Supply Shocks Prolong Silver Shortage

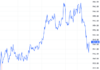

Today, Kitco.com headlines with “Silver Price Surge Reshaping Precious Metals Market.” Silver is ending the week at a record high above $56 per ounce, marking an impressive 97% increase since January 2025. Meanwhile, gold is testing a significant resistance level at $4,200 per ounce, up nearly 61% year-to-date. Kitco.com cites analysts suggesting this silver rally could push the gold-silver ratio back to 50. If predictions of gold reaching $5,000 by 2026 are accurate, it implies silver could hit $100 per ounce.

Bank of America raises silver forecast to $65 per ounce by 2026

Investors are finally recognizing how scarce silver has become. Industrial demand tied to global economic electrification has created a significant supply deficit for five consecutive years. This imbalance triggered a series of supply shocks in 2025.

Data from exchanges and brokerages show silver inventories in Shanghai Futures Exchange (SHFE) warehouses recently hit their lowest since 2015, while volumes at the Shanghai Gold Exchange (SGE) also dropped to a nine-year low. This decline follows China’s record-high precious metals exports of over 660 tons in October.

Another silver report notes: Market analysis shows recent trading differs from fleeting phenomena. Silver’s price momentum stems from structural supply-demand imbalances affecting industrial users, institutional holders, and physical markets.

The clearest sign of silver’s shortage is lease rates—the cost to borrow physical silver for immediate delivery—surging above 30% annually during peak deficits, compared to the normal 1-3%.

The current physical silver shortage reflects deeper structural shifts in global consumption patterns. Industrial applications dominate demand, particularly solar panel and electric vehicle production. Solar panel manufacturing alone requires 5,700–6,000 tons of silver annually, while EV batteries consume 25–50 grams per unit.

Given these structural market factors, major global institutions have raised their 2026 silver price forecasts. Bank of America increased its prediction to $65 per ounce, expecting the structural deficit to persist. JPMorgan, HSBC, and others also raised long-term forecasts due to shortages in London Bullion Market Association vaults.

Beyond institutions, many experts believe silver’s surge past the $50 psychological barrier signals a supercycle. Blue Line Futures strategist Phillip Streible predicts silver could reach $100 per ounce, nearly doubling its current price. Mike Maloney, author of “Guide to Investing in Gold and Silver,” boldly forecasts silver could quadruple relative to gold during a “monetary reset.”

Domestic Investors See Further Upside for Silver

Silver’s sharp rise on November 29th pushed domestic prices to unprecedented levels, surprising investors. Phu Quy Jewelry’s silver bars traded at 2,118,000–2,184,000 VND/tael (buy-sell) at 5 PM. Phu Quy and Bao Tin Minh Chau’s silver ingots reached 56,853,191–58,613,187 VND/kg.

Kim-Phuc-Loc 1 tael silver bars sold for 2,004,000–2,055,000 VND/tael.

Facing these highs, domestic investors agree current prices have broken a 14-year support level—the “final price wall.” This signals silver’s phase shift, with the market poised for a strong rally.

These views align with global silver experts. Investor confidence is stronger than ever, anticipating further gains.

UBS’s forecast of silver peaking at $57 per ounce in 2026, followed by $60 short-term, is seen as reliable, despite 45-60% gains for April buyers.

Silver Bar Prices Surge Past 45 Million VND/kg, Setting New Record Highs

Domestic silver bar prices have surged to unprecedented highs, driven by significant global economic data.