Illustrative image.

New Government Decree on Seizing Collateral for Non-Performing Loans

On November 25, 2025, the Government issued Decree 304/2025/NĐ-CP, outlining conditions for seizing collateral assets of non-performing loans. This aims to enhance the management of bad debts and protect the interests of all parties involved. The decree takes effect from December 1, 2025.

Under the new regulations, the sole residence and primary work tools of borrowers can only be seized under specific conditions. Additionally, the secured party must allocate a compensation fund equivalent to 6–12 months of the minimum wage for the guarantor. The decree also clarifies the rights and responsibilities of guarantors and credit institutions in verifying and certifying assets, ensuring transparency and legality.

The issuance of this decree is expected to help banks manage non-performing loans more effectively, reduce credit risks, maintain financial market stability, protect capital, and stimulate economic recovery.

Government Establishes Road Accident Damage Reduction Fund

On October 23, 2025, the Government issued Decree 279/2025/NĐ-CP, establishing the Road Accident Damage Reduction Fund (RADRF). The decree outlines the fund’s formation, management, expenditure, and usage. It takes effect from December 15, 2025.

The RADRF is a non-budget state financial fund managed by the Ministry of Public Security. It has accounts at the State Treasury and authorized commercial banks, with the international transaction name “Road Accident Damage Reduction Fund (RADRF).”

The fund is capitalized with VND 500 billion from the central budget, along with voluntary contributions, domestic and international aid, and interest from deposits. Expenditures focus on supporting road accident victims, families of deceased victims, rescue participants, and awareness campaigns. Support levels range from VND 5 million to VND 100 million, depending on the case.

The decree also outlines management responsibilities, financial transparency, and coordination with provincial People’s Committees to assess damages and propose support needs.

Government Repeals Several Outdated Decrees

On November 3, 2025, the Government issued Decree 285/2025/NĐ-CP, repealing eight decrees that are no longer relevant or have been replaced by new legislation. The decree takes effect from December 30, 2025.

Among the repealed decrees are Decree 105/2006/NĐ-CP on the Intellectual Property Law, Decree 35/2007/NĐ-CP on electronic banking transactions, and several decrees related to electricity.

Decree 285/2025/NĐ-CP also partially repeals decrees concerning specific policies on seeds, capital, and technology in medicinal plant cultivation, as well as investment conditions under the Ministry of Industry and Trade’s jurisdiction.

The repeal aims to simplify legal regulations, facilitating state management and business operations.

State Bank Issues New Legal Framework for Debt Management Companies

On September 30, 2025, the State Bank issued Circular 31/2025/TT-NHNN, comprehensively regulating the activities of subsidiaries and affiliates of credit institutions in debt management and asset recovery. The circular takes effect from December 1, 2025.

The circular defines the scope of debt management companies’ activities, including managing and resolving non-performing loans, managing collateral assets, debt trading, and purchasing collateral assets during debt recovery.

Under the new regulations, debt purchases are only permitted when credit institutions maintain a non-performing loan ratio below 3%, ensuring systemic safety. Debt trading must be transparent, comply with credit and collateral agreements, and align with signed contracts.

The circular also requires debt management companies to establish internal regulations for debt handling, risk management, and submit them to the State Bank for supervision. Companies established before the circular’s effective date must complete compliance plans within 12 months.

Ministry of Finance Repeals Circular on Treasury Share Management

On October 24, 2025, the Ministry of Finance issued Circular 96/2025/TT-BTC, repealing Circular 19/2003/TT-BTC dated March 20, 2003, on adjusting charter capital and managing treasury shares in joint-stock companies. Circular 96/2025/TT-BTC takes effect from December 15, 2025.

The repeal is based on updated provisions in the Accounting Law, Securities Law, Enterprise Law, and related legal documents from 2015–2025.

The repeal ensures legal consistency and provides a modern legal basis for managing charter capital, treasury shares, and financial activities of joint-stock companies. This is a crucial step in modernizing the legal framework, enhancing transparency, and improving corporate financial management in Vietnam.

Ministry of Finance Amends Circular on Financial Safety Ratios for Securities Companies

On October 29, 2025, the Ministry of Finance issued Circular 102/2025/TT-BTC, amending Circular 91/2020/TT-BTC to update financial safety ratios and handling measures for securities companies. The circular takes effect from December 15, 2025.

The amendments adjust deductions, undistributed profits, and collateral asset values, while introducing a market risk mechanism for concentrated investments. This ensures accurate assessments of financial capacity and risk management in securities companies.

New regulations on convertible bonds, redeemable preferred shares, and non-cash expenses ensure available capital reflects actual operations, mitigating settlement and market risks. The calculation method for settlement risk value and adjustment coefficients is applied rigorously, stabilizing capital flows and protecting investor interests.

Securities companies have six months to address cases where available capital falls below 180%. These measures enhance financial governance, increase transparency, and strengthen the safety of Vietnam’s securities market.

Ministry of Agriculture and Environment Issues New Vehicle Emission Standards

On June 16, 2025, the Ministry of Agriculture and Environment issued Circular 06/2025/TT-BNNMT, introducing the National Technical Regulation on Vehicle Emissions (QCVN 85:2025/BNNMT). The circular takes effect from December 16, 2025.

The new standards set modern emission limits, aligning with environmental protection goals, air pollution control, and improved urban living quality.

Vehicles must meet QCVN 85:2025/BNNMT emission standards, while older or imported vehicles will continue under current standards until the Prime Minister announces a replacement roadmap. The circular also clarifies implementation responsibilities for ministries, agencies, local authorities, and stakeholders, with a mechanism for addressing issues promptly.

Decree 304/2025/NĐ-CP: Regulations on Collateral Conditions for Non-Performing Loan Seizure

The government has recently issued Decree No. 304/2025/NĐ-CP, dated November 25, 2025, outlining the conditions for the seizure of collateral assets tied to non-performing loans.

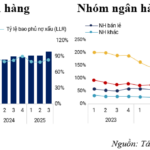

Q3 Non-Performing Loan Coverage Ratio Continues to Improve

The non-performing loan coverage ratio of the banking system continued its recovery trend in Q3. Effective management of bad debts has provided banks with additional time to rebuild their buffers following the previous sharp decline. Each bank implements distinct provisioning policies based on its strategic direction, leading to varying approaches in provisioning across different groups.

New Proposal Directly Affecting Millions of Vehicles to Take Effect Next Year

The implementation of Level 4 standards for vehicles manufactured between 2017 and 2021 in Hanoi and Ho Chi Minh City is a notable concern, as nearly 16% of these vehicles fail to meet the required criteria.