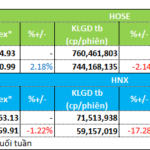

Following a positive November, the market kicked off December 2025 with a notably optimistic sentiment. The benchmark index continued its upward trajectory, despite unchanged liquidity conditions. By the close, the VN-Index climbed 10.68 points (+0.63%) to reach 1,701.67, surpassing the psychological resistance level of 1,700. Foreign trading activity remained a downside, with net selling nearing VND 317 billion across the market.

Proprietary trading desks of securities firms net-bought VND 54 billion on HOSE.

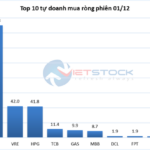

Specifically, VHM dominated with a net buy of VND 150 billion, significantly outpacing other stocks. VRE followed with VND 42 billion, trailed by HPG (VND 42 billion), TCB (VND 11 billion), GAS (VND 10 billion), MBB (VND 9 billion), DCL (VND 2 billion), FPT (VND 2 billion), CII (VND 2 billion), and EVF (VND 2 billion).

Conversely, securities firms led net selling in EIB with VND -49 billion, followed by HDB (VND -34 billion), E1VFVN30 (VND -30 billion), ACB (VND -26 billion), and VNM (VND -22 billion). Notable net selling was also observed in MSN (VND -18 billion), SHB (VND -14 billion), VIC (VND -11 billion), MWG (VND -10 billion), and VJC (VND -5 billion).

PYN Elite Fund Expands Holdings with HDG and YEG Acquisitions

PYN Elite Fund has recently announced the acquisition of additional shares in Yeah1 Group Corporation (HOSE: YEG) and Had Group Corporation (HOSE: HDG).