I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

VN30 futures contracts saw a unanimous rise during the trading session on December 1, 2025. Specifically, VN30F2512 (F2512) increased by 0.53%, reaching 1,933.2 points; 41I1G1000 (I1G1000) rose by 0.91%, hitting 1,932.7 points; the 41I1G3000 (I1G3000) contract gained 0.38%, reaching 1,927 points; and the 41I1G6000 (I1G6000) contract climbed 0.77%, closing at 1,930 points. The underlying index, VN30-Index, ended the session at 1,933.56 points.

Additionally, most VN100 futures contracts also advanced during the December 1, 2025 trading session. Notably, 41I2FC000 (I2FC000) increased by 0.5%, reaching 1,831.1 points; 41I2G1000 (I2G1000) rose by 0.78%, closing at 1,830 points; the 41I2G3000 (I2G3000) contract dipped by 0.08%, settling at 1,820.5 points; and the 41I2G6000 (I2G6000) contract remained unchanged at its reference level of 1,808.2 points. The underlying index, VN100-Index, concluded the session at 1,834.56 points.

During the December 1, 2025 trading session, the VN30F2512 contract surged strongly from the opening bell, with buying pressure initially dominating. However, short sellers quickly re-entered the market, causing the contract to trade sideways for most of the morning session. In the afternoon, the contract continued to fluctuate in a tug-of-war between buyers and sellers. Despite buyers’ efforts to push prices higher toward the end of the session, sellers managed to restrain the upward momentum, narrowing the gains for F2512, which closed at 1,933.2 points, up by 10.2 points.

Intraday Chart of VN30F2512

Source: https://stockchart.vietstock.vn/

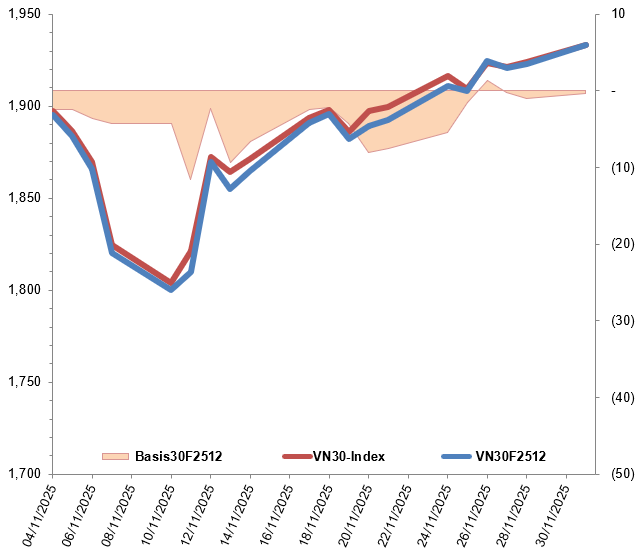

At the close, the basis of the F2512 contract narrowed compared to the previous session, reaching -0.36 points. This indicates a less pessimistic sentiment among investors.

Fluctuations of VN30F2512 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated using the formula: Basis = Futures Contract Price – VN30-Index

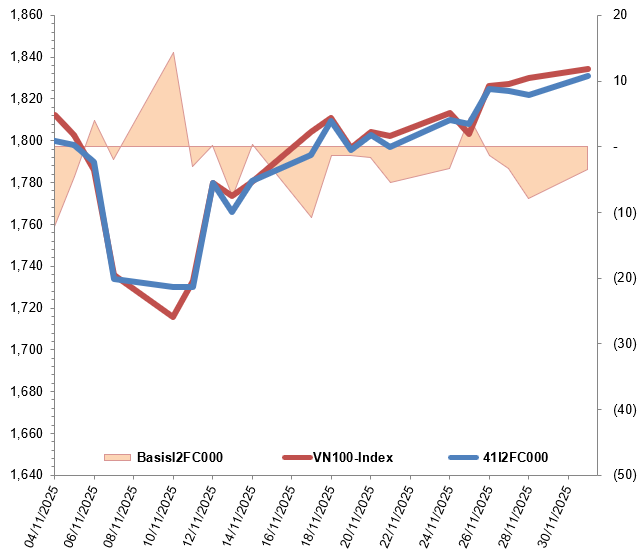

Meanwhile, the basis of the I2FC000 contract also narrowed compared to the previous session, reaching -3.46 points. This suggests a less pessimistic sentiment among investors.

Fluctuations of 41I2FC000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated using the formula: Basis = Futures Contract Price – VN100-Index

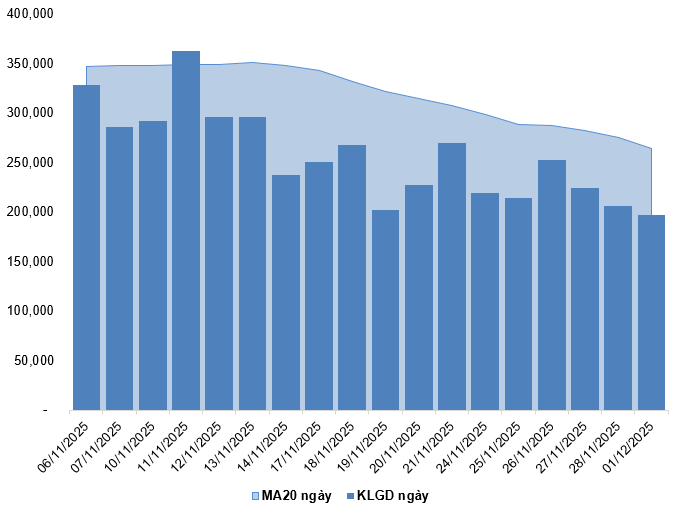

Trading volume and value in the derivatives market decreased by 4.08% and 3.59%, respectively, compared to the session on November 28, 2025. Specifically, the trading volume of F2512 decreased by 4.07%, with 196,937 contracts matched. The trading volume of I2FC000 reached 98 contracts, up by 113.04%.

Foreign investors continued to buy net, with a total net buying volume of 1,504 contracts during the December 1, 2025 trading session.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

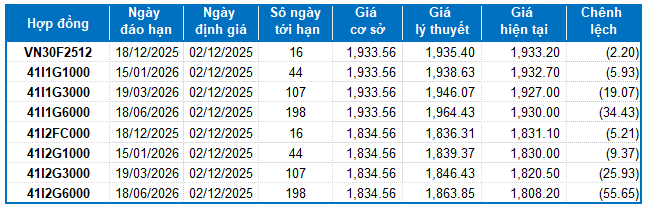

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of the start of December 2, 2025, the fair price range for futures contracts currently trading in the market is as follows:

Summary Table of Derivatives Pricing for VN30-Index and VN100-Index

Source: VietstockFinance

Note: The opportunity cost in the pricing model has been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments suitable for each type of futures contract.

I.3. Technical Analysis of VN30-Index

During the December 1, 2025 trading session, the VN30-Index continued to trade in a tug-of-war, with a small-bodied candlestick pattern and trading volume below the 20-session average, indicating cautious investor sentiment.

Currently, the index is approaching the October 2025 high (equivalent to the 1,945-1,970 point range), while the Stochastic Oscillator has entered the overbought territory.

If the indicator generates a sell signal and exits this zone in the near future, short-term correction risks may emerge.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

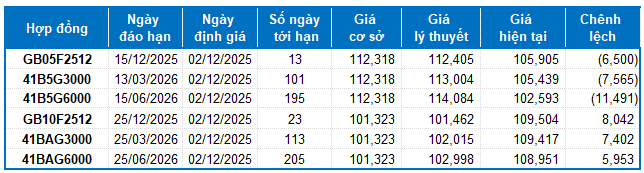

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of the start of December 2, 2025, the fair price range for futures contracts currently trading in the market is as follows:

Summary Table of Government Bond Futures Pricing

Source: VietstockFinance

Note: The opportunity cost in the pricing model has been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments suitable for each type of futures contract.

According to the above pricing, the GB05F2512, 41B5G3000, and 41B5G6000 contracts are currently attractively priced. Investors may focus their attention and consider buying these futures contracts in the near future, as they present a bargain in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 18:28 01/12/2025

Vietstock Weekly 01-05/12/2025: Fueling Momentum for a Breakthrough

The VN-Index has sustained its position above the Middle Bollinger Band, marking its third consecutive week of recovery. However, the current upward momentum lacks conviction, as trading volumes remain below the 20-week average. Additionally, technical indicators such as the MACD and Stochastic Oscillator have yet to signal a clear buying opportunity. It is likely that the index will continue to oscillate within the 1,680–1,720 range until sufficient liquidity emerges to drive a decisive breakout.

Derivatives Market Week 01-05/12/2025: Total Trading Volume Declines for Sixth Consecutive Week

On November 28, 2025, most VN30 and VN100 futures contracts declined during the trading session. While the VN30-Index edged higher, it formed a small-bodied candlestick pattern accompanied by below-average trading volume over the past 20 sessions, indicating investor hesitation.