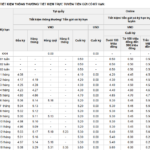

Saigon Jewelry Company lists the price of SJC gold bars at VND 152.9 – 154.9 million per tael (buy – sell), unchanged from yesterday morning.

Mi Hong Gold System quotes gold bars at VND 153.2 – 154.9 million per tael.

Bao Tin Minh Chau JSC lists gold bars at VND 153.4 – 154.9 million per tael.

Meanwhile, the price of gold rings from various brands has surged significantly. Specifically, Bao Tin Minh Chau gold rings are listed at VND 151.5 – 154.5 million per tael, up VND 1.2 million per tael compared to yesterday morning.

Gold ring prices surge significantly.

Phu Quy gold rings are listed at VND 150.7 – 153.7 million per tael, up VND 700,000 per tael…

At the same time, the global gold price is quoted at USD 4,219 per ounce, unchanged from yesterday morning.

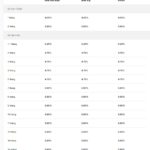

In the currency market, the central exchange rate announced by the State Bank this morning stands at VND 25,155 per USD, unchanged from yesterday morning.

Vietcombank’s USD rate is VND 26,191 – 26,412 per USD (buy – sell), up VND 6 compared to yesterday morning.

In the free market, the USD is traded at around VND 27,730 – 27,850 per USD (buy – sell).

At the Entrepreneur Coffee Program organized by the Ho Chi Minh City Business Association on November 29, Dr. Can Van Luc, a member of the Prime Minister’s Policy Advisory Council, stated that over the past 11 months, the exchange rate has increased by approximately 3.36%.

According to Dr. Luc, the recent exchange rate increase is due to multiple factors, including those related to gold, and the government has implemented decisive measures to stabilize this market.

It is expected that more commercial banks and enterprises will be licensed to produce and import gold, which will increase market supply and eliminate the monopoly of SJC gold bars.

The anticipated additional interest rate cut by the U.S. Federal Reserve (FED) in December and the continuation of this trend in 2026 will help reduce pressure on the USD/VND exchange rate.

“In reality, the free market exchange rate has stabilized significantly over the past two weeks, and the official market rate has not increased as much as before,” said Dr. Luc.

Year-End Stock Market: Macroeconomic Pressures and Geopolitical Risks

The VN-Index is striving to reclaim the 1,700-point milestone, after briefly surrendering the 1,600-point mark and dipping to the 1,580 region in early mid-October 2025.