Phuoc An Port is located in the Southern Key Economic Region.

|

The Board of Directors of Phuoc An Port has approved a private placement of 125 million shares at VND 13,610 per share, aiming to raise over VND 1,701 billion. The newly issued shares will be restricted from transfer for one year. The offering is expected to take place between 2025 and 2026, pending approval from the State Securities Commission (SSC).

Upon completion, PAP’s chartered capital will increase to VND 3,570 billion, while the ownership stakes of the two largest shareholders will decrease from 31.41% to 21.06%. Petrovietnam (PVN) will hold 9.8%, and Hoanh Son One-Member LLC will retain 11.26%. Neither will participate in this offering.

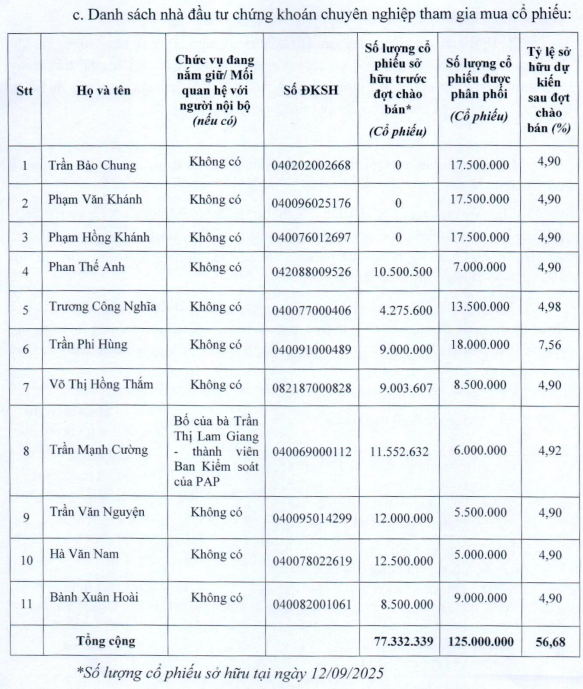

Eleven investors to acquire the full issuance, with one becoming a major shareholder

PAP’s Board also approved a list of 11 investors expected to purchase the entire 125 million shares. Mr. Tran Phi Hung is set to acquire the largest portion, 18 million shares, becoming a major shareholder with a 7.56% stake, equivalent to 27 million shares post-transaction. The remaining 10 investors will each hold less than 5% of the capital.

Among the registered investors, only Mr. Tran Manh Cuong has ties to the company’s internal affairs, as the father of Ms. Tran Thi Lam Giang, a member of PAP’s Supervisory Board. Mr. Cuong plans to purchase 6 million shares, increasing his ownership to 4.92% of the capital, or over 17.5 million shares post-issuance.

Source: PAP

|

On the UPCoM market, PAP’s share price remains stable at VND 26,500, nearly double the private placement price. Over the past year, the stock has risen by nearly 10% but is still down almost 40% from its peak of nearly VND 40,000 in late February 2025. Average trading liquidity is low, at just over 3,000 shares per day.

| PAP’s Stock Price Performance Since 2025 |

Raised funds allocated to key Phase 2 packages of Phuoc An Port

The VND 1,701 billion raised from the offering will be allocated to three key components of Phase 2 of Phuoc An Port. PAP plans to allocate VND 500 billion for package XL04, which includes the construction of Phase 2.1 berths; VND 550 billion for package XL05, covering land reclamation, foundation treatment, shoreline protection, internal roads, bridges, and auxiliary systems for Phase 2.2; and over VND 651 billion for the purchase of a tugboat under package 18. Disbursement is expected to span from 2025 to 2026.

According to PAP, Phase 1 of the port project was completed and operational by Q4/2024. The company is currently implementing Phase 2 and preparing to invest in Phase 3 to complete the entire berth system, with a target completion date of 2026. Phase 2 alone has a total contract value of nearly VND 7,153 billion. PAP emphasizes that increasing equity capital is essential to ensure timely payments to contractors and reduce reliance on bank loans.

Investment in a VND 5 trillion industrial park project

Concurrently, PAP’s Board approved the investment in the construction and operation of the Phu An Industrial Park infrastructure project, spanning 3.3 million square meters, with a 50-year operation period and a total investment of nearly VND 4,962 billion. The project is expected to be implemented between 2025 and 2028, funded by equity and raised capital.

Despite owning a large-scale seaport and an integrated logistics system, PAP has reported consecutive losses from 2021 to 2024 and has recorded virtually no revenue since 2016. This pressure continued into the first nine months of 2025, with a net loss peaking at over VND 379 billion, reversing from a profit of nearly VND 10 billion in the same period last year. Accumulated losses as of September 2025 exceeded VND 410 billion, and equity capital decreased to VND 2,077 billion.

| PAP’s Annual Net Profit |

– 10:05 01/12/2025

Audit of State Capital and Asset Management at Vietnam National Coal and Mineral Industries Group (TKV)

The Government Inspectorate will conduct a 60-day inspection of state capital and asset management at TKV.

Spectacular Business Breakthrough: OCBS Surges Capital to 3.2 Trillion VND with a Series of Major Strategic Moves

On November 27, 2025, OCBS Securities Corporation (OCBS) held an Extraordinary General Meeting of Shareholders to approve a capital increase plan, raising its charter capital to VND 3,200 billion. This marks OCBS’s second capital hike in 2025, following the successful completion of its previous increase from VND 300 billion to VND 1,200 billion in July 2025.

Haxaco Fined for Tax-Related Violations

Haxaco has been fined for misreporting, resulting in underpayment of corporate income tax for the years 2020 and 2021.