Last week, the VN-Index continued its upward trend, closing at 1,690.99 points, marking a 2.18% increase from the previous week. This is the third consecutive week of gains, contributing to a 3.13% recovery in November. Notably, the index ended the month at its highest level, breaking a two-month adjustment streak.

Market optimism was partly fueled by positive developments in U.S. stocks, as the Federal Reserve (Fed) is expected to cut interest rates in its December meeting. This anticipation has made investors more cautious yet closely monitoring the situation.

Foreign investors continued to net sell VND 563.35 billion on HOSE, primarily in VCB, VIC, and VRE. Conversely, VNM, VPB, and POW saw net buying. Despite the prevailing selling trend, the market witnessed more net buying sessions in the short term.

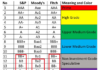

Most sectors traded within narrow ranges, focusing on accumulation. The market’s primary momentum came from the Vingroup sector, with VIC up 13.37%, VRE up 6.37%, and VPL surging 27.52%.

Stock market gains driven primarily by select blue-chip stocks.

According to CSI Securities, the market maintains positive expectations for the final month of the year, but thin liquidity raises questions about the recovery’s sustainability. The VN-Index is currently moving in a “zigzag” pattern after bottoming around 1,580 points, indicating accumulation rather than a rapid breakout. CSI recommends maintaining a cautious portfolio, gradually increasing exposure during market corrections, and avoiding exceeding 70% stock allocation until significant capital returns.

The market is likely to experience volatility in upcoming sessions due to a lack of leading capital. However, current conditions are seen as necessary accumulation for a new trend in 2026.

Experts from SHS Securities note that the VN-Index is actively accumulating around the 1,645 support level, with expectations to reach 1,700 points. After a recovery phase led by large-cap stocks, many sectors adjusted from September to October, returning to more reasonable price levels, and low-price demand is rising. However, quality investment opportunities remain limited, requiring cautious allocation.

November liquidity declined sharply, with average trading volumes dropping to 700 million shares per session, significantly lower than October’s 1 billion shares. This indicates that capital remains on the sidelines, especially as the market enters year-end portfolio restructuring and NAV finalization. New investors are advised to assess 2026 prospects before committing.

Dragon Capital highlights that Vietnamese stocks are supported by key pillars for continued positive growth in 2025 and 2026.

Corporate earnings exceeded expectations. The latest data shows that in the first nine months of this year, profits of 80 companies tracked by Dragon Capital grew by 22.4%, surpassing early-year forecasts. Full-year 2025 growth is estimated at 21.3%, with 2026 maintaining 16.2%.

Market valuations are attractive, with projected P/E ratios of 12.5-13 for 2025 and 11 for 2026. Vietnam’s valuations remain lower than regional peers despite impressive profit growth.

“With the upgrade from frontier to emerging market status, Vietnam’s market valuation is poised for higher re-rating as significant international fund inflows are expected,” Dragon Capital emphasized.

Vietnamese FMCG Leader Dominating 80% Market Share Set to List on HOSE

As a leading player in the fast-moving consumer goods (FMCG) industry, Masan Consumer Holdings (Masan Consumer, UPCoM: MCH) has captured market attention with its upcoming listing on the Ho Chi Minh City Stock Exchange (HOSE). This highly anticipated event highlights the company’s strong foundation, powerful brand presence, and substantial scale, positioning it as a long-term anchor for both domestic and international capital inflows.

Vietnamese National Assembly Approves Amendments to Resolution 98 on Pilot Mechanisms and Special Policies for Ho Chi Minh City’s Development

The National Assembly is set to review and amend Resolution 98, piloting special mechanisms and policies for Ho Chi Minh City’s development. Additionally, tailored policies will address challenges and bottlenecks related to projects, land issues, inspection conclusions, audits, and court rulings in Ho Chi Minh City, Da Nang City, and Khanh Hoa Province.

CADIVI’s Medium-Voltage Subsea Cables Make a Splash at the 2025 Power Conference

At the 2025 National Power Science and Technology Conference held on November 27-28, 2025, CADIVI’s electrical cables captured the attention of industry experts and businesses, particularly with their innovative medium-voltage underground cable solutions.