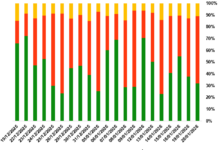

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), Vietnam’s fish cake and surimi exports witnessed remarkable growth in the first 10 months of 2025, reaching USD 292 million—a 24% increase compared to the same period in 2024.

This surge is driven by rebounding demand in key markets such as South Korea, Thailand, China, and notably the EU, where consumption of convenient processed seafood products is expanding rapidly. These results not only solidify Vietnam’s growing position in the global surimi industry but also open new opportunities for businesses in late 2025 and 2026.

Traditional markets like South Korea and Thailand continue to dominate Vietnam’s fish cake and surimi exports, accounting for USD 71 million and USD 67 million, respectively, in the first 10 months of 2025. This highlights the pivotal role of Asian markets in Vietnam’s overall exports in this category.

Exports to the EU surged by 73% in 2025 compared to 2024, with demand concentrated on convenient, ready-to-eat products in compact packaging.

Meanwhile, China remains a high-potential market for Vietnamese surimi, with a robust 44% growth in value.

Additionally, Vietnam is expanding into new markets such as Spain, Taiwan, and Colombia, demonstrating efforts to diversify exports and reduce reliance on a few key regions.

Over 50 companies are currently engaged in fish cake and surimi exports, with leading firms like Dalu Surimi, Kicoimex, and Coimex holding significant market shares.

Globally, surimi demand is on the rise. Fish cakes and surimi products offer a cost-effective alternative to fresh seafood as fish prices climb, particularly in regions with middle-income consumers. Moreover, surimi-based products like crab sticks, convenient fish cakes, and fish balls align with the growing trend of fast and convenient consumption, fueling the global surimi market.

However, global supply faces increasing competition. Notably, Russia—a major exporter of pollock—is projected to significantly boost its surimi production. Despite this, the market can absorb additional supply if Vietnamese businesses leverage their cost and quality advantages.

Alongside opportunities, Vietnam’s fish cake and surimi industry faces notable challenges. Raw material costs, particularly for white fish and by-products, can fluctuate dramatically. Without effective cost management, profit margins may shrink.

Logistics and volatile shipping costs significantly impact exports, especially to distant markets like Europe, where transportation and preservation expenses (e.g., freezing) can be burdensome.

Furthermore, stringent food safety and traceability certifications required by markets like the EU, North America, and Japan necessitate substantial investments from Vietnamese companies.

Competition in these markets is intensifying. Beyond Russia, countries like Thailand and China are ramping up surimi production, exerting pressure on market share and pricing.

Looking ahead, with global demand recovering, Vietnam’s fish cake and surimi exports are poised for continued positive growth.

Seafood Exports to the U.S. Face Turbulence Amid Retaliatory Tariffs

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), seafood exports are experiencing significant growth, reflecting the industry’s relentless efforts amidst a volatile market. However, over the past three months, seafood exports to the U.S. have begun to decline due to the impact of retaliatory tariffs.

Vietnam’s Seafood Exports Projected to Hit $10.5 Billion in 2023

The Vietnam Association of Seafood Exporters and Producers (VASEP) forecasts that the country’s seafood export turnover will reach a record-breaking $10.5 billion this year.