Stock Market Analysis for the Week of November 24-28, 2025

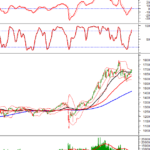

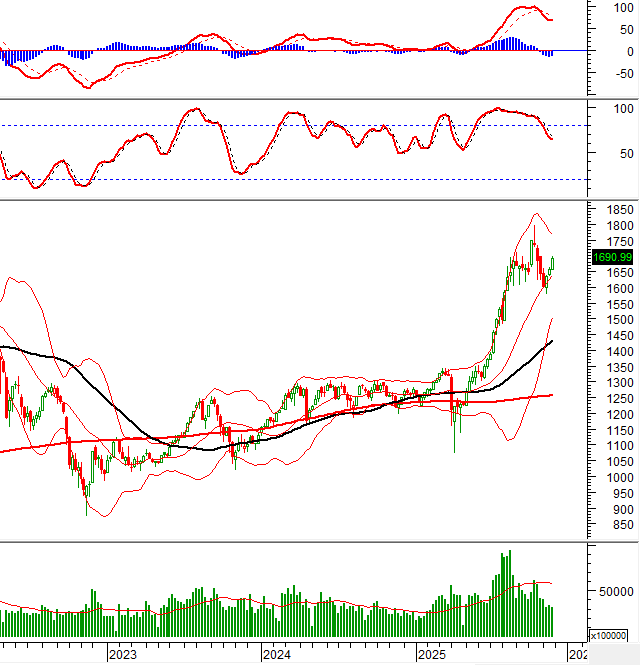

During the week of November 24-28, 2025, the VN-Index remained above the Middle line of the Bollinger Bands, marking its third consecutive week of recovery.

However, the current upward trend lacks conviction, as trading volumes continue to hover below the 20-week average. Meanwhile, key indicators such as MACD and Stochastic Oscillator have yet to signal a buying opportunity. The index is likely to experience continued volatility within the 1,680-1,720 range until sufficient capital emerges to drive a new breakout.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Stochastic Oscillator Enters Overbought Territory

On November 28, 2025, the VN-Index saw a slight increase, accompanied by a small-bodied candlestick pattern. The erratic trading volume in recent sessions reflects investor uncertainty.

Currently, the Stochastic Oscillator has risen into overbought territory after generating a buy signal. If the indicator reverses and exits this zone in upcoming sessions, downside risks will escalate.

HNX-Index – Remains Below the Middle Line

On November 28, 2025, the HNX-Index declined for the second consecutive session, trading below the Middle line of the Bollinger Bands, indicating persistent investor pessimism.

Additionally, the gap between the 50-day SMA and 100-day SMA continues to narrow, while trading volumes have consistently fallen below the 20-session average since November 5, 2025.

If conditions do not improve and a death cross occurs in upcoming sessions, the medium-term outlook will become increasingly bearish.

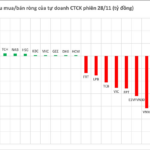

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index for the VN-Index is currently above the 20-day EMA. If this trend persists in the next session, the risk of a sudden downward thrust will diminish.

Foreign Capital Movement: Foreign investors returned to net buying on November 28, 2025. Sustained buying by foreign investors in upcoming sessions would further bolster market sentiment.

Technical Analysis Department, Vietstock Advisory Division

– 16:58 November 30, 2025

Vietnam’s First Enterprise Surpasses $43 Billion in Market Capitalization

At the close of today’s trading session (November 28), Vingroup’s VIC shares surged by 5% to reach 260,400 VND per share. This milestone propelled Vingroup’s market capitalization past the 1 quadrillion VND mark for the first time in its history, making it the first Vietnamese company listed on the stock exchange to achieve this remarkable feat.

Technical Analysis for the Afternoon Session of November 28: Sustaining the Uptrend

The VN-Index continues its upward trajectory, nearing the Upper Band of the Bollinger Bands. Meanwhile, the HNX-Index remains in a tug-of-war, with trading volumes consistently hovering at lower levels.