optimizing funding costs, enhancing non-interest income, and managing bad debts rather than aggressively growing its loan portfolio. As a result, although its interest income is lower than BIDV and VietinBank, Vietcombank often leads in net profit.

VPBank’s interest income reached VND 71.807 trillion in the first nine months, up 18%. This growth is primarily driven by retail credit expansion, SME lending, and the strong recovery of FE Credit. Following a period of restructuring its consumer lending operations, VPBank is regaining its growth momentum and widening the gap with other private banks like Techcombank, SHB, and HDBank.

MB also made a strong impression, recording VND 62.955 trillion in lending interest income, a 19% increase. This is the highest growth rate among the major banks and highlights the effectiveness of MB’s strategy, given its largest customer base in Vietnam.

Among mid-sized banks, HDBank achieved VND 49.115 trillion, a 13% increase, benefiting from its consumer-aviation-retail ecosystem. Techcombank recorded VND 48.853 trillion, a 7% increase—lower than the industry average due to its cautious approach to lending in the real estate and high-income customer segments. Nonetheless, Techcombank retains its leadership in profitability among private banks, thanks to its selective lending strategy and focus on high-quality credit customers.

SHB stands out in this group with a 25% increase, bringing its interest income to VND 46.795 trillion. Sacombank achieved VND 43.454 trillion, a 16% increase, continuing its positive growth trajectory after years of bad debt resolution and restructuring.

Collectively, the top 10 banks recorded nearly VND 658 trillion in interest income in the first nine months.

Among smaller banks, data reveals significant polarization, but several names showed impressive acceleration. ABBank grew by 43%, reaching VND 9.472 trillion in interest income. BAB, VBB, VAB, and BVB all recorded double-digit growth, accompanied by strong credit expansion.

HDBank’s Deputy CEO Trần Hoài Nam: Aiming to Become an “ASEAN Asset”

As one of the top five Vietnamese enterprises with the highest ACGS (ASEAN Corporate Governance Scorecard) ratings in 2024, HDBank is entering a new phase of acceleration. With a bold ambition to elevate its governance standards to regional best practices, the bank is strategically preparing for the next evaluation cycle. HDBank’s ultimate goal is to position itself as a premier “ASEAN asset,” setting a benchmark for excellence in the region.

TNG Escalates Debt, Injects $22 Million into CCN Son Cam 1 Project

TNG Investment and Trading JSC (HNX: TNG) is leveraging a VND 500 billion loan from BIDV to accelerate infrastructure development at the Son Cam 1 Industrial Cluster. Spanning nearly 70 hectares, the project is poised to generate consistent revenue through its 47-hectare leasable land, expected to reach full occupancy by 2034.

Entrepreneur Đỗ Quang Vinh Honored Among Top 10 Red Star Award Recipients 2025

On November 26th, the Red Star Award – Outstanding Young Vietnamese Entrepreneurs 2025 ceremony took place in Hanoi. Mr. Do Quang Vinh, Vice Chairman of the Board of Directors and Deputy CEO of SHB Bank, Chairman of the Board of Directors of SHS, was honored to be among the TOP 10 outstanding entrepreneurs of this year’s Red Star Award.