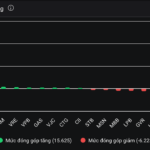

Market liquidity decreased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 519 million shares, equivalent to a value of more than 16.1 trillion VND; the HNX-Index reached over 50.5 million shares, equivalent to a value of over 974 billion VND.

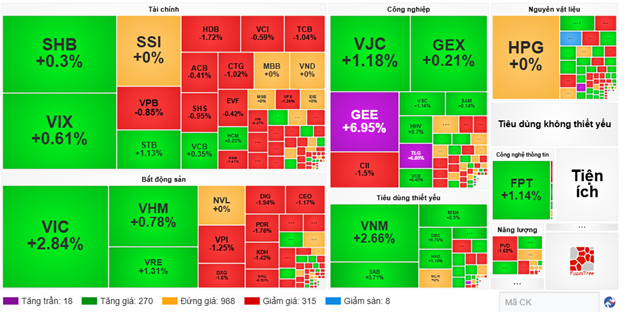

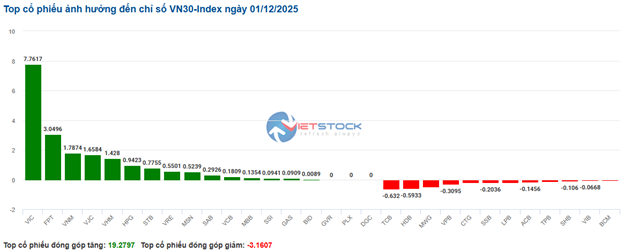

The VN-Index opened the afternoon session on a positive note as buyers maintained their dominance. However, towards the end of the session, selling pressure suddenly increased, narrowing the index’s gains but still closing in the green. In terms of influence, VIC, VPL, VHM, and GEE were the most positively impactful stocks on the VN-Index, contributing 15.2 points. Conversely, TCB, CTG, HVN, and GVR faced selling pressure, reducing the index by over 2.6 points.

| Top 10 Stocks Impacting VN-Index on December 1, 2025 (Point-Based) |

In contrast, the HNX-Index experienced a rather pessimistic trend, negatively impacted by stocks such as KSV (-9.97%), KSF (-0.82%), SHS (-2.38%), and CEO (-2.72%).

| Top 10 Stocks Impacting HNX-Index on December 1, 2025 (Point-Based) |

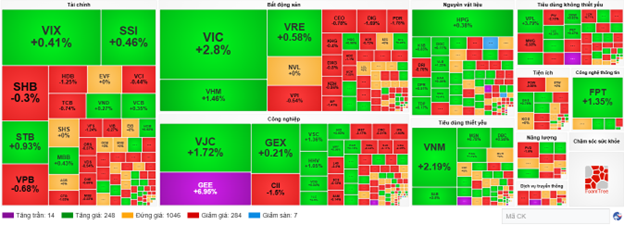

At the close, the market rose with a broad green trend across most sectors. Specifically, the non-essential consumer sector led the market with a 2.47% increase, primarily driven by VPL (+6.95%), MWG (+0.13%), PNJ (+0.66%), CTF (+0.26%), and TTF (+3.55%). The real estate and essential consumer sectors followed with gains of 2.11% and 1.14%, respectively. Conversely, the materials sector saw the largest decline, down 1%, mainly due to HPG (-0.19%), GVR (-2.2%), NKG (-1.23%), and MSR (-2.34%).

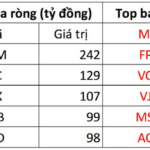

In terms of foreign trading, foreign investors turned net sellers with over 102 billion VND on the HOSE, concentrated in VIC (158.95 billion), VHM (69.65 billion), VCB (64.76 billion), and HDB (46.11 billion). On the HNX, foreign investors net sold over 9 billion VND, focusing on MBS (10.56 billion), PVS (5.71 billion), CEO (2.82 billion), and NTP (2.1 billion).

| Foreign Net Buying/Selling Trends |

Morning Session, December 1: Fluctuations Around 1,700 Points

The VN-Index continued to fluctuate around the 1,700-point mark during the late morning session. By the midday break, the VN-Index rose by over 9 points (+0.55%), reaching 1,700.28 points, while the HNX-Index hovered near the reference level at 259.08 points. However, market breadth was less positive, with sellers dominating as 323 stocks declined and 288 advanced.

Market liquidity showed signs of improvement. The trading value on the HOSE this morning exceeded 9 trillion VND, up 12.63% from the previous session. However, trading on the HNX decreased by 23.59% compared to the previous session, reaching only over 22 million units, equivalent to nearly 414 billion VND.

In terms of influence, the top 10 positively impacting stocks contributed a total of 13.88 points to the VN-Index, with VIC alone adding over 6 points. Conversely, CTG and TCB exerted the most pressure, reducing the index by over 1 point.

| Top 10 Stocks Impacting VN-Index in the Morning Session of December 1, 2025 (Point-Based) |

Sectoral divergence continued to dominate. The real estate sector temporarily led the market with a 1.37% increase, primarily driven by the Vin group trio: VIC (+2.84%), VHM (+0.78%), and VRE (+1.31%). Meanwhile, the rest of the sector faced significant selling pressure, including BCM (-1.5%), KSF (-1.22%), KDH (-1.43%), PDR (-1.78%), TCH (-1.71%), DXG (-1.6%), CEO (-1.17%), DIG (-1.94%), and SIP (-2.3%).

Additionally, the non-essential and essential consumer sectors traded actively, with highlights such as VPL (+4.21%), DGW (+1.83%); VNM (+2.66%), SAB (+5.71%), HAG (+1.15%), MML (+3.25%), VSF (+1.2%), and HAG (+1.15%). However, several stocks recorded significant adjustments, including PNJ (-1.1%), FRT (-1.02%), HHS (-1.42%), MSH (-1.66%), and VHC (-1.04%).

The industrial sector also rose slightly by 0.52%, with buying interest in stocks like VJC (+1.18%), VSC (+1.14%), HHV (+0.7%), and GEE and TLG hitting their upper limits.

Conversely, the communication services sector temporarily lagged with a 1.01% decline, influenced by adjustments in leading stocks such as VGI (-1.23%), FOX (-0.96%), and CTR (-0.81%).

Source: VietstockFinance

|

Foreign investors were net sellers with a value of over 207.8 billion VND across all three exchanges, with selling concentrated in VIC at 99.08 billion VND. Meanwhile, VNM led the net buying list with a value of 86.74 billion VND.

| Top 10 Stocks with Strongest Foreign Net Buying/Selling in the Morning Session of December 1, 2025 |

10:30 AM: Investor Hesitancy Leads to Mixed Index Movements

Investors showed signs of hesitation, causing the main indices to enter a state of tug-of-war. As of 10:30 AM, the VN-Index maintained a gain of over 11 points, trading around 1,700 points. The HNX-Index dipped slightly by 0.28 points, trading around 259 points.

The breadth of the VN30-Index showed green dominating. Specifically, on the positive side, VIC added 7.7 points, FPT added 3 points, VNM added 1.78 points, and VJC added 1.65 points. Conversely, some stocks still faced selling pressure, with TCB, HDB, MWG, and VPB reducing the index by over 2 points.

Source: VietstockFinance

|

Real estate stocks continued to show strong divergence. On the buying side, VIC rose 2.92%, VHM rose 1.55%, and VRE rose 0.88%, continuing to lead the sector’s gains. Conversely, most other stocks like CEO, DIG, DXG, KHG, and KDH still faced selling pressure, though the negative impact was not significant.

Similarly, the industrial sector maintained a good increase despite breadth divergence. Specifically, buying interest was seen in stocks like GEE (+6.95%), VJC (+1.77%), GEX (+0.75%), and VSC (+1.36%).

Conversely, the financial sector performed less favorably, with selling pressure dominating banking stocks such as SHB (-0.6%), HDB (-1.41%), TCB (-0.89%), and VPB (-1.68%).

Compared to the opening, sellers still dominated despite breadth favoring unchanged stocks (over 1,000). There were 248 advancing stocks (14 at the upper limit) and 284 declining stocks (7 at the lower limit).

Source: VietstockFinance

|

Market Opening: Green Dominates Early Session

At the start of the December 1 session, as of 9:30 AM, the VN-Index fluctuated around 1,700 points after surging nearly 10 points. Similarly, the HNX-Index also rose slightly, trading around 260 points. This positive trend was partly reflected in the S&P Global Purchasing Managers’ Index™ (PMI®) report.

According to the report, Vietnam’s manufacturing sector continued its robust growth in November 2025, with the PMI reaching 53.8 points, marking the fifth consecutive month of expansion. Despite supply chain disruptions and rising input costs due to natural disasters, market demand remained strong. Notably, export orders saw their highest increase in 15 months, prompting businesses to ramp up hiring and maintain optimistic outlooks for the coming year.

Turning to market dynamics, the real estate sector was among the top performers in the early session, with leading stocks like VIC (+6.76%), VHM (+3.5%), and VRE (+3.36%) standing out.

Essential consumer goods also contributed to the market’s recovery, with significant contributions from stocks like VNM (+0.94%), DBC (+1.88%), SAB (+3.34%), and MSN (+0.52%).

In addition to these sectors, many large-cap stocks also performed positively, including VCB, VJC, GAS, and MBB, which helped support the index.

– 15:25 01/12/2025

Halting the Debt Swap Deal Between Two Real Estate Giants

The conversion of Hoang Quan Real Estate’s VND 212 billion debt to Hai Phat Investment into 21.2 million shares has been temporarily halted. This decision follows Hoang Quan Real Estate’s review, which identified the need for additional information and adjustments to the issuance registration dossier.

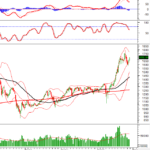

Vietstock Weekly 01-05/12/2025: Fueling Momentum for a Breakthrough

The VN-Index has sustained its position above the Middle Bollinger Band, marking its third consecutive week of recovery. However, the current upward momentum lacks conviction, as trading volumes remain below the 20-week average. Additionally, technical indicators such as the MACD and Stochastic Oscillator have yet to signal a clear buying opportunity. It is likely that the index will continue to oscillate within the 1,680–1,720 range until sufficient liquidity emerges to drive a decisive breakout.

Vietnam’s First Enterprise Surpasses $43 Billion in Market Capitalization

At the close of today’s trading session (November 28), Vingroup’s VIC shares surged by 5% to reach 260,400 VND per share. This milestone propelled Vingroup’s market capitalization past the 1 quadrillion VND mark for the first time in its history, making it the first Vietnamese company listed on the stock exchange to achieve this remarkable feat.