Track VHC with a target price of VND 61,600 per share

FPT Securities (FPTS) forecasts that the 2025 net revenue of Vinh Hoan Corporation (HOSE: VHC) will remain flat year-over-year, with a slight 0.2% increase compared to the previous year. The fourth quarter of 2025 is expected to see a 1.4% rise in net revenue. This is due to the pangasius segment facing stagnation amid intensified competition in the U.S. market and weakened demand in China.

Gross profit margin in Q4 2025 is projected to decline by 1.6 percentage points year-over-year due to higher soybean meal costs as China increases imports. For 2025, VHC’s gross profit margin is expected to improve significantly, driven by higher export prices and a sharper-than-expected reduction in raw pangasius farming costs.

The short-term outlook for Q4 2025 and 2025 remains largely unchanged, with weak export performance in the U.S. and China offset by positive prospects in Europe.

Specifically, the U.S. market (accounting for approximately 30% of revenue) has slowed due to a 10.1% quarter-over-quarter and 20% year-over-year decline in demand, following a pre-tariff stockpiling phase and increased competitive pressure. VHC’s market share in the U.S. decreased by 5 percentage points in the first nine months of 2025, as it is no longer the sole company exempt from anti-dumping duties. Eight companies are now exempt under POR20. Additionally, Vietnamese pangasius faces competition from Vietnamese tilapia, which benefits from lower tariffs compared to China, with exports surging 332% year-over-year.

The European market (accounting for approximately 20% of revenue) is growing positively, supported by tariff exemptions under free trade agreements like EVFTA and UKFTA. Vietnamese pangasius also gains a competitive edge as the EU imposes a 13.7% tariff on Russian pollock products due to the Russia-Ukraine conflict. The collagen and gelatin segment further contributes, driven by rising health and wellness demand.

The Chinese market (accounting for approximately 7% of revenue) continues to decline due to (1) weakened domestic demand amid a post-dual-crisis economic downturn and (2) competition from (i) domestic tilapia, which faces a 47% tariff in the U.S., and (ii) Russian pollock, still banned from U.S. imports.

The 2025 profit margin is estimated at 16.5% (up 1.4 percentage points year-over-year), driven by (1) higher-than-expected export prices (up 10.6%) due to a shortage of raw pangasius supply, and (2) significantly lower farming costs thanks to abundant soybean meal production from favorable weather conditions.

FPTS highlights that on October 26, 2025, Vietnam and the U.S. announced a joint statement on a reciprocal trade framework during the 47th ASEAN Summit in Malaysia. The agreement aims to facilitate mutual market access by addressing tariff and non-tariff barriers. Vietnam plans to expand market access for most U.S. industrial and agricultural goods, while the U.S. maintains a 20% reciprocal tariff under Executive Order 14257 on Vietnamese goods, with some products eligible for a 0% tariff.

Both countries are finalizing the reciprocal trade agreement, expected to be signed and implemented by December 2025.

FPTS recommends tracking VHC with a target price of VND 61,600 per share. Investors may consider buying VHC at VND 51,400 per share, offering a potential 20% return.

Learn more here

BCM Outlook Positive with Target Price of VND 77,400 per Share

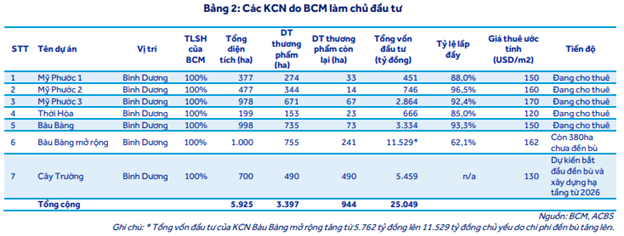

ACB Securities (ACBS) reports that in the first nine months of 2025, Becamex Infrastructure Development Investment Corporation (HOSE: BCM) achieved robust results with revenue of VND 5,201 billion (up 62% year-over-year) and post-tax profit of VND 2,269 billion (up 195%), completing 92% of the annual profit target.

ACBS forecasts 2025 revenue at VND 7,118 billion (up 36% year-over-year) and post-tax profit at VND 2,953 billion (up 23%).

BCM’s leverage ratio improved slightly in the first nine months of 2025 but remains significantly higher than the industry median. Total debt decreased by VND 1,389 billion to VND 22,239 billion. The Net Debt/Equity ratio fell from 102.1% to 90.8%, compared to the industry median of -11.5%. The Net Debt/EBITDA ratio dropped from 10.3x to 6.2x, versus the industry median of -0.7x.

BCM’s plan to issue 150 million shares (14.5% of outstanding shares) via public auction at VND 50,000 per share was not approved by major shareholders. As a result, the company has continuously issued bonds to restructure capital for major projects. From August 2025 onward, BCM issued VND 2,500 billion in bonds. In Q4 2025, BCM plans to issue an additional VND 2,000 billion in private bonds. ACBS projects BCM’s leverage ratio to remain around 100% in 2025-2026.

ACBS notes improved prospects for the industrial real estate segment, with Vietnam’s competitive advantages (political stability, cost-effective production, and numerous FTAs) expected to enhance its FDI attractiveness long-term, despite short-term challenges. The U.S.-Vietnam framework agreement announced in late October 2025 maintains tariffs at levels better than those announced in April 2025 and comparable to neighboring countries. Registered FDI in the first ten months of 2025 rose 15.6% year-over-year to USD 31.5 billion, with disbursed FDI reaching USD 21.3 billion (up 8.8%), the highest in five years.

ACBS expects BCM to achieve double-digit growth in 2026, with the residential real estate segment (bulk land sales in Binh Duong New City) and industrial parks (primarily through VSIP joint ventures) driving recovery. Revenue is projected at VND 7,861 billion (up 10% year-over-year), with post-tax profit at VND 3,426 billion (up 16%).

Based on these expectations, ACBS maintains a positive outlook for BCM with a target price of VND 77,400 per share.

Learn more here

Buy HHV with Target Price of VND 18,000 per Share

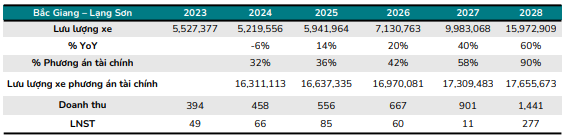

BIDV Securities (BSC) reports that in Q3 2025, Deo Ca Infrastructure Investment Joint Stock Company (HOSE: HHV) recorded net revenue of VND 913 billion (up 15% year-over-year) and net profit of VND 129 billion (up 24%).

For the first nine months of 2025, HHV achieved net revenue of VND 2,596 billion (up 13%) and net profit of VND 406 billion (up 31%). The BOT segment contributed VND 1,627 billion (up 13%), primarily due to an 11% increase in vehicle traffic. The construction segment generated VND 838 billion (up 8%), mainly from projects like Quang Ngai – Hoai Nhon, Dong Dang – Tra Linh, and Mai Son QL45 (51% of revenue). Profit from associates reached VND 71 billion (up 61%), driven by the Cam Lam Vinh Hao project.

BSC considers HHV’s Q3 and nine-month results in line with expectations, as projects like Quang Ngai – Hoai Nhon and Dong Dang – Tra Linh remain on schedule. The 45% gross profit margin aligns with BSC’s full-year forecast of 44%.

BSC forecasts 2025 revenue at VND 3,552 billion (up 7%) and net profit at VND 583 billion (up 37%), with an EPS of VND 1,230 and P/E of 9.9x. P/B is projected at 0.4x.

In 2026, BSC expects growth to be driven by BOT and construction. The BOT segment is anticipated to grow steadily as the Bac Giang – Lang Son expressway turns profitable following the completion of the Huu Nghi – Chi Lang project. Vehicle traffic on the expressway is expected to increase by 15% in 2026.

Source: BSC

|

The construction segment will continue growing in Q4 2025 as projects accelerate to meet 2021-2025 cycle deadlines. BSC expects 8-10% growth in 2025 and 2026-2027, driven by (1) government policies boosting public investment and (2) new projects like Dong Dang – Tra Linh, HCMC – Chon Thanh, and Tan Phu – Bao Loc. As of Q3 2025, the backlog totals VND 4,567 billion, ensuring two years of work.

For 2026, BSC projects revenue at VND 3,718 billion (up 5%) and net profit at VND 698 billion (up 19%), with an EPS of VND 1,472 and P/E of 8.x. P/B is expected to remain at 0.4x.

Based on these projections, BSC recommends buying HHV with a target price of VND 18,000 per share.

Learn more here

– 11:01 01/12/2025

How Are Samsung’s Four Major Vietnamese Factories Faring Post-Trump’s Tariffs and Natural Disasters in Thai Nguyen?

South Korean conglomerate Samsung has unveiled its Q3 2025 business results, highlighting the performance of its four key manufacturing facilities in Vietnam: Samsung Thai Nguyen (SEVT) in Thai Nguyen province, Samsung Bac Ninh (SEV), Samsung Display Vietnam (SDV) in Bac Ninh province, and Samsung Electronics HCMC CE Complex (SEHC) in Ho Chi Minh City.

Unmet Demand: The Vast Opportunity in Vietnam’s Senior Care Real Estate Market

The current elderly care system is still in its infancy, with fewer than 30% of communes and wards offering support models for seniors. Nationwide, the number of specialized care centers remains under 100, highlighting significant gaps in meeting the growing needs of the aging population.