Vingroup’s stock (ticker: VIC) has surged over sixfold since the beginning of the year, consistently reaching new highs to the astonishment of investors. The conglomerate, founded by billionaire Pham Nhat Vuong, became the first Vietnamese enterprise to surpass a market capitalization of 1 million billion VND, setting an unprecedented record.

However, this success story isn’t for everyone. Many investors have been left on the sidelines, watching Vingroup’s high-speed train zoom past without securing a seat. Missing the train is one thing, but halting just shy of paradise is another level of disappointment.

Among those feeling the most regret on Vingroup’s upward trajectory is SK Group. The South Korean conglomerate was once a major shareholder, holding over 6% of Vingroup’s capital following a strategic partnership agreement signed in 2019.

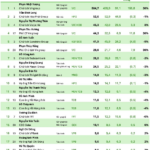

At that time, SK invested approximately 23.3 trillion VND (around 1 billion USD) to acquire a total of 205.7 million VIC shares (equivalent to 113,000 VND per share). This included 154.3 million shares issued privately by Vingroup and 51.4 million secondary shares purchased from VinCommerce (now WinCommerce).

SK did not trade VIC shares afterward, only receiving a stock dividend at a 12.49% ratio from Vingroup in 2021. This increased their holdings to over 231 million shares, though their ownership percentage remained unchanged.

After six years of partnership, the South Korean chaebol decided to part ways with Pham Nhat Vuong’s conglomerate. SK’s 2024 annual report, released earlier this year, classified Vingroup as an asset held for sale. The divestment was executed through three agreed-upon transactions.

On January 16, 2025, SK transferred nearly 51 million VIC shares (valued at over 2 trillion VND) to restructure its investment portfolio. This reduced the South Korean group’s stake in Vingroup from 6.05% to 4.72%, removing it from the list of major shareholders.

On April 17, SK further sold nearly 65 million VIC shares in an agreed transaction worth nearly 4.6 trillion VND. The final divestment phase occurred over two days, August 4-5, with a total of nearly 116 million shares sold, valued at approximately 12.6 trillion VND.

In total, the South Korean conglomerate netted over 19 trillion VND from the Vingroup divestment. This figure falls significantly short of SK’s initial investment. Adding to the regret, VIC shares have surged by approximately 120% since SK’s complete exit.

SK Group is one of South Korea’s largest conglomerates, operating in sectors such as telecommunications, technology, electronics, energy, logistics, and services. Since 2018, SK has invested heavily in Vietnam, totaling over 3.5 billion USD, becoming a strategic partner in several leading Vietnamese conglomerates.

However, over the past year, the South Korean chaebol has continuously divested from major Vietnamese investments, including Vingroup, Masan, and Imexpharm. These divestments align with SK’s global restructuring strategy, focusing resources on semiconductors, artificial intelligence, and electric vehicle batteries—key growth pillars for the group.

Meanwhile, Vingroup, under Pham Nhat Vuong’s leadership, continues to shape a vast ecosystem spanning technology, industry, real estate, infrastructure, energy, and socio-cultural sectors. Its flagship brands include VinFast, Vinhomes, VinSpeed, and VinMetal.

As of Q3 2025, Vingroup’s total assets exceeded 1 million billion VND, making it the second non-financial enterprise in Vietnam to achieve this milestone, following PVN.

Vingroup is also executing the largest share issuance in its history (nearly 3.9 billion shares) to double its charter capital to 77 trillion VND. The final list of shareholders eligible for the issuance will be confirmed on December 8.

If successful, Vingroup will surpass Hoa Phat to become Vietnam’s largest non-financial enterprise by charter capital, trailing only Vietcombank, MB, and VPBank.

Vingroup’s Market Cap Surpasses $43 Billion, Equal to Combined Value of Vietcombank, VietinBank, and BIDV

Vingroup’s remarkable surge has propelled its market capitalization beyond the $43 billion mark, making it the first Vietnamese enterprise to achieve this historic milestone.

Vietnam’s First Enterprise Surpasses $43 Billion in Market Capitalization

At the close of today’s trading session (November 28), Vingroup’s VIC shares surged by 5% to reach 260,400 VND per share. This milestone propelled Vingroup’s market capitalization past the 1 quadrillion VND mark for the first time in its history, making it the first Vietnamese company listed on the stock exchange to achieve this remarkable feat.