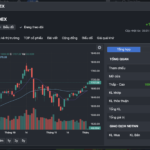

Technical Signals of VN-Index

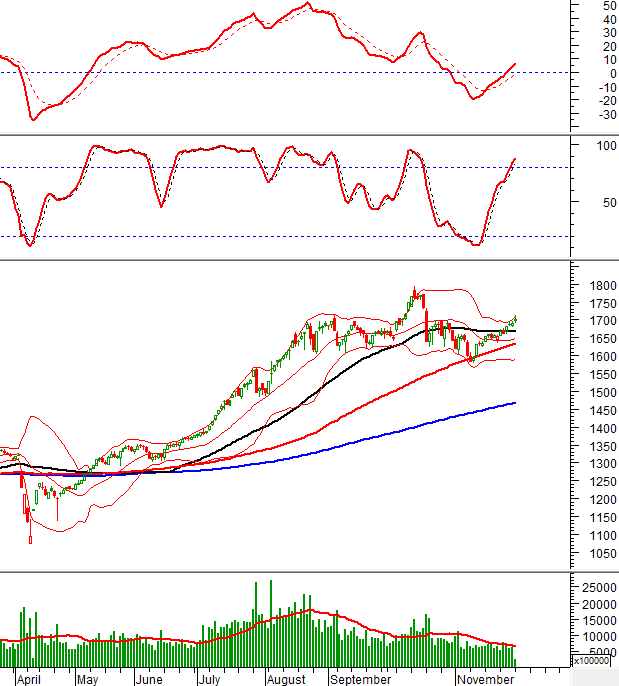

During the morning trading session on December 1, 2025, the VN-Index continued its fourth consecutive day of growth, reaching the psychological threshold of 1,700 points. The author anticipates the index will soon surpass this level.

The MACD indicator continues to rise after crossing above the zero line, and the index is currently touching the Upper Band of the Bollinger Bands, indicating a positive short-term outlook.

Technical Signals of HNX-Index

The HNX-Index declined for the third consecutive session, approaching its previous November 2025 low (around 255-259 points).

Trading volume remains consistently below the 20-day average, reflecting investor caution.

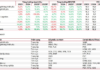

GAS – Petrovietnam Gas Joint Stock Corporation

In the morning session on December 1, 2025, GAS shares rose for the fourth consecutive session, forming a Big White Candle pattern accompanied by increased volume surpassing the 20-session average, indicating active investor participation.

The price remains near the Upper Band of the Bollinger Bands, while the MACD indicator continues to form higher highs and higher lows after generating a buy signal, further supporting the short-term uptrend.

STB – Saigon Thuong Tin Commercial Joint Stock Bank

STB shares rebounded slightly during the morning session on December 1, 2025, following three consecutive days of decline.

However, volume continued to decrease, remaining below the 20-session average, suggesting persistent investor caution.

Currently, STB’s price is below the Middle Band of the Bollinger Bands, and the Stochastic Oscillator has reissued a sell signal. Without improvement in technical indicators, the outlook is likely to remain unfavorable in the near term.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:07 December 1, 2025

Is the Stock Market Set for a Breezier December?

The VN-Index concluded November with its second consecutive weekly gain, edging closer to the 1,700-point milestone. However, weak liquidity and a zigzagging upward trend indicate cautious investor sentiment. As we enter the final month of the year, the market is anticipated to turn more positive, yet significant volatility remains likely due to heightened pressure from portfolio rebalancing and NAV (net asset value) closures.

Vietstock Daily 02/12/2025: Is Market Volatility Here to Stay?

The VN-Index extended its rally for a fourth consecutive session, surpassing the psychological threshold of 1,700 points. However, intense tug-of-war dynamics during the session, coupled with trading volumes remaining below the 20-day average, suggest lingering investor hesitation. The index is likely to experience further volatility around the September 2025 peak (1,695–1,711 range) in upcoming sessions.

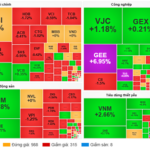

Market Pulse 12/01: Foreign Investors Resume Net Selling of Bluechips, VN-Index Struggles at 1,700 Points

At the close of trading, the VN-Index climbed 10.68 points (+0.63%) to reach 1,701.67, while the HNX-Index dipped 2 points (-0.77%), settling at 257.91. Overall market breadth leaned bearish, with 379 decliners outpacing 314 advancers. The VN30 basket showed a more balanced performance, with 16 gainers and 14 losers.