Mr. Nguyen Viet Thang, CEO of Hoa Phat Group and Chairman of HPA’s Board of Directors

According to event details, this offering aims to raise 1.257 trillion VND. The funds will be allocated for capital restructuring, enhancing financial capacity, and expanding production. Vietcap Securities is the exclusive advisor and issuing agent.

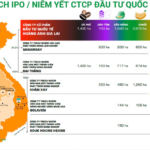

Scale and Achievements After 10 Years

Opening the event, Mr. Nguyen Viet Thang, CEO of Hoa Phat Group and Chairman of HPA’s Board of Directors, emphasized:

“2025 marks Hoa Phat’s 10th year in agriculture. This sector now contributes the second-largest revenue and profit to the Group, following the steel industry.”

To date, HPA operates a closed-loop value chain, including: 7 pig farm clusters covering 387.9 ha; 3 Australian cattle farms spanning 625 ha; 2 poultry farms covering 50 ha; and 2 feed mills with a total capacity of 600,000 tons/year.

In terms of production capacity, HPA annually supplies 750,000 market pigs, 150,000 Australian cattle, and 336 million eggs. The company ranks among Vietnam’s Top 10 largest pig farming enterprises and holds the top market share for whole Australian cattle supply.

HPA’s leadership attributes its advantage to applying industrial management principles to agriculture, evident in meticulous procurement and production processes. A stringent control system for electricity, water, and material consumption helps maintain low production costs. Specifically, HPA’s average pig farming cost is approximately 42,000 VND/kg, significantly lower than market prices (59,000–61,000 VND/kg).

Financial Metrics and Efficiency of the 2F (Feed-Farm) Model

In the first nine months of 2025, HPA’s after-tax profit reached 1.295 trillion VND. Operational efficiency metrics outperformed industry averages, with a net profit margin of 21%, ROE at 56.4%, and ROA at 31.7%.

Ms. Pham Thi Hong Van, CEO of HPA

Ms. Pham Thi Hong Van, CEO of HPA, explained that this efficiency stems from the fully integrated Feed-Farm model (Full Ownership). The company avoids contract farming to control disease risks and conflicts of interest. Instead, HPA fully controls feed and breeding stock.

Regarding breeding stock, HPA’s DanBred pigs achieve a weaning rate of 33–34 piglets/sow/year, 1.5 times higher than Vietnam’s average (22–25). For feed production, self-sufficiency (51% internal supply) and avoiding raw material speculation maintain stable, high profit margins.

Investment Strategy and Valuation

During the discussion, HPA’s leadership clarified a cautious development approach. For the food sector, the company is researching but not immediately implementing, as it seeks to control distribution to end consumers. HPA avoids white chicken farming due to competition with imports and has not expanded egg production to Southern Vietnam due to market volatility.

Discussion Session

Land expansion remains a challenge due to zoning regulations. However, the company’s current projects are on 50-year land with full legal compliance. Land asset values have increased over time; for example, industrial land rental in Hung Yen rose from over 50 USD to nearly 150 USD/m².

Regarding share valuation, at an IPO price of 41,900 VND/share, HPA’s trailing 12-month P/E ratio is 6.5, lower than the industry median of 20.9. The company plans to pay a cash dividend of approximately 3,850 VND/share in the next 12 months, yielding 9.2%.

Mr. Thang affirmed:

“I assure you that Hoa Phat Agriculture will always stand by and prioritize shareholders’ interests. Every action and decision is made with the collective good and shareholder value in mind.”

By 2030, HPA aims to increase feed production to 1 million tons/year, market pigs to 900,000, Australian cattle to 73,000, and eggs to 336 million. Target revenue exceeds 12 trillion VND, with after-tax profit around 1.75 trillion VND.

For the offering timeline, interested investors can register to purchase HPA shares until 4:00 PM on December 15, 2025, through Vietcap Securities. Share allocation is scheduled for December 16–17, 2025, with payment due by December 24, 2025.

HAGL’s Most Valuable Asset Suddenly Focused on “Purely Commercial” Unit: Bầu Đức’s Undisclosed Reasons Revealed

Bầu Đức revealed that the most valuable land assets of HAGL are currently concentrated within Hoàng Anh Gia Lai International Investment (formerly known as Hưng Thắng Lợi).

Bầu Đức Lists Lao Subsidiary, Pledges 50% Cash Dividends for 3 Years, No Stock Dividends

At the investor meeting held on the afternoon of November 25th, HAGL Chairman Doan Nguyen Duc announced plans to list HAGL International Investment Joint Stock Company on the stock exchange in Q2 2026. He also committed to distributing cash dividends at a rate of 50% of profits for the first three years.

Bầu Đức’s IPO Pledge for Subsidiary: 30% Annual Growth, 50% Profit as Dividends

At the investor meeting held on the afternoon of November 25th, Mr. Doan Nguyen Duc (Bầu Đức), Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HAGL, HOSE: HAG), unveiled preliminary details about the IPO plans for its subsidiary, HAGL International Investment Joint Stock Company, accompanied by impressive commitments.