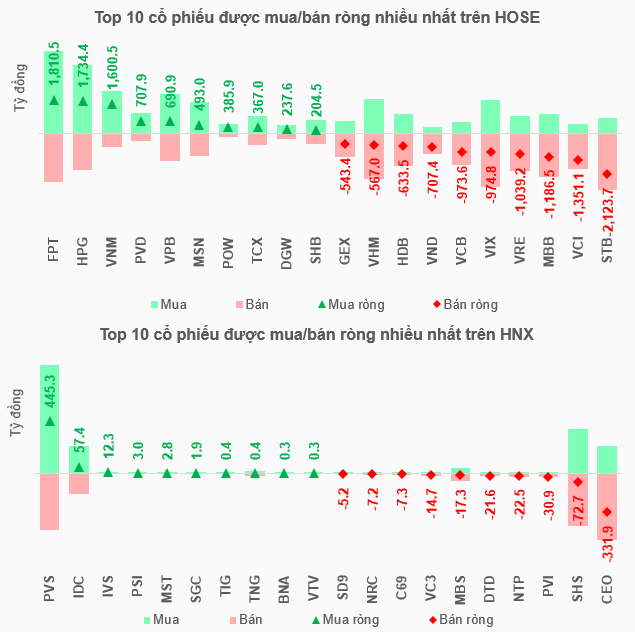

In November, foreign investors purchased nearly VND 49 trillion and sold approximately VND 56.2 trillion on the HOSE, marking a reduction in scale compared to previous months. This occurred amidst a decrease in average trading value on the exchange to around VND 22.7 trillion per session (compared to an average of VND 38 trillion per session in the previous four months).

As a result, foreign investors net-sold nearly VND 7.2 trillion, marking the 9th consecutive month of net selling since the beginning of 2025 and the 4th consecutive month of net selling. This brings the cumulative net selling since the start of the year to over VND 113 trillion.

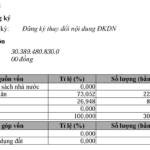

STB was the most net-sold stock of the month, with over VND 2.1 trillion, followed by VCI with nearly VND 1.4 trillion, MBB with nearly VND 1.2 trillion, and VRE with over VND 1 trillion. On the buying side, FPT led with over VND 1.8 trillion, followed by HPG with over VND 1.7 trillion and VNM with over VND 1.6 trillion.

On the HNX, foreign investors net-sold over VND 55 billion in November, a relatively modest figure. The most net-sold stocks were CEO with nearly VND 332 billion and SHS with nearly VND 73 billion, while the top net-bought stocks were PVS with over VND 445 billion and IDC with over VND 57 billion.

Source: VietstockFinance

|

Despite continued net selling by foreign investors, market participants quickly identified several positive signals. Notably, the scale of net selling has significantly decreased after three peak months, totaling over VND 76 trillion on the HOSE. Additionally, three out of the four rare net-buying sessions in November occurred in the latter part of the month, accompanied by milder net selling, indicating a gradual improvement in market sentiment.

Supported by these factors, the VN-Index consistently recovered, closing November at 1,690.99 points—the highest monthly closing level ever recorded.

Source: VietstockFinance

|

Multiple Factors Support a Return to Net Buying in 2026

Reflecting on the recent period of significant net selling and evaluating key factors for the coming year, experts unanimously anticipate a more positive scenario.

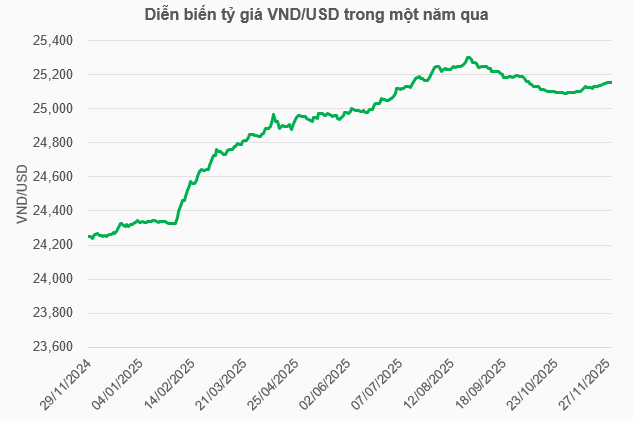

In a discussion with the author, Mr. Lưu Chí Kháng – Head of Proprietary Trading, Kien Viet Securities (CSI), attributed the continuous net selling by foreign investors in 2025 primarily to unfavorable exchange rate movements. The VND depreciated against the USD, while the USD weakened against other currencies. According to VietstockFinance, the central exchange rate as of November 29 stood at 25,125 VND/USD, up nearly 3.4% since the beginning of the year.

Source: VietstockFinance

|

However, the scenario of the Fed lowering interest rates to 3.5-3.75% in December is becoming increasingly likely, part of a rate-cutting cycle extending into 2026. Mr. Kháng believes this will support the exchange rate, providing room for the Vietnamese government to maintain accommodative monetary policies, fostering positive sentiment in the Vietnamese stock market.

Furthermore, after continuous net selling, culminating in profit-taking during the market peak in recent months, foreign investors’ holdings have dropped to approximately 14-15%, indicating limited room for further net selling.

Within the optimistic outlook for Vietnam’s economy in 2026, with expected double-digit GDP growth, controlled inflation, a more favorable exchange rate, and the stock market’s upgrade, Mr. Kháng forecasts that foreign investors will soon return Vietnam to their net-buying list.

Typically, foreign funds convene at the beginning of the year to outline their plans, with significant portfolio adjustments commencing about a month later. Therefore, the likelihood of Vietnam’s market returning to net buying from Q1/2026 is quite high.

According to Mr. Nguyễn Hồng Điệp – Founder, CEO of Vick Corporation, the strong net selling trend in recent years has been driven by capital flows shifting to higher-performing markets, particularly the U.S. However, this trend is likely to reverse to net buying in 2026.

Based on the upgrade roadmap, Mr. Điệp predicts that foreign investors will shift to net buying around February (before the Lunar New Year), with even stronger buying from September, initiating a very strong and prolonged net-buying cycle.

The scenario of foreign investors reversing to net buying in 2026 is gaining widespread consensus among experts.

In the short term, the anticipated Fed rate cut in December is generating significant investor optimism. However, from a cautious perspective, Mr. Nguyễn Hồng Điệp believes this event will impact market psychology rather than capital flows.

Specifically, while U.S. investors anticipate accommodative monetary policies in 2026, particularly at the Fed’s upcoming meeting, this is unlikely to directly affect capital flows into the Vietnamese stock market. Instead, it carries psychological significance, suggesting that if the U.S. market continues to thrive, there’s no reason for the Vietnamese market to decline.

“The market is buoyant about the Fed’s potential rate cut, but perhaps we should adopt a more sober perspective,” Mr. Điệp remarked.

From Mr. Lưu Chí Kháng’s viewpoint, positive news from the Fed’s rate cut is likely to gradually reflect in the market until the official announcement in December, though short-term dynamics remain uncertain.

– 10:07 02/12/2025

Tracking the Shark Money Flow on December 1st: Foreign and Proprietary Trading Divergence as VN-Index Surges

On a day when the VN-Index surged past the 1,700-point milestone, proprietary trading desks at securities firms engaged in net buying, while foreign investors focused their net selling on market-leading stocks.

The US Dollar Suffers Its Steepest Weekly Decline in Four Months

In the final week of November (24–28/11/2025), the US dollar experienced a sharp reversal, plunging in value on the international market after a previous week of surging gains. This downturn came as expectations grew that the Federal Reserve would cut interest rates in the following month.

THACO Announces ₫120 Billion Capital Reduction, Prepares for ₫10.13 Trillion Capital Increase

THACO emphasizes that capital adjustments, including both reductions and increases in charter capital, are integral to its strategy for refining governance models and optimizing capital efficiency. The corporation remains committed to sustainable development, leveraging its financial strength, streamlined management, and long-term investment vision to actively contribute to the nation’s economic growth.