Companies Leaving the Stock Exchange Due to Lack of “Public Standards”

Since June 2025, the stock market has witnessed a series of companies initiating delisting procedures for various reasons.

Some are forced to leave due to failing to meet new capital and shareholder structure criteria; others delist due to prolonged losses or violations of information disclosure obligations. Notably, some companies opt to delist despite positive business results.

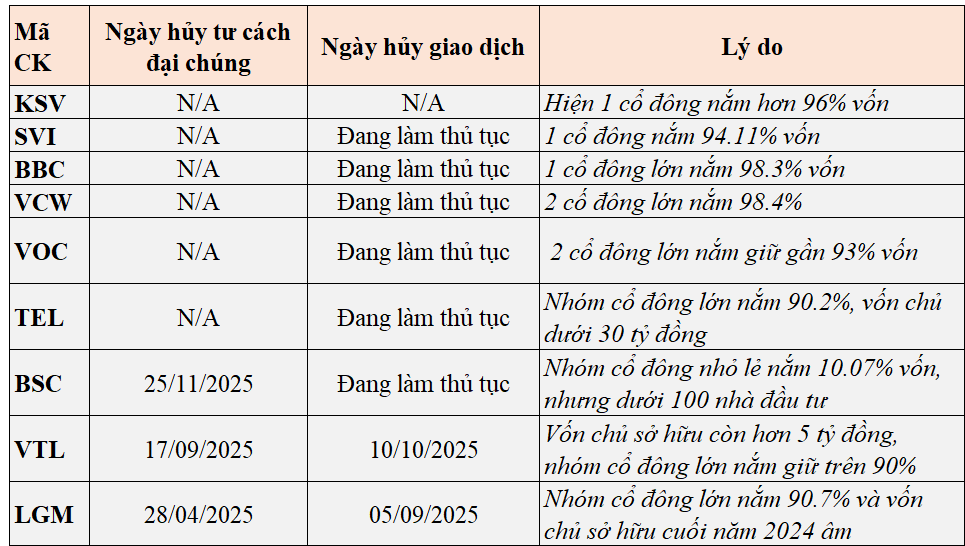

Most companies delisting from the stock exchange have a highly concentrated shareholder structure (over 90%), significantly reducing the proportion of minority shareholders. Additionally, their chartered capital and equity capital fall below VND 30 billion, failing to meet the minimum requirements for public company status.

|

According to Circular 19/2025/TT-BTC and the amended Securities Law of 2024, the conditions for maintaining public company status have been significantly tightened. Specifically, companies must have a minimum chartered capital and equity capital of VND 30 billion. Furthermore, at least 10% of voting shares must be held by a minimum of 100 minority investors, excluding major shareholders. This regulation aims to ensure shareholder diversification, limit power concentration, and enhance market transparency. |

Major shareholders hold over 90% of capital

Currently, several companies are in the process of seeking shareholder approval to revoke their public company status, a direct consequence of failing to meet legal requirements rather than waiting to be forced off the exchange.

A prime example is Bien Hoa Packaging JSC (Sovi, HOSE: SVI), which is preparing an extraordinary shareholders’ meeting in mid-December 2025 to propose revoking its public company status and delisting. As of November 18, 2025, SVI’s shareholder structure shows TCG Solutions Pte. Ltd., a subsidiary of Thai Containers Group under SCG (Thailand), holding 94.11% of capital. The remaining 5.89% does not meet the minimum requirements for minority shareholder numbers and ratios.

Similarly, Vimico JSC (Vimico, HNX: KSV) still fails to meet the minimum shareholder structure criteria. With a chartered capital of VND 2,000 billion, Vietnam National Coal and Mineral Industries Group (TKV) holds over 96% of the capital, resulting in nearly absolute shareholder concentration. The risk of losing public company status may materialize from early 2026 unless the company is granted special mechanisms.

At Bibica (HOSE: BBC), PAN Group (HOSE: PAN) currently holds 98.3% of BBC’s capital as its parent company. Following the SSC’s announcement of public company status revocation, HOSE will delist BBC shares. Subsequently, the company will proceed with deregistering its securities at VSDC.

In early November 2025, shareholders of Song Da Water Investment JSC (UPCoM: VCW) approved the revocation of its public company status and stock trading deregistration. Two major shareholders hold over 98% of VCW’s capital: GELEX Infrastructure JSC (62.46%) and REE Clean Water LLC (35.95%).

Likewise, Vocarimex (UPCoM: VOC) and Telecommunication Works Development JSC (UPCoM: TEL) are also in the process of revoking their public company status.

Meanwhile, over 10.1 million shares of Thang Long Wine JSC (UPCoM: VTL) were delisted on October 10, 2025, after VTL’s public company status was revoked by the SSC on September 17. The company’s shareholder structure failed to meet the minimum requirement of 10% shares held by at least 100 minority investors, while its equity capital as of December 31, 2024, was only over VND 5 billion, significantly below the mandated VND 30 billion.

Legamex JSC (UPCoM: LGM) officially delisted on September 5, with its public company status revoked on August 5, 2025. Major shareholders held 90.7% of shares, and the company’s equity capital at the end of 2024 was negative by nearly VND 79 billion.

|

List of Companies Failing to Meet Shareholder Structure Criteria

Source: Author’s compilation

|

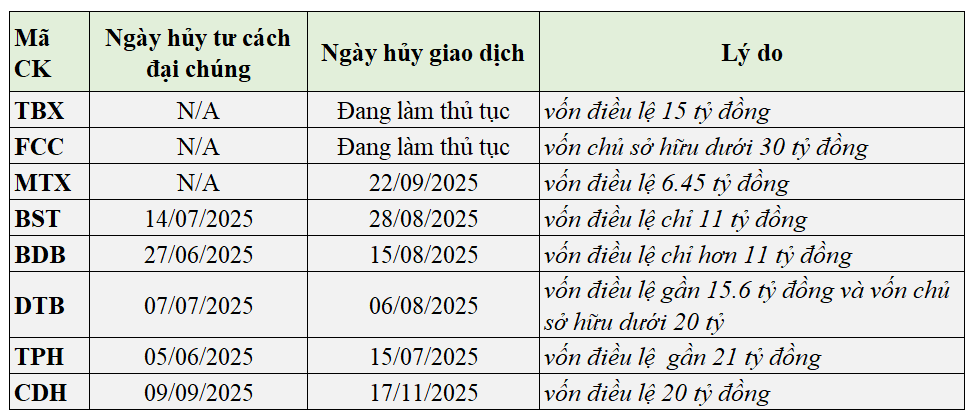

Chartered capital below VND 30 billion

HNX recently warned Thai Binh Cement (HNX: TBX) of delisting risks due to its chartered capital of only VND 15 billion.

Go Cong Urban Development (UPCoM: MTX) had all 645,000 shares delisted from September 22, 2025, due to a chartered capital of only VND 6.45 billion, despite being listed for just over a year.

Similarly, Binh Thuan Books and Equipment JSC (HNX: BST) with a chartered capital of VND 11 billion was delisted from August 29.

Companies like Binh Dinh Books and Equipment JSC (OTC: BDB), Bao Loc Urban Development JSC (DTB), Hanoi Textbook Printing JSC (TPH), and Hai Phong Public Works and Tourism Services JSC (Haputou, UPCoM: CDH) face similar situations due to small chartered capital and non-compliant shareholder structures, forcing them to delist.

|

List of Companies Failing to Meet Capital Criteria

Source: Author’s compilation

|

Delisting due to violations

Apart from non-compliance, some companies delist due to prolonged financial deterioration or violations of information disclosure obligations.

For instance, Investco JSC (UPCoM: ING) had over 20.8 million shares delisted on November 24, 2025, amid trading restrictions and a record loss of VND 232 billion in the first nine months. Accumulated losses by September 2025 reached nearly VND 545 billion, resulting in negative equity of over VND 289 billion.

Song Da 27 (UPCoM: S27) had nearly 1.6 million shares delisted after losing public company status on October 3, 2025. The company had previously been suspended for failing to rectify its restricted status due to not holding annual shareholders’ meetings for two consecutive years.

Similar situations occurred at Song Da Fire Protection and Construction Investment JSC (UPCoM: SDX) and Tung Khanh Production and Trading JSC (UPCoM: TKG).

|

Violations of Information Disclosure Obligations

Source: Author’s compilation

|

Meanwhile, some companies voluntarily delist. CTX Holdings (UPCoM: CTX) approved the demutualization of its enterprise as per regulations.

This move followed the company’s announcement of record-high Q3 net profit of over VND 216 billion, 98 times higher year-on-year, attributed to the transfer of a prime three-front land project in Hanoi.

HIPT Group (UPCoM: HIG) also proposed delisting, approved at its 2025 shareholders’ meeting.

Market screening is inevitable

According to Nguyen The Minh, Director of Research and Individual Customer Development at Yuanta Securities Vietnam, one reason many companies delist is operational inefficiency. This leads to shrinking equity capital, even negative equity, particularly among smaller enterprises.

Additionally, companies face significant pressure from public company obligations, including shareholder number and ratio regulations, and stringent reporting requirements. Over time, they find the public company model no longer suitable.

Many companies also see no benefit in raising capital through the market. Listing can expose major shareholders to asset volatility risks, impacting business operations and causing more harm than good, leading to withdrawal.

For companies delisting due to information disclosure violations, Minh notes that annual penalties from the SSC for non-compliant listed companies are substantial. Regulations are becoming stricter, emphasizing transparency and sustainable capital market development to protect shareholder interests, especially minority shareholders. Thus, listed companies must comply with the Securities Law.

Many companies neglect their responsibilities to shareholders, often operating as family businesses without recognizing public company obligations.

Moreover, complying with corporate governance and information disclosure requires expertise in securities law. “Smaller companies lack the resources to maintain specialized teams like larger enterprises, leading to oversights and violations,” Minh explains.

IPO wave set to intensify

Contrary to delisting trends, IPO activity remains vibrant with major deals, including Vinpearl (HOSE: VPL), Techcom Securities (HOSE: TCX), GELEX Infrastructure, and Hoa Phat Agriculture (HPA), recently receiving SSC approval for public offerings.

Minh anticipates more large IPOs ahead, including state-owned enterprises. Individual investors remain dominant, but institutional investors will lead capital flows, with foreign investors playing a catalytic role.

In terms of sector prospects, he expects finance and real estate to remain significant long-term but with reduced shares as telecommunications and consumer production sectors expand.

– 09:22 02/12/2025

Breaking News: Vietnam’s Top Billion-Dollar Gold Mining Giant Issues Urgent Alert on Potential Public Status Revocation Amid 5x Stock Surge

With an overwhelmingly concentrated shareholder structure, where state ownership dominates nearly entirely, Vietnam National Coal and Mineral Industries Group (Vinacomin) has announced its intention to file for the revocation of its public company status.

DSC Securities Shareholder Shakeup Post-IPO

Following the completion of the offering of 35.3 million shares to existing shareholders, DSC Securities has welcomed a new major shareholder, while Chairman Nguyen Duc Anh and NTP Investment Corporation have reduced their holdings.

CTX Seeks Exit from Market Following Sale of Prime Triple-Frontage Land Project in Hanoi

CTX Holdings’ move to delist from its public company status comes on the heels of its Q3 earnings report, which revealed an nearly eight-year high in net profit, driven by the sale of a prime, triple-frontage land project in Hanoi. The stock market reacted negatively, with shares hitting the lower limit for two consecutive sessions.