Novaland Group (stock code: NVL) has recently reported the trading activities of shares by an individual related to an insider, Mrs. Cao Thi Ngoc Suong, the wife of Mr. Bui Thanh Nhon, Chairman of NVL’s Board of Directors.

According to the report, Mrs. Suong successfully sold over 2.3 million NVL shares out of the nearly 17.3 million shares she had previously registered, equivalent to 13% of the registered amount. The reason for not completing the transaction was attributed to a change in her plans.

Following the transaction, Mrs. Suong’s holdings in Novaland decreased from 50.5 million shares to over 48.2 million shares, representing 2.35% of NVL’s charter capital. It is estimated that Mrs. Suong earned approximately 36 billion VND from this transaction.

In addition to Mrs. Suong, the group of related shareholders associated with Mr. Bui Thanh Nhon’s family has continuously reduced their ownership ratio since the beginning of the year. Previously, in late October, Diamond Properties JSC also registered to sell 2.1 million NVL shares to balance their investment portfolio. However, the company only sold nearly 1.13 million shares due to adjustments in response to market developments.

Mrs. Cao Thi Ngoc Suong sold over 2.3 million NVL shares out of the nearly 17.3 million shares she had registered.

After these two transactions, the total ownership ratio of the group of related shareholders associated with Mr. Bui Thanh Nhon’s family dropped below 37%, approaching the critical 36% threshold. This level is essential for the Chairman’s family to maintain their veto power at Novaland.

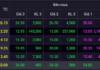

In Q3 of this year, Novaland Group recorded a net revenue of 1,683 billion VND and a post-tax loss of 1,153 billion VND, compared to a profit of 2,950 billion VND in the same period last year.

For the first nine months, the consolidated net revenue reached nearly 5,398 billion VND. Of this, net revenue from sales was nearly 4,956 billion VND, a 33% increase compared to the same period last year, driven by handovers at projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Sunrise Riverside, and Palm City. Net revenue from services reached 442 billion VND.

However, the consolidated post-tax profit recorded a loss of 1,820 billion VND, primarily due to a decrease in financial activity revenue.

As of September 30, NVL’s total assets amounted to nearly 239,575 billion VND. Inventory was recorded at 152,285 billion VND, with land and projects under construction accounting for 95% of this value. The remainder includes completed real estate and real estate goods awaiting handover to customers.

By the end of Q3, Novaland’s total debt was over 64,000 billion VND, with short-term debt totaling approximately 32,000 billion VND.

Hospital Leader Successfully Acquires 6 Million TNH Shares

Mr. Nguyen Anh Dinh, Project Director of TNH Hospital, has successfully acquired 6 million TNH shares as planned, thereby increasing his ownership stake to 3.7% of the company’s charter capital.

Amid Novaland’s Stock Recovery, Chairman’s Wife Sells 2.3 Million Shares, Pocketing Over VND 23 Billion

Mrs. Cao Thi Ngoc Suong has successfully sold over 2.3 million NVL shares, significantly lower than the initially registered figure of more than 17 million units.