I. MARKET DYNAMICS OF WARRANTS

By the close of the trading session on December 1, 2025, the market recorded 136 advancing codes, 116 declining codes, and 36 unchanged codes.

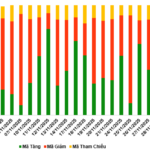

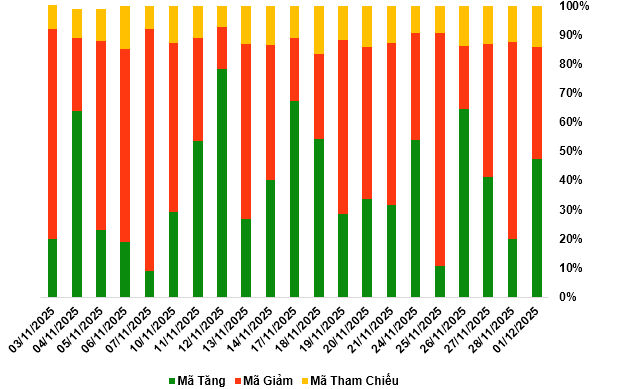

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

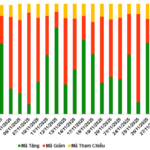

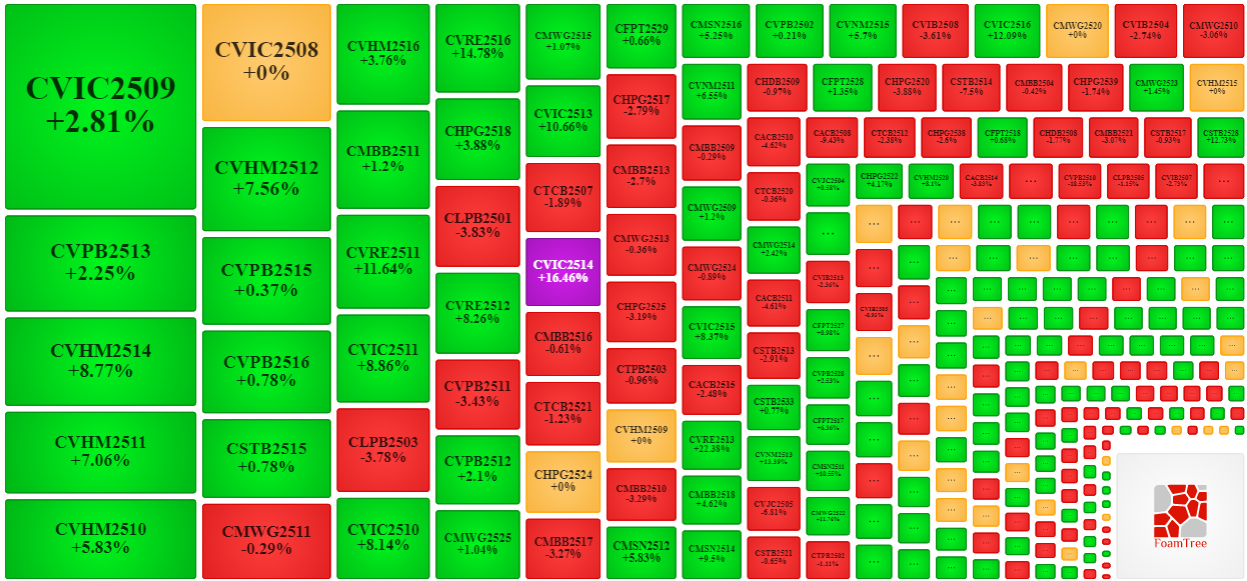

Source: VietstockFinance

During the December 1, 2025 trading session, the market exhibited mixed movements, with buyers gaining a slight edge, leading to price increases for most warrant codes. Notably, the top gainers among warrant codes were CVIC2509, CVPB2513, CVHM2514, and CVHM2511.

Source: VietstockFinance

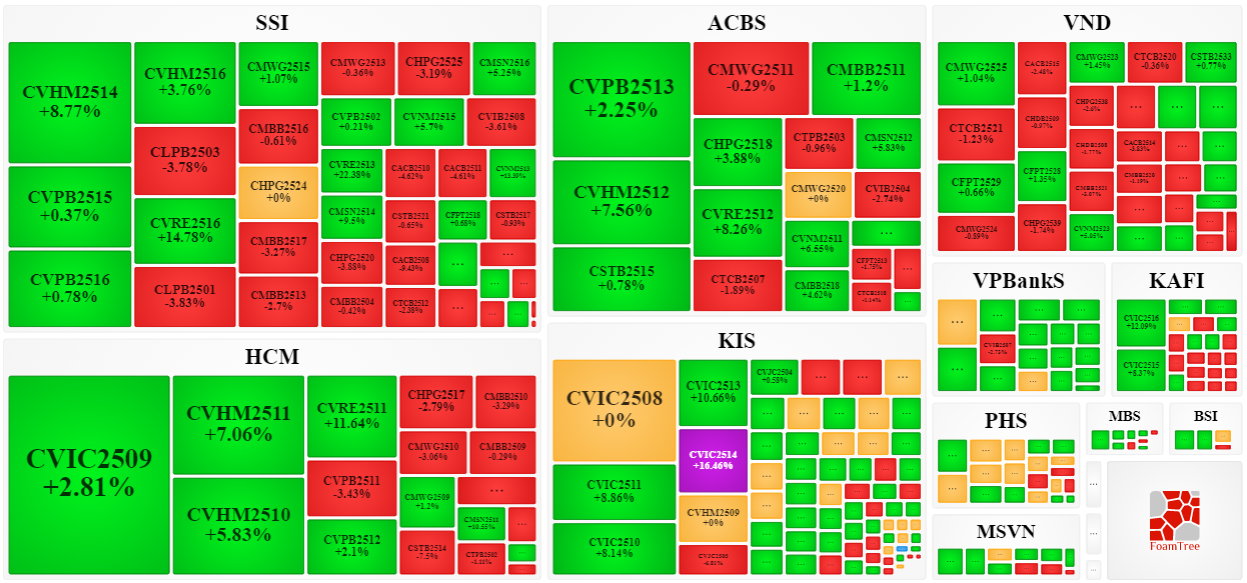

Source: VietstockFinance

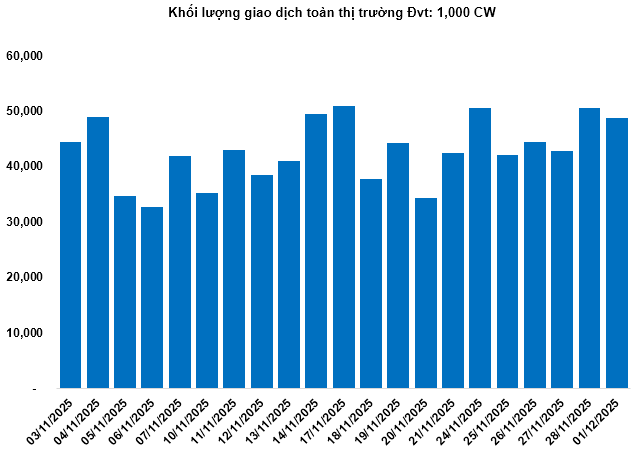

Total market trading volume on December 1 reached 48.71 million CW, down 3.71%; trading value hit 74.9 billion VND, a 15.95% decrease compared to the November 28 session. Among these, CHPG2535 led the market in both trading volume and value, with a total volume of 5 million CW, equivalent to 3.73 billion VND.

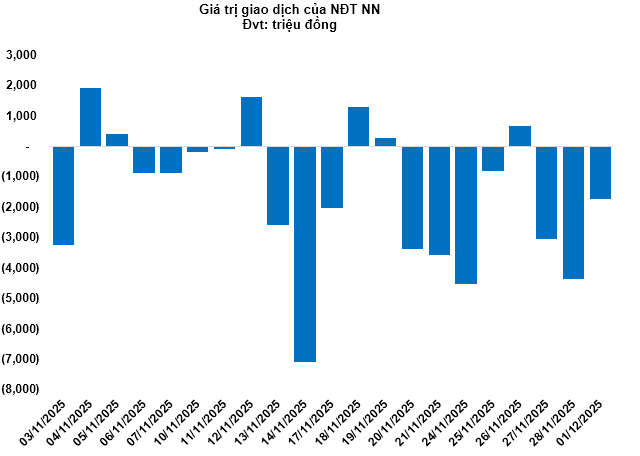

Foreign investors continued to net sell in the December 1 session, with a total net sell value of 1.73 billion VND. CVNM2519 and CVNM2518 were the two most heavily net-sold codes.

Securities companies SSI, ACBS, VND, and HCM are currently the issuers with the most warrant codes in the market.

Source: VietstockFinance

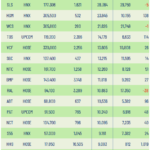

II. MARKET STATISTICS

Source: VietstockFinance

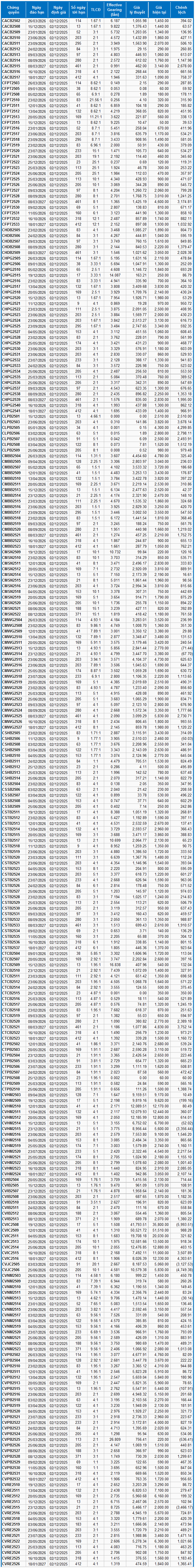

III. WARRANT VALUATION

Based on the valuation method appropriate as of the starting date of December 2, 2025, the fair prices of warrants currently trading in the market are as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model has been adjusted to align with the Vietnamese market. Specifically, the risk-free treasury bill rate (Government Treasury Bill) is replaced by the average deposit rate of major banks, with maturity adjustments suitable for each type of warrant.

According to the above valuation, CVIC2508 and CVJC2506 are currently the two most attractively priced warrant codes.

Warrant codes with higher effective gearing will experience larger fluctuations in response to the underlying securities. Currently, CVPB2525 and CTCB2509 are the two warrant codes with the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 December 1, 2025

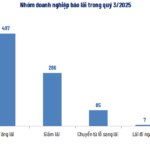

9-Month Business Overview: Profit Growth Outpaces Revenue Surge

The Q3 and 9-month 2025 financial results of listed companies reveal a shifting growth narrative. While revenue remains important, net profit growth has outpaced it significantly, indicating that profitability is now the key driver. This growth gap stems from various factors, including cost-cutting measures and non-core income streams playing a more prominent role in overall performance.