I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON DECEMBER 1, 2025

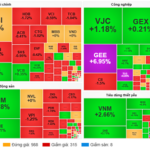

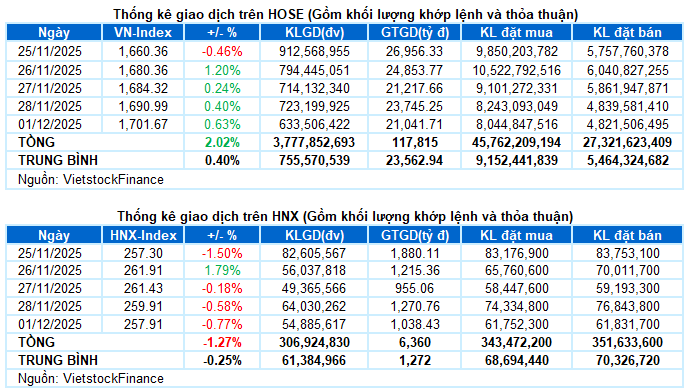

– Key indices showed mixed movements during the December 1 trading session. The VN-Index rose by 0.63%, reaching 1,701.67 points. In contrast, the HNX-Index declined by 0.77%, closing at 257.91 points.

– Trading volume on the HOSE floor decreased by 17.9%, totaling nearly 520 million units. The HNX floor also recorded just over 50 million matched units, an 18.1% drop compared to the previous session.

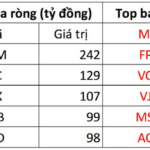

– Foreign investors net sold over VND 102 billion on the HOSE and VND 9 billion on the HNX.

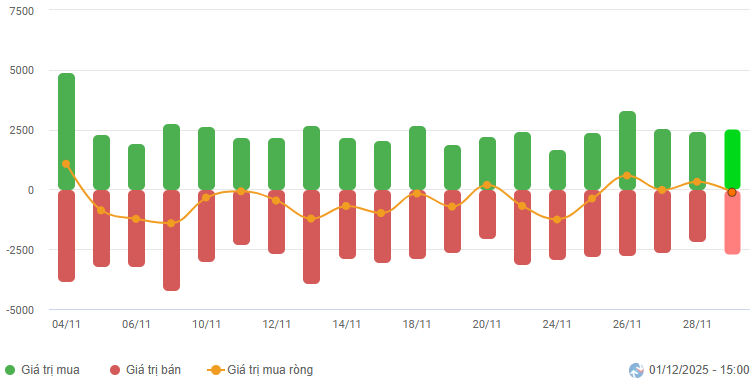

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

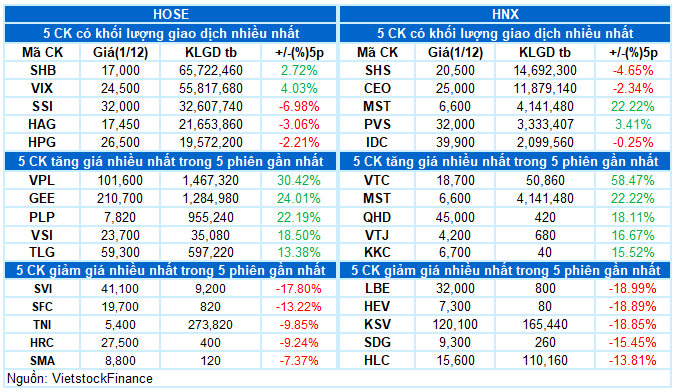

Net Trading Value by Stock Code. Unit: Billion VND

– The VN-Index kicked off December with a strong start, breaking through the psychological barrier of 1,700 points early in the day, driven by robust blue-chip stocks. The index quickly expanded its gains to over 22 points within the first half-hour. However, this marked the peak for the day, as the momentum slowed due to limited market breadth. The rally relied heavily on a few leading stocks, while the majority exhibited clear divergence, with more decliners than advancers. The VN-Index closed the session at 1,701.67 points, up 10.68 points from the previous session.

– In terms of influence, the top 10 stocks contributed 18.55 points to the VN-Index‘s rise, with the Vingroup trio (VIC, VPL, and VHM) alone adding 14 points. Conversely, TCB and CTG exerted the most significant downward pressure, subtracting over 1.5 points from the index.

Top Influencing Stocks on the Index. Unit: Points

– The VN30-Index gained 9.64 points (+0.5%), closing at 1,933.56 points. The basket’s breadth was relatively balanced, with 16 advancers and 14 decliners. On the positive side, SAB stood out with an impressive 5.6% increase. VIC, GAS, and VHM also surged by over 2%. Conversely, SSI and GVR were the bottom performers, dropping by 2.4% and 2.2%, respectively.

Divergent trends continued to dominate industry groups. Non-essential consumer goods and real estate led the market with over 2% gains, primarily driven by VPL, TSC, VTB (all hitting ceiling prices), PNJ (+0.66%); VIC (+3.65%), VHM (+3.65%), and VRE (+1.9%). However, most other stocks in these sectors were in the red, notably FRT (-1.36%), TNG (-2.07%), HTM (-6.19%), MSH (-2.63%), STK (-1.78%); BCM (-1.5%), KDH (-2.43%), KBC (-1.84%), PDR (-2.67%), DXG (-2.13%), and CEO (-2.72%).

Essential consumer goods and industrial sectors showcased notable highlights, including VNM (+1.41%), MSN (+1.81%), SAB (+5.6%), PAN (+1.27%); VTP (+2.63%), MST (+4.76%), GEE, and TLG (both hitting ceiling prices).

Conversely, the materials sector lagged with a 1% decline, weighed down by GVR (-2.2%), MSR (-2.34%), NKG (-1.23%), HSG (-1.2%), DPR (-2.44%), HGM (-1.78%), DHC (-2.24%), and KSV (hitting floor price). The financial sector also exerted significant pressure, with numerous stocks adjusting over 1%, including CTG, TCB, LPB, ACB, HDB, TCX, SSI, MSB, EIB, BVH, and TPB.

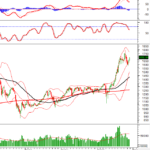

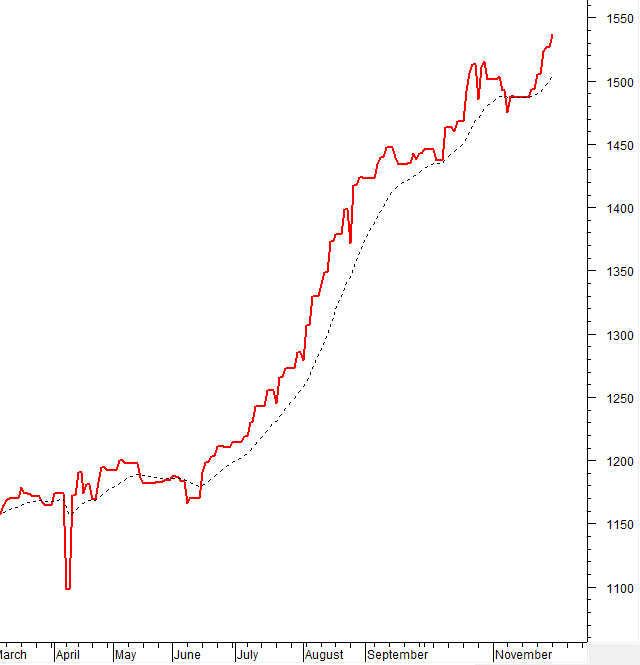

The VN-Index extended its winning streak to four consecutive sessions, surpassing the 1,700-point psychological barrier. However, the session’s strong tug-of-war and below-average 20-day trading volume indicate investor hesitation. The index is likely to oscillate around the September 2025 peak (1,695-1,711 range) in the coming sessions.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – Fourth Consecutive Session of Gains

The VN-Index extended its winning streak to four consecutive sessions, surpassing the 1,700-point psychological barrier. However, the session’s strong tug-of-war and below-average 20-day trading volume indicate investor hesitation.

The index is likely to oscillate around the September 2025 peak (1,695-1,711 range) in the coming sessions.

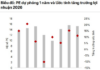

HNX-Index – Death Cross Emerges

The HNX-Index declined for the third consecutive session, retreating to test the November 2025 low (255-259 range).

The index’s medium-term outlook has turned more negative with the emergence of a Death Cross between the 50-day SMA and 100-day SMA.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors were net sellers in the December 1, 2025 session. If this trend continues, market volatility may persist.

III. MARKET STATISTICS FOR DECEMBER 1, 2025

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:10, December 1, 2025

Market Pulse 12/01: Foreign Investors Resume Net Selling of Bluechips, VN-Index Struggles at 1,700 Points

At the close of trading, the VN-Index climbed 10.68 points (+0.63%) to reach 1,701.67, while the HNX-Index dipped 2 points (-0.77%), settling at 257.91. Overall market breadth leaned bearish, with 379 decliners outpacing 314 advancers. The VN30 basket showed a more balanced performance, with 16 gainers and 14 losers.

Halting the Debt Swap Deal Between Two Real Estate Giants

The conversion of Hoang Quan Real Estate’s VND 212 billion debt to Hai Phat Investment into 21.2 million shares has been temporarily halted. This decision follows Hoang Quan Real Estate’s review, which identified the need for additional information and adjustments to the issuance registration dossier.

Vietstock Weekly 01-05/12/2025: Fueling Momentum for a Breakthrough

The VN-Index has sustained its position above the Middle Bollinger Band, marking its third consecutive week of recovery. However, the current upward momentum lacks conviction, as trading volumes remain below the 20-week average. Additionally, technical indicators such as the MACD and Stochastic Oscillator have yet to signal a clear buying opportunity. It is likely that the index will continue to oscillate within the 1,680–1,720 range until sufficient liquidity emerges to drive a decisive breakout.