I. MARKET DYNAMICS OF WARRANTS

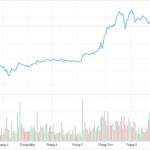

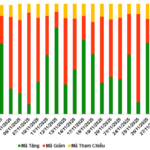

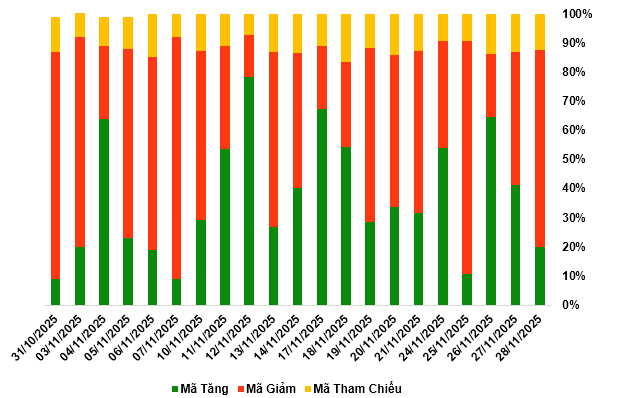

By the close of trading on November 28, 2025, the market recorded 57 gainers, 198 decliners, and 33 unchanged securities.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

Source: VietstockFinance

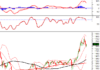

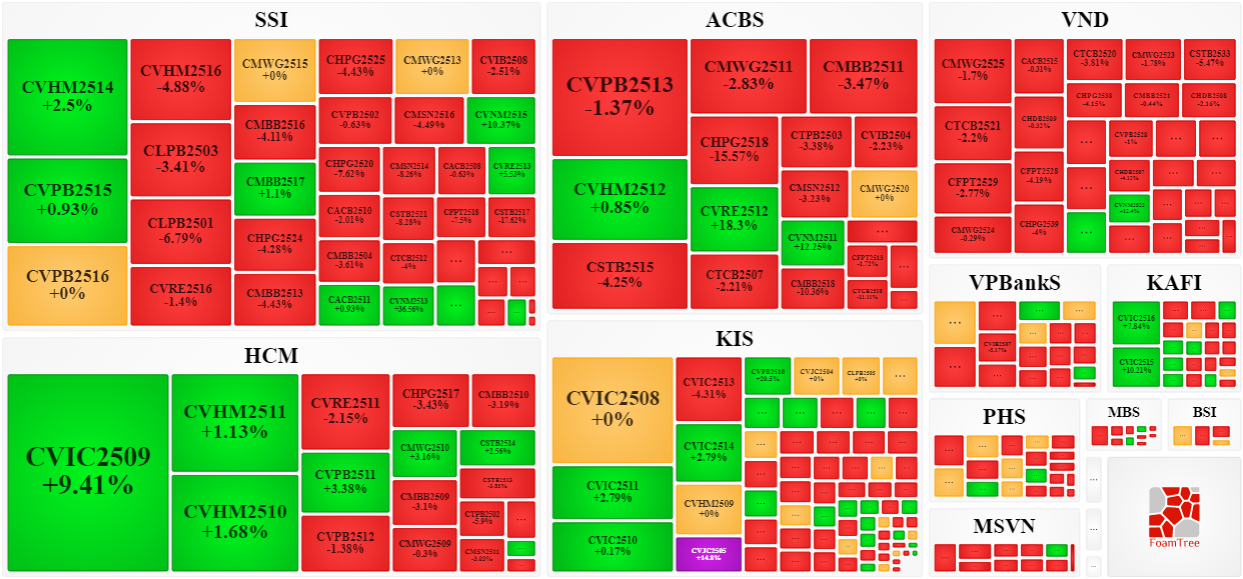

During the November 28, 2025 session, selling pressure dominated, causing most warrant prices to decline. Notably, the major decliners included CVPB2513, CSTB2515, CMWG2511, and CMBB2511.

Source: VietstockFinance

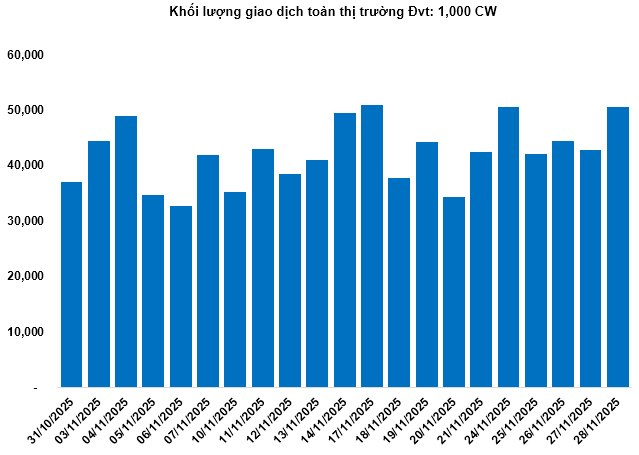

Total market volume on November 28 reached 50.59 million CW, up 14.06%; trading value hit 89.11 billion VND, a 6.4% increase from November 26. CMBB2518 led in volume with 3.07 million CW, while CHPG2518 topped trading value at 6.48 billion VND.

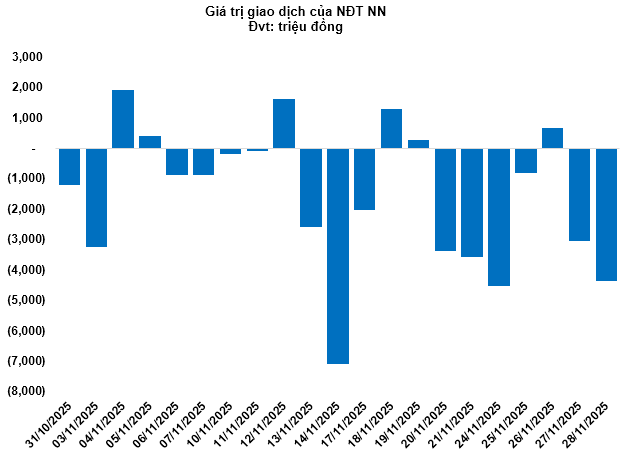

Foreign investors resumed net selling on November 28, totaling 4.38 billion VND. CHPG2518 and CVNM2511 saw the highest net outflows. For the week, foreign net selling exceeded 12.6 billion VND.

Securities firms SSI, ACBS, VND, and HCM are the leading issuers with the most warrants in the market.

Source: VietstockFinance

Source: VietstockFinance

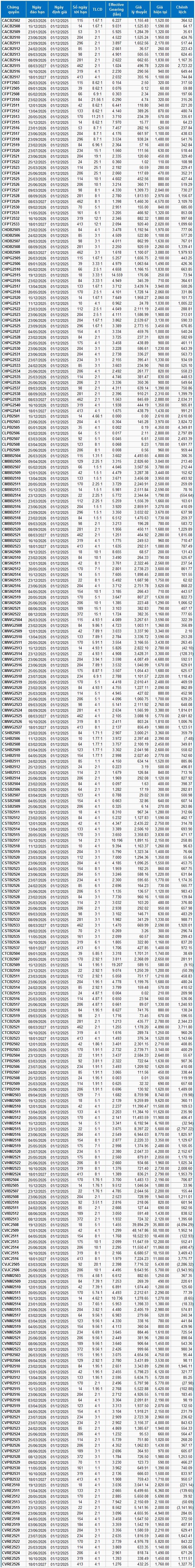

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method effective from December 1, 2025, the fair prices of actively traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for warrant maturity.

According to this valuation, CVIC2508 and CVJC2506 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying assets. Currently, CTCB2509 and CHPG2515 have the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 17:58 30/11/2025

Today’s Crypto Market, November 28: A Tough Decision Awaits Bitcoin

Bitcoin’s upward trajectory is anticipated to solidify once it breaches the $94,000–$95,000 resistance level, according to leading market analysts.

SHB: Dual Momentum Fueled by Capital Expansion Strategy and Foreign Investment Opportunities

Our upcoming capital increase strategy is poised to propel SHB into the top 4 private banks by charter capital, solidifying our competitive edge through enhanced financial strength.