Recently, the stock market has witnessed numerous companies announcing share buybacks.

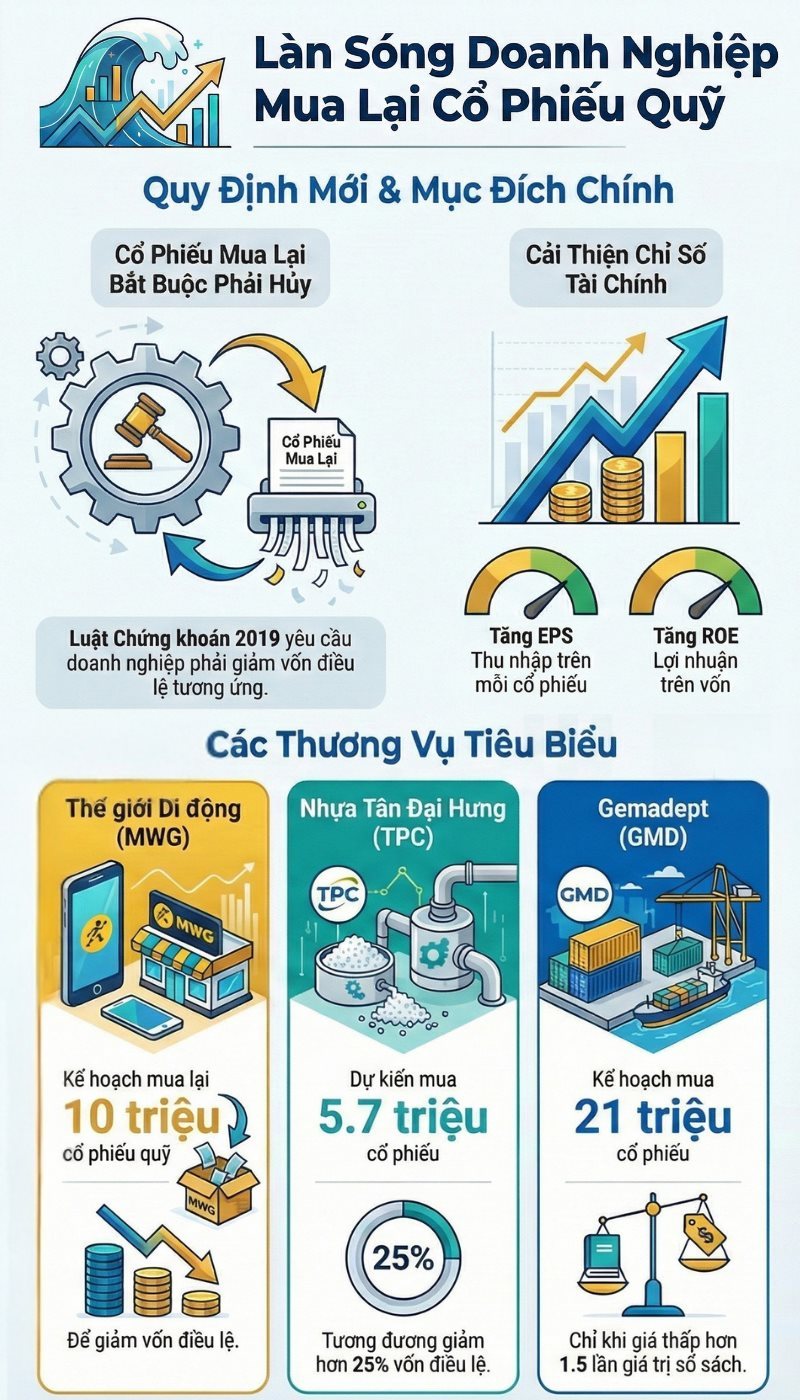

Mobile World Investment Corporation (MWG) has announced the repurchase of 10 million shares under the approved plan, to be executed via order matching from November 19 to December 18, 2025.

The transaction is expected to utilize approximately VND 800 billion from the undistributed after-tax profit of nearly VND 12,600 billion, as per the 2024 financial report.

T-Corp Asset Management Group (TVC) also announced the completion of the purchase of 14.46 million shares out of the registered 15 million shares from October 6 to November 4, with an estimated value of VND 170 billion. This move reduced the charter capital below the VND 1,000 billion mark, leaving the company with over 96.1 million shares outstanding.

Tan Dai Hung Plastic (TPC) plans to propose a special shareholders’ meeting in early December to approve the repurchase of 5.7 million shares, reducing the charter capital by over 25% (from VND 225 billion to VND 168 billion). The company will use VND 77.2 billion from the capital surplus with a maximum purchase price of VND 13,500 per share.

What is the purpose of share buybacks under the new regulations?

Before the 2019 Securities Law took effect, treasury shares were seen as a “lifeline” for companies to stabilize stock prices during market downturns. Companies could buy shares at low prices to limit selling pressure and sell them later when conditions were favorable, even using them as a flexible capital-raising tool.

However, the new legal framework has changed. Purchased treasury shares cannot be sold, meaning buybacks definitively lead to a reduction in charter capital. The decision-making process has also been tightened, requiring shareholder approval instead of the previous board-approved limit of 10%.

From a financial perspective, share buybacks are now viewed as a capital restructuring measure. Reducing the number of outstanding shares immediately improves metrics like EPS and ROE, while BVPS can increase as profits are distributed among fewer shares. However, the debt-to-equity ratio (D/E) may rise, requiring shareholders to assess the company’s financial health and strategy before making investment decisions.

For MWG, whose shares are trading at their highest level since April 2022, Chairman Nguyen Duc Tai emphasized that the buyback aims not to support the price but to implement a long-term strategy to increase ownership and enhance shareholder value. The company allocates a portion of its annual profits for this purpose, demonstrating a robust financial position with ample cash reserves.

At T-Corp Asset Management Group (TVC), management views the shares as trading below book value, and the buyback is seen as a way to bolster investor confidence. The company has accumulated profits of over VND 300 billion, and despite allocating VND 200 billion for the buyback, management remains committed to paying a 10% dividend for 2021 and an additional 6% interim dividend by year-end if 2025 results are favorable.

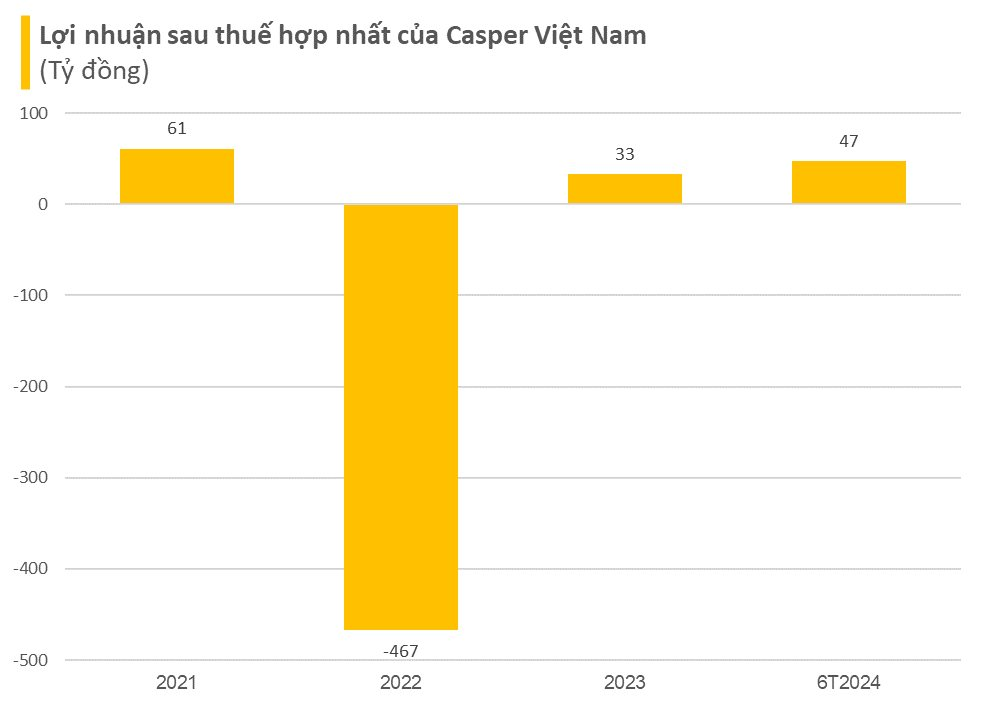

Tan Dai Hung Plastic, on the other hand, focuses more on restructuring than improving metrics. Facing increasing competition from Chinese companies, the company reduced prices, leading to a loss in 2023. The share buyback and capital reduction, as described by Chairman Pham Trung Cang, aim to alleviate pressure on return on equity, reduce outstanding shares to 15–17 million units, and create room for resuming dividend payments.

Nevertheless, the market still sees cases of share buybacks aimed at price stabilization. Gemadept (GMD) received shareholder approval for a plan to repurchase 21 million treasury shares at the 2025 AGM, to be executed only when the market price falls below 1.5 times book value, or approximately VND 45,000 per share.

This plan emerged after a market crash in early April due to tariff issues, which drove GMD’s price down to VND 42,000—its lowest since September 2023. At the time, management believed the market price did not reflect the company’s true value. However, with shares now recovering to the VND 60,000–63,000 range, the company has not yet activated the plan.

The new legal context has significantly shifted the narrative around treasury shares: from a short-term price support tool to a long-term financial restructuring solution aimed at enhancing shareholder value. The success or failure of this strategy will depend on a company’s cash flow health, growth prospects, and management’s commitment to shareholder interests.

Stock Market Update November 27: Widespread Stock Declines, One Bank Stock Surges to a Striking Purple

The stock market session on November 27th closed in the green, yet underlying dynamics painted a less optimistic picture.

Enterprise Reports 15x Profit Surge Year-Over-Year, Stock Hits 9 Consecutive Circuit Breakers, Soaring 150% in Just 2 Months

Amidst the VN-Index’s struggle to find equilibrium, marked by low liquidity and pronounced anchoring effects, Halcom Vietnam JSC’s stock (HID) has emerged as a rare standout. Defying the prevailing cautious sentiment, HID has consistently surged to its maximum daily limit, showcasing remarkable resilience and investor confidence.

What is the Purpose of a Series of Corporate Share Buybacks?

Recently, several companies have been repurchasing treasury shares. Notably, under the Securities Law 2019 (effective from January 1, 2021), treasury shares must be canceled upon repurchase, and the company’s chartered capital must be reduced accordingly. This raises the question: what is the purpose of companies engaging in such share buybacks?