Once Vietnam’s leading rice exporter, Angimex began its decline in 2022 following the prosecution of former Chairman Do Thanh Nhan – Illustrative image

|

Angimex has scheduled its 2025 Annual General Meeting (AGM) for the morning of December 20th in An Giang province. The company has also prepared contingency plans for a second and third meeting on December 22nd and 24th, respectively, in case the first meeting fails to meet the necessary conditions. This move comes after the company was unable to hold the AGM within the mandated timeframe, despite requesting a one-month extension from the end of June 2025.

In a statement issued in late October 2025, the Board of Directors (BOD) explained that the previous BOD failed to convene the 2025 AGM on time. This delay prevented the company from selecting an auditing firm to review its 2025 semi-annual financial statements, as required by regulations. The first half of the year also saw significant changes in the company’s leadership, including the replacement of the CEO, legal representative, and Chief Accountant, which disrupted accounting processes and financial statement preparation.

The newly elected BOD, appointed on October 21, 2025, has approved the convocation of the AGM and pledged to expedite the completion of financial statements for full disclosure.

Debt and Asset Resolution Proposals to Dominate AGM Agenda

The AGM will focus on resolving various debt obligations, including bank loans, bond issuances, financial lease debts, and non-performing receivables. The meeting will also outline restructuring plans for 2026.

Angimex’s 2025 business plan targets consolidated revenue of VND 10 billion, a 96% decrease from the previous year, with no additional losses (the company reported a loss of nearly VND 260 billion in 2024). The company plans to seek partners to transfer projects, liquidate, or lease idle assets to raise capital.

| Angimex’s Business Performance from 2015 to 2024 |

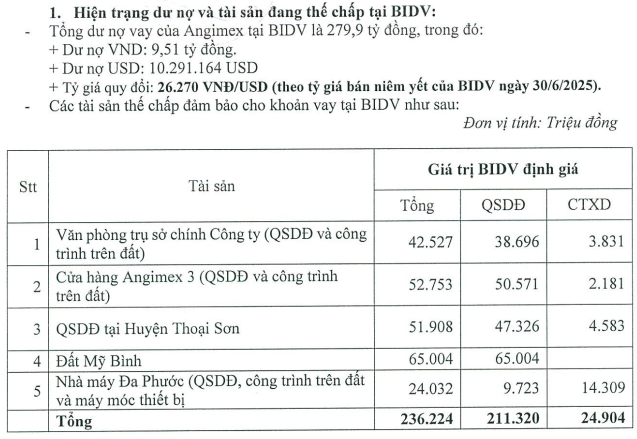

BIDV Debt of Nearly VND 280 Billion is secured by assets valued at over VND 236 billion, including land in My Binh, Angimex Store 3, and land use rights in Thoai Son. Per the 2024 AGM resolution, the company was approved to hand over assets to settle the debt but has been unable to complete the process due to a lack of partners and personnel changes. The BOD proposes continued collaboration with BIDV to dispose of the collateral, granting the BOD full authority to complete the process by Q4/2026.

Source: Angimex

|

Two Bond Issuances, AGMH2123001 (VND 350 billion) and AGMH2223001 (VND 300 billion), with an interest rate of 12% per annum, matured in November 2023 and September 2024, respectively. Angimex commits to completing legal procedures and finding partners to dispose of collateral assets for full repayment, expected by Q1/2027.

Financial Lease Debt with Vietinbank Leasing, totaling nearly VND 93 billion with an outstanding balance of VND 37.4 billion, has all matured. Vietinbank Leasing has terminated the contract and initiated asset recovery. Angimex proposes collaborating to hand over assets and find transferees to settle the debt.

Current Status of Debt with Vietinbank Leasing

|

Long-term Advance Payment of VND 179 Billion to Huynh Thi Thuy Vy, incurred in late 2021, is also on the resolution agenda. The BOD proposes implementing necessary legal and accounting procedures to definitively resolve this long-standing issue.

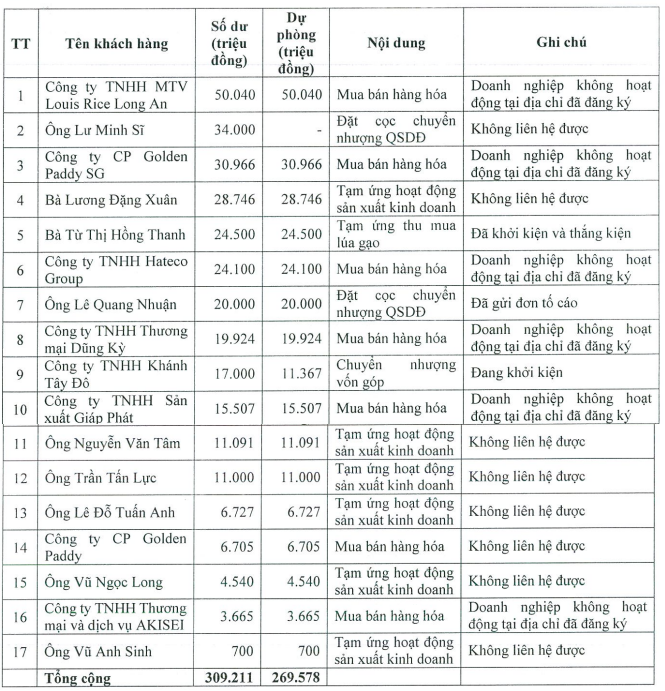

Non-Performing Receivables of Over VND 309 Billion, with provisions of nearly VND 270 billion as of year-end 2024, have been outstanding for years and are difficult to recover despite lawsuits and complaints. The BOD seeks approval to sell these receivables in their current state, with a starting price equal to the principal and a 10% reduction for each unsuccessful auction until resolution.

Current Status of Non-Performing Receivables

|

2026 Outlook: Comprehensive Restructuring and Addressing Misconduct

The AGM report highlights Angimex’s severe financial crisis, with accumulated losses of VND 243.76 billion as of December 31, 2022, exceeding equity. The situation is exacerbated by allegations of financial misconduct against former leaders, including Nguyen Hoang Tien, former CEO from April 23 to October 17, 2025, who is accused of diverting funds to personal accounts for unauthorized purposes.

The 2026 restructuring plan focuses on three pillars: resolving major debts with BIDV, bondholders, and tax authorities; addressing misconduct and recovering lost assets; and seeking strategic investors to revive rice production and export operations.

Election of New BOD for 2026-2030 Term

Due to the delayed AGM, close to the end of the 2021-2025 term, the BOD proposes early termination of the current term and election of a new BOD for the 2026-2030 term, comprising five members. Nominations will be accepted until 5 PM on December 17.

List of BOD Members for the 2021-2025 Term

|

|

Due to the late submission of the 2025 semi-annual audited financial statements, exceeding the 45-day limit, AGM shares remain under trading restrictions. This follows the mandatory delisting from HOSE on May 9, 2025, due to negative equity in the 2024 audited financial statements. Trading resumed on UPCoM on May 23 but was immediately restricted. In the latest session on November 28, 2025, AGM shares rose nearly 8% to VND 2,800 per share but remain down 21% over the past month and 19% year-on-year. Average liquidity exceeds 115,000 shares per session. The stock peaked at VND 62,000 per share in March 2022 before plummeting over 95% following developments related to former Chairman Do Thanh Nhan in April 2022, leading to bank credit tightening, increased collateral requirements, and business contraction from 2022 onward.

|

– 13:43 01/12/2025

Angimex Fined for Breaching Disclosure Regulations

Angimex has been fined VND 92.5 million by the State Securities Commission of Vietnam (SSC) for failing to disclose mandatory information as required by law.

Unified Moves by The World Mobile Group, Tan Dai Hung Plastic, T-Corp, and Gemadept

Under the new provisions of the 2019 Securities Law (effective from January 1, 2021), all treasury shares purchased must be canceled, and the company is required to reduce its chartered capital accordingly. Given that treasury shares can no longer be resold as before, what is the purpose of such transactions?

HAGL’s Decade of Transformation: From a $1.5B Debt Peak to a Billion-Dollar Vision

Chairman Doan Nguyen Duc reveals that after overcoming accumulated losses of trillions of VND, HAGL now confidently aims for an annual profit of 2,000 billion VND within reach. The company’s ambition extends further to 5,000 billion, and even 10,000 billion VND per year in the near future. HAGL is determined to become a billion-dollar company.

Real Estate Giant Acquires Struggling Forestry Firm in Multi-Billion-Dollar Deal

Vietnam Forestry Corporation (Vinafor, HNX: VIF) has successfully auctioned 96,200 shares, representing 48.1% of the equity in Central Forestry Seedling Company (SFS). The starting price was set at 603,900 VND per share, and the winning bidder was Thanh Vinh Real Estate Development Investment Corporation, with a total transaction value exceeding 58 billion VND.