Following the National Assembly’s approval of the North-South high-speed railway investment plan, two major private enterprises swiftly entered the fray. VinSpeed (under Vingroup) submitted its proposal on May 14th, followed shortly by THACO. Both aim to be the lead investor, but their approaches differ significantly.

The North-South high-speed railway spans over 1,500 km, traversing 20 provinces with a design speed of 350 km/h. According to the proposals, the total investment is approximately $61 billion (excluding land acquisition). This strategic infrastructure project has the potential to reshape regional competitiveness for decades.

Notably, both THACO and VinSpeed commit to self-financing 20% of the capital (nearly $12.3 billion). However, the remaining 80% loan differs: VinSpeed requests a 0% interest government loan for 30 years, while THACO seeks commercial loans from domestic and international institutions.

THACO pledges to raise capital from the market, proposing government guarantees and interest subsidies for 30 years. The 7-year timeline includes: Hanoi – Vinh and HCMC – Nha Trang in 5 years, and Nha Trang – Vinh in the subsequent 7 years. The company also aims to manufacture train carriages and locomotives in Vietnam by 2029.

In contrast, VinSpeed proposes a model where the government provides an 80% interest-free loan. VinSpeed commits to completing the entire route within 5 years of land acquisition, ensuring no cost overruns or delays, while also developing R&D technology.

In terms of fiscal burden, THACO’s plan is lighter as the loan comes entirely from the market, though government guarantees are still required. Conversely, VinSpeed’s proposal demands substantial resources but offers a clear timeline, reducing the entire project duration to 5 years.

Regarding commitment levels, VinSpeed guarantees no cost overruns or delays, along with a “5 benefits” package for the government. THACO ensures quality and timeline but has not announced similar cost control provisions as VinSpeed.

In terms of industrial and technological ecosystems, VinSpeed aims for a comprehensive high-speed rail industry, mastering core technologies through R&D under a Vietnamese brand. THACO focuses on manufacturing train carriages and locomotives by 2029, reducing imports and targeting regional exports.

Overall, both proposals have distinct advantages. However, prioritizing rapid full-route completion, cost overrun risk control, and clear timeline and cost commitments, VinSpeed demonstrates a clear advantage.

High-Speed Rail Project: Company Urges Immediate Action with $100 Billion Funding Pledge

Mr. Truong stated that he has submitted an urgent petition regarding his exclusion from the North-South High-Speed Railway project meeting. He has requested a direct meeting to present and clarify his investment proposal and capital plan.

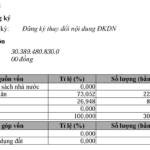

THACO Announces ₫120 Billion Capital Reduction, Prepares for ₫10.13 Trillion Capital Increase

THACO emphasizes that capital adjustments, including both reductions and increases in charter capital, are integral to its strategy for refining governance models and optimizing capital efficiency. The corporation remains committed to sustainable development, leveraging its financial strength, streamlined management, and long-term investment vision to actively contribute to the nation’s economic growth.

High-Speed North-South Railway Project: Direct Investment Emerges as the Sole Viable Model

Renowned economist Vu Dinh Anh asserts that the optimal financing model for the North-South high-speed rail project is direct private investment, wherein the state provides 80% of the capital through loans, and private investors contribute the remaining 20%. This approach surpasses both traditional public investment and public-private partnerships (PPPs) in terms of efficiency and feasibility.