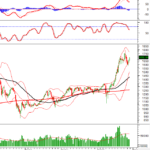

As of the November 28th session close, the VN-Index settled at 1,691 points, marking a 2.18% increase compared to the previous week’s closing price. The average daily trading value for the week reached VND 18,627 billion, 13% lower than the 20-session average.

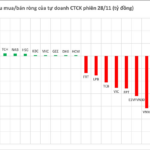

Last week, large-cap stocks showed notable divergence. While some stocks like VIC, VNM, and VPL recorded solid gains, supporting the index, many banking and securities stocks traded sideways or faced selling pressure.

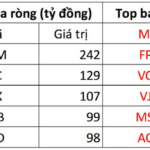

Foreign capital flows showed signs of improvement, with foreign investors reducing net selling and even turning net buyers in some late-week sessions. This helped stabilize investor sentiment and bolstered the VN-Index’s recovery.

Aiming for the 1,700-point resistance test

Mr. Nguyen Anh Khoa, Head of Analysis and Investment Advisory, Agriseco Securities

Technically, the VN-Index maintained its upward structure last week, forming a three-week winning streak and closely following the 20-week moving average (MA20). Looking ahead, Mr. Khoa expects the VN-Index to target the critical 1,700-point resistance level. To successfully overcome this barrier, market liquidity needs to improve with a more positive market breadth.

Conversely, profit-taking pressure around the resistance level is possible as the index approaches higher prices. However, the overall market trend remains positive, supported by attractive valuations across many sectors and expectations of continued earnings growth in 2026.

Liquidity has been relatively low recently. Agriseco’s expert cites several reasons for this cautious investor sentiment:

First, the VN-Index is approaching the strong 1,700-point resistance level, making investors hesitant to deploy new capital due to adjustment risks at higher prices.

Second, many stocks, particularly in the banking and securities sectors, have already experienced significant rallies, leading to caution after profit-taking.

Third, following the Q3/2025 earnings season, the market is in a short-term information vacuum, causing active capital to remain on the sidelines. Additionally, foreign selling pressure has been a significant factor in investor caution.

However, Mr. Nguyen Anh Khoa believes this pressure has eased somewhat, as foreign buying activity improved noticeably in the final sessions of the week.

These factors could impact the market’s short-term upward momentum, especially as the VN-Index nears the 1,700-point psychological resistance, which requires strong buying pressure to break through. Without sufficient liquidity support, the index may continue to trade within the 1,650–1,700 range in the near term.

In Mr. Khoa’s view, within this narrow trading range and declining liquidity, the next leg of the rally is likely to be led by sectors with supportive macroeconomic fundamentals, attractive valuations, and early recovery signals.

Several groups have the potential to lead the market. First, the banking sector benefits from a stable macro environment and high credit growth expectations for 2026. Many banks’ price-to-book (P/B) ratios are now attractive and below their five-year averages.

Second, the residential real estate, construction, and building materials sectors are expected to benefit from a vibrant real estate market and increased public investment disbursement. Companies with clean land banks, clear legal status, or construction firms with strong backlogs may attract investment capital.

Additionally, companies benefiting from year-end consumption growth, such as retail, or blue-chip stocks in the VN30 index, could also lead the market.

VN-Index’s “shake-out” phase: Consider exploratory investments

Mr. Nguyen Thai Hoc – Securities Analyst, Pinetree

Last week, the VN-Index rose, but the rally was driven primarily by Vingroup-related stocks. The VIC-VPL-VHM trio contributed nearly 40 points to the index’s 36-point gain, while most other stocks traded sideways or continued to consolidate.

Low liquidity reflected cautious sentiment, as capital flowed narrowly into a few large-cap groups.

Foreign investors remained net sellers but at a significantly reduced rate, near VND 600 billion. Domestic institutions were the sole support, maintaining market stability amid overall caution.

For the upcoming week, Mr. Hoc notes that despite two consecutive weeks of retail selling, the VN-Index held above 1,700 points. This suggests a higher probability of a “shake-out” phase rather than the start of a deep correction.

In the early sessions, the index is likely to continue sector rotation and consolidate around current levels.

In a positive scenario, if key sectors like real estate or energy absorb supply well and rebound, the VN-Index could break through 1,700 points in the second half of the week, targeting the previous high around 1,750 points.

Conversely, if buying power is insufficient or profit-taking increases, the index may retest the 1,640–1,650 support zone before establishing a new uptrend. Overall, Mr. Hoc favors the positive scenario, as selling pressure is not overwhelming, and low liquidity indicates holding rather than panic selling.

Strategically, this phase favors a positive but selective approach. Existing investors can hold positions and observe market reactions around 1,700 points. “Strong profit-taking should only be considered when the index nears higher resistance levels or shows clear signs of weakening buying power,” the Pinetree expert advises.

For new investors, consider small, exploratory investments in stocks with positive price action, strong fundamentals, and attracting capital inflows, particularly in energy, consumer, real estate, chemicals, and technology sectors.

Invest gradually, avoid chasing momentum, and maintain cash reserves for potential support zone retests.

Many stocks now at attractive levels

A recent report by NH Securities (NHSV) highlights the market’s challenging environment for investors, with index-driving stocks rising while most others decline. However, NHSV emphasizes strong fundamentals, noting that many stocks have retreated to attractive investment levels, making selling unnecessary.

Regarding rising interest rates, NHSV attributes this to year-end credit demand, expecting rates to ease post-Lunar New Year as capital needs normalize.

Vietstock Weekly 01-05/12/2025: Fueling Momentum for a Breakthrough

The VN-Index has sustained its position above the Middle Bollinger Band, marking its third consecutive week of recovery. However, the current upward momentum lacks conviction, as trading volumes remain below the 20-week average. Additionally, technical indicators such as the MACD and Stochastic Oscillator have yet to signal a clear buying opportunity. It is likely that the index will continue to oscillate within the 1,680–1,720 range until sufficient liquidity emerges to drive a decisive breakout.

Vietnam’s First Enterprise Surpasses $43 Billion in Market Capitalization

At the close of today’s trading session (November 28), Vingroup’s VIC shares surged by 5% to reach 260,400 VND per share. This milestone propelled Vingroup’s market capitalization past the 1 quadrillion VND mark for the first time in its history, making it the first Vietnamese company listed on the stock exchange to achieve this remarkable feat.