On November 29th, during the Huba Entrepreneur Coffee program organized by the Ho Chi Minh City Business Association, economic experts forecasted Vietnam’s 2026 economic outlook, focusing on growth, interest rates, and exchange rates.

At the event, Mr. Dominic Scriven, Chairman of Dragon Capital, stated that 2026 will be an exceptionally favorable year for Vietnam’s economy.

Mr. Dominic Scriven, Chairman of Dragon Capital, predicts 2026 will be an exceptionally favorable year for Vietnam’s economy.

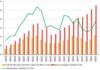

Recovery signals from businesses, public investment, export markets, and capital markets indicate that the economy is converging on multiple factors for a strong breakout in 2025-2026. Notably, GDP growth in 2026 could even reach 9.3-10%, a scenario once considered out of reach; corporate profit growth is forecasted at over 16%.

One significant driver is the integration of 5 million individual business households into the formal economy. New regulations, such as bank payments and electronic invoices, are expected to enhance cash flow transparency and expand this sector’s contribution. This shift alone is projected to add approximately 1% to GDP annually over the next three years.

“Confidence has returned. Many businesses report brighter market prospects, more stable orders, and increased investment motivation. Vietnam is in a prime position in the cycle. The opportunity for a breakout is clear,” said Mr. Dominic Scriven.

According to Mr. Dominic Scriven, to ensure high and stable growth, Vietnam needs to increase public investment from $25 billion to $32-33 billion annually and maintain this level for several consecutive years. This strategy has been successfully implemented by many countries, and Vietnam is now in a golden position to capitalize on it.

Economic experts predict Vietnam could achieve a 10% growth rate in 2026.

According to Dr. Can Van Luc, a member of the Prime Minister’s Policy Advisory Council, Vietnam’s economy has passed its most challenging phase, with many export industries facing reduced orders and weakened domestic consumption. Currently, most macroeconomic indicators show a more positive trend: inflation is under control, exchange rates are stable, foreign investment flows remain strong, and some major export markets are beginning to recover demand.

Dr. Luc stated that this year Vietnam is likely to achieve an 8% growth rate (compared to the initial target of 8.3-8.5%), partly due to natural disaster impacts estimated at 60 trillion VND. In contrast, Thailand, a direct competitor, is only expected to grow by 2%.

“In 2026, we aim for a 9-10% growth rate, provided there are no unusual natural disasters,” said Dr. Luc.

Regarding interest rates, Dr. Luc noted that the U.S. Federal Reserve (Fed) is trending toward rate cuts, with an additional reduction expected in December. He believes that U.S. rate cuts are a positive signal for Vietnamese businesses, as they will lower USD interest rates, reduce exchange rate pressure, and decrease capital outflows from Vietnam.

On inflation, Dr. Luc advised against excessive concern. Since commodity prices are stable and not rising, there is no need to worry. Notably, fuel prices are expected to remain unchanged or even decrease due to abundant supply, alternative energy sources, and weak demand.

2026 will mark a return to natural growth momentum for the market, as external factors become more favorable and businesses adapt to the new economic state.

“Vietnam has a significant advantage with a market of nearly 100 million people, an expanding middle class, and strong international investor interest. These factors create important growth potential for 2026,” Dr. Luc concluded.

Dragon Capital’s Perspective: Vietnam’s Economic Outlook and Corporate Health on the Cusp of 2026

At the 86th HUBA Entrepreneur Café event, themed “Economic Forecast for 2026 – Growth, Interest Rates, and Exchange Rates,” held on the morning of November 29th, Mr. Dominic Scriven, Chairman of Dragon Capital, offered a unique perspective. Drawing from his experience with foreign investment funds, he provided keen insights into the health of businesses by closely monitoring capital markets, bonds, and stocks.

2026 Economic Landscape: A Golden Opportunity for Businesses and Ho Chi Minh City’s Vision of a Megacity

At the 86th HUBA Entrepreneur Café event, themed “Economic Forecast for 2026 – Growth, Interest Rates, and Exchange Rates,” held on the morning of November 29th, Dr. Cấn Văn Lực, Chief Economist at BIDV and a member of the Prime Minister’s Policy Advisory Council, shared insights into the economic landscape and strategic directions for businesses in the context of 2026.

High-Speed North-South Railway Project: Direct Investment Emerges as the Sole Viable Model

Renowned economist Vu Dinh Anh asserts that the optimal financing model for the North-South high-speed rail project is direct private investment, wherein the state provides 80% of the capital through loans, and private investors contribute the remaining 20%. This approach surpasses both traditional public investment and public-private partnerships (PPPs) in terms of efficiency and feasibility.