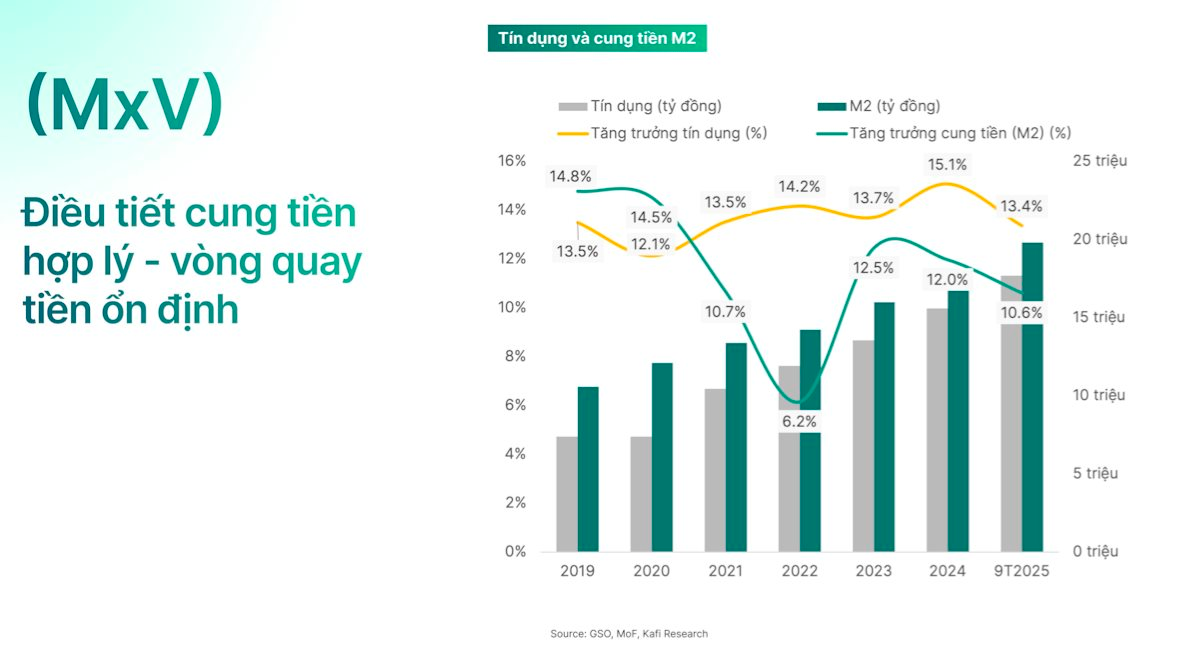

At the Kafi Insight seminar themed “360° Investment – Optimizing Assets, Seizing Opportunities”, Mr. Trinh Duy Viet, Kafi’s Strategy Director, highlighted the government’s ambitious goal of achieving double-digit GDP growth by 2026 as the primary driver of Vietnam’s economy. To meet this target, credit expansion must accelerate, leading to a higher money supply growth rate in the short term and corresponding inflationary pressures.

Mr. Viet noted that during 2020–2025, money supply growth lagged behind credit growth due to net capital outflows from Vietnam. “To achieve the 2026 double-digit growth target, the economy must accelerate money supply expansion. Consumption and credit will be decisive, with credit growth in 2026 needing to surpass this year’s estimated 16%,” he emphasized.

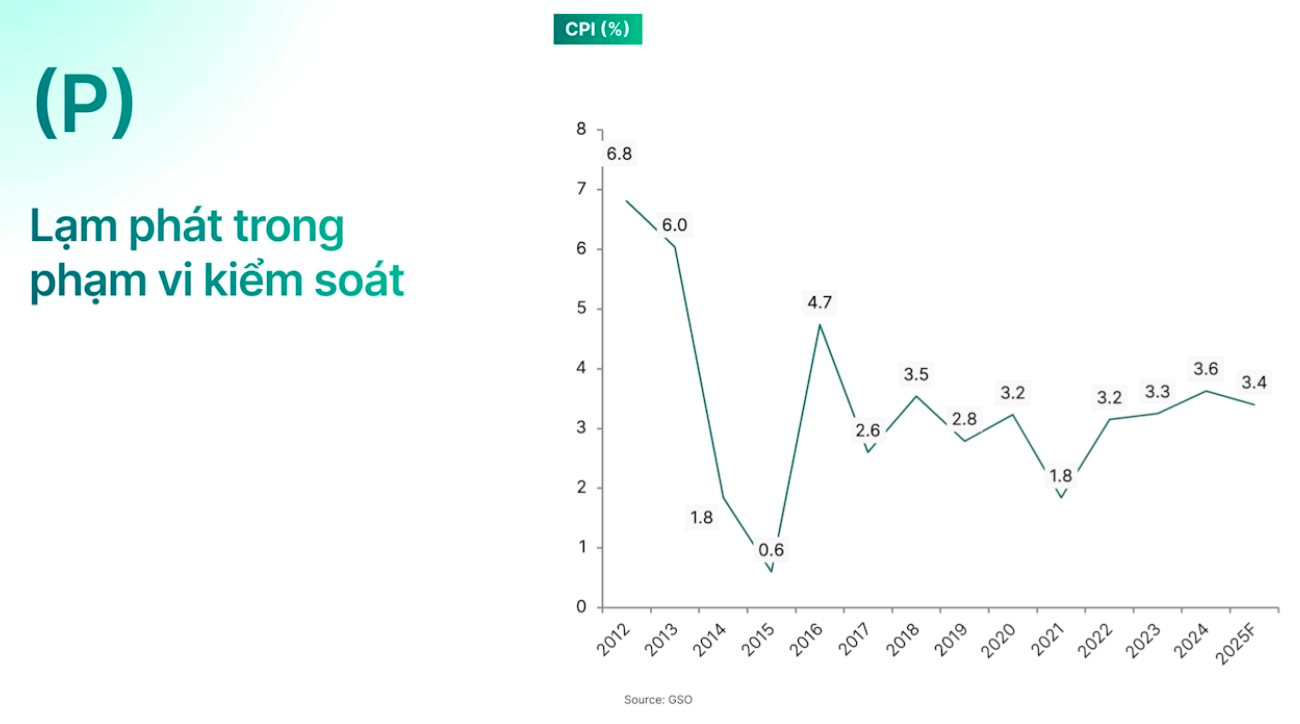

While many global economies face significant inflationary pressures, Vietnam has maintained relatively stable prices. This stability stems from a low money velocity, preventing the money supply from fully translating into GDP and CPI growth. Additionally, Vietnam’s CPI basket comprises largely domestically supplied goods, reducing vulnerability to international price fluctuations.

Experts highlight three key economic bright spots: robust consumption recovery supporting growth, accelerated investment driven by public spending, and resilient international trade amid global volatility, collectively bolstering economic stability and optimism.

5 Catalysts Propelling Vietnam’s Stock Market in 2026

Kafi experts predict continued stock market growth in 2026, fueled by five converging catalysts.

First, institutional reforms and investment incentives. Central economic development resolutions are being implemented, notably the shift to a two-tier urban governance model, streamlining operations for greater efficiency.

These reforms are expected to unlock nearly 50% of GDP in frozen assets from stalled projects. Once unblocked, money velocity will rise significantly, fostering growth without excessive money supply pressure.

Second, private sector engagement in key infrastructure projects. Encouraging private investment in metro systems, railways, and airports will ease fiscal burdens and enhance efficiency, leveraging the private sector’s agility and optimization capabilities.

With energy demand projected to rise 10–15% amid double-digit GDP growth, Vietnam must expedite energy projects and expand private partnerships. New SOE development resolutions are also expected to accelerate privatization, listings, and divestments.

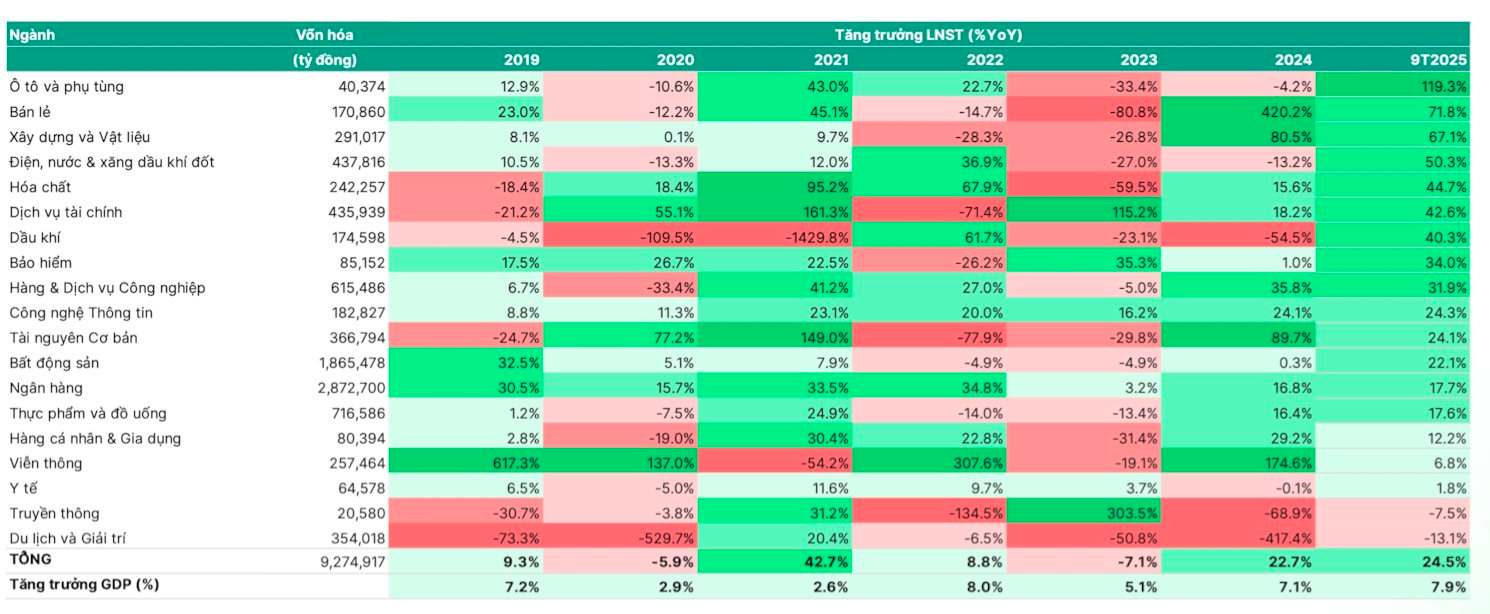

Third, listed companies will benefit most from GDP acceleration. Profit growth typically mirrors economic cycles, and listed firms, with strong foundations, expansion capacity, and transparency, are poised to gain. Under a double-digit 2026 GDP scenario, their profits could rise 20–30%, offering attractive investment opportunities.

Foreign capital inflows are another critical factor. After five years of outflows from emerging markets, foreign capital is expected to return as global macro risks subside. With Vietnam’s upgraded status, the market will attract international funds, potentially bringing $400–500 million via ETFs and significantly more from active funds.

Fourth, increased supply through IPOs, new listings, and SOE divestments. Adding large-cap, transparent stocks in strategic sectors will enhance market depth and liquidity, making Vietnam more appealing to foreign investors.

Finally, valuation remains attractive. The market’s P/E ratio of 14.5–14.7 is below historical averages despite improving GDP and EPS outlooks. This suggests significant upside potential. As investors embrace the 2026 growth narrative, they’ll accept higher valuations, sustaining market momentum.

Top Reasons to Invest and Own a Property in Isla Bella Subdivision, Vinhomes Vu Yen, Hai Phong

Isla Bella, also known as Paradise Island, is one of the most renowned and sought-after subdivisions, boasting a pinnacle of design excellence and harmonious low-density construction. Highly acclaimed by savvy investors from the North and Hai Phong, this exclusive enclave is a coveted destination for those seeking unparalleled luxury and sophistication.

Dragon Capital’s Perspective: Vietnam’s Economic Outlook and Corporate Health on the Cusp of 2026

At the 86th HUBA Entrepreneur Café event, themed “Economic Forecast for 2026 – Growth, Interest Rates, and Exchange Rates,” held on the morning of November 29th, Mr. Dominic Scriven, Chairman of Dragon Capital, offered a unique perspective. Drawing from his experience with foreign investment funds, he provided keen insights into the health of businesses by closely monitoring capital markets, bonds, and stocks.

2026 Economic Landscape: A Golden Opportunity for Businesses and Ho Chi Minh City’s Vision of a Megacity

At the 86th HUBA Entrepreneur Café event, themed “Economic Forecast for 2026 – Growth, Interest Rates, and Exchange Rates,” held on the morning of November 29th, Dr. Cấn Văn Lực, Chief Economist at BIDV and a member of the Prime Minister’s Policy Advisory Council, shared insights into the economic landscape and strategic directions for businesses in the context of 2026.