As of December 1st’s close, most gold brands maintained their prices from the afternoon, except DOJI, which dropped by 500,000 VND/tael for both buying and selling, settling at 153.2 – 155.2 million VND/tael. Currently, gold traders are selling at 155.2 million VND/tael. Bao Tin Minh Chau and Bao Tin Manh Hai buy at 153.7 million VND/tael; SJC, DOJI, PNJ, and Phu Quy list their buying price at 153.2 million VND/tael. Compared to last week’s close, today’s gold prices have risen by approximately 300,000 VND/tael.

Bao Tin Minh Chau’s gold rings and Kim Gia Bao pressed gold rings from Bao Tin Manh Hai increased by 200,000 VND/tael from the afternoon, reaching 152 – 155 million VND/tael. Today, gold ring prices rose by about 300,000 – 500,000 VND/tael compared to the previous close.

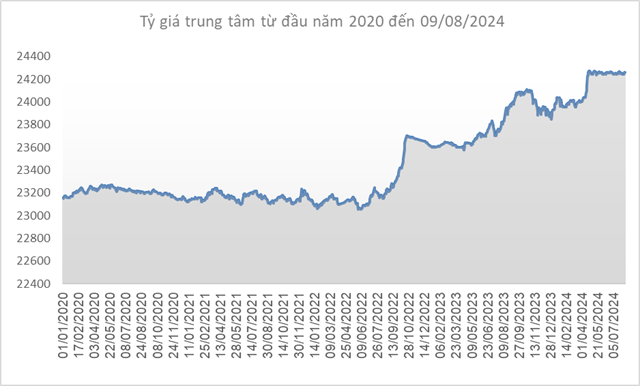

Gold price chart at Bao Tin Manh Hai

———————-

As of 1:00 PM, SJC gold prices at Bao Tin Minh Chau, SJC, PNJ, and Phu Quy decreased by 500,000 VND/tael compared to 9:00 AM. Specifically, Bao Tin Minh Chau traded at 153.7 – 155.2 million VND/tael; SJC and PNJ listed at 153.2 – 155.2 million VND/tael; Phu Quy adjusted down to 152.2 – 155.2 million VND/tael. However, prices at these brands remain about 300,000 VND/tael higher than last week’s close. Bao Tin Manh Hai and DOJI kept their SJC gold prices unchanged from the morning.

Gold ring prices at Bao Tin Minh Chau and SJC dropped by 400,000 VND/tael from 9:00 AM, trading at 151.8 – 154.8 million VND/tael and 151 – 153.5 million VND/tael, respectively. Meanwhile, DOJI increased gold ring prices by 300,000 VND/tael to 151.2 – 154.2 million VND/tael. Bao Tin Manh Hai has not adjusted Kim Gia Bao pressed gold ring prices.

———————-

As of 9:00 AM, SJC gold prices across traders rose by 600,000 – 800,000 VND/tael from last week’s close for both buying and selling. Currently, SJC, DOJI, and PNJ list at 153.7 – 155.7 million VND/tael. Bao Tin Manh Hai and Bao Tin Minh Chau trade at 153.7 – 155.2 million VND/tael and 154.2 – 155.7 million VND/tael, respectively. Mi Hong increased buying prices by 1 million VND/tael to 154 – 155.5 million VND/tael.

Gold ring prices across brands also rose by 300,000 – 800,000 VND/tael. Bao Tin Minh Chau increased by 700,000 VND/tael, now at 152.2 – 155.2 million VND/tael. SJC rose by 800,000 VND/tael from last week, trading at 151.4 – 153.9 million VND/tael. At Bao Tin Manh Hai, Kim Gia Bao pressed gold rings list at 151.8 – 154.8 million VND/tael.

———————-

As of 6:00 AM on December 1st, SJC gold prices at major firms remained steady from the previous close. SJC, DOJI, and PNJ maintained buying prices at 152.9 million VND/tael and selling at 154.9 million VND/tael. Bao Tin Minh Chau and Bao Tin Manh Hai listed at 153.4 – 154.9 million VND/tael, unchanged with a 1.5 million VND/tael spread.

Gold ring prices also remained steady from last week’s close. Bao Tin Minh Chau listed at 151.5 – 154.5 million VND/tael. PNJ kept prices at 150.9 – 153.9 million VND/tael, while SJC listed around 150.6 – 153.1 million VND/tael. DOJI increased to 151 – 154 million VND/tael. At Bao Tin Manh Hai, Kim Gia Bao pressed gold rings remained at 151.5 – 154.5 million VND/tael.

Last week, gold rings and bars rose by an average of 4.5 million VND/tael from the week’s open.

At the time of reporting, global gold prices traded around $4,221/ounce, up $3.30 (0.08%) from the previous session. Domestic gold prices are about ~20-21 million VND/tael higher than global prices (based on Vietcombank exchange rates).

According to Reuters, global gold prices are set for a 3.6% weekly gain and a 5.2% monthly rise, marking the fourth consecutive monthly increase.

“Expectations are that we’ll continue to see the economy slow as we move into 2026, and the Fed is very likely to cut rates, which is drawing some investors back to gold,” said Bart Melek, Global Head of Commodity Strategy at TD Securities. Gold typically performs well in low-interest-rate environments.

Recent dovish remarks from Fed Governor Christopher Waller and New York Fed President John Williams, along with weaker economic data following the recent U.S. government shutdown, have bolstered expectations of a rate cut next month.

Traders now see an 87% chance of a Fed rate cut in December, up from 50% last week.

Meanwhile, “silver’s technical charts have turned more positive over the past week or so, and that is attracting chart-based speculators into bullish positions in the silver market,” said Jim Wyckoff, Senior Analyst at Kitco Metals.

Gold demand in major Asian markets weakened this week as high prices slowed retail buying despite India’s wedding season. In China, the removal of tax incentives for gold purchases reduced consumer demand.

Linh San

Gold Ring and Bullion Prices Surge on November 28th Morning

Opening today’s trading session, the prices of gold rings and gold bars at numerous enterprises surged by up to 1.2 million VND per tael compared to yesterday’s closing session.