On December 1st, foreign investors net sold VND 120 billion as the VN-Index surged nearly 11 points. The trading trend of foreign investors has become less clear in recent sessions. However, this remains a positive shift compared to the consistent net selling seen throughout the year.

On a day when the market rallied, driven primarily by Vingroup-related stocks, foreign investors net sold most heavily in VIC and VHM, totaling nearly VND 159 billion and VND 70 billion, respectively.

Conversely, foreign investors net bought most significantly in FPT and MSN, with amounts of nearly VND 94 billion and VND 91 billion, respectively.

| Foreign Trading Trends from November 2025 to Present |

| Top Stocks with Highest Foreign Net Trading on December 1st |

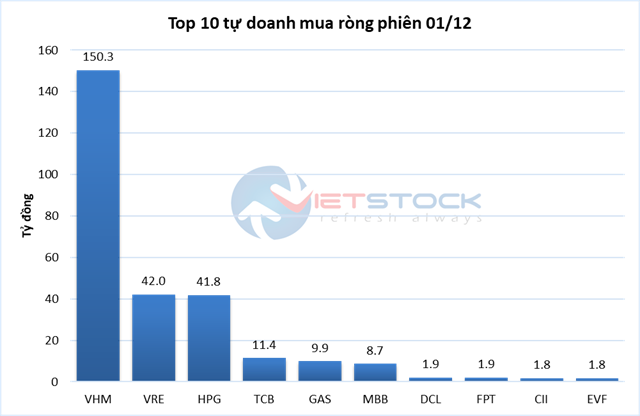

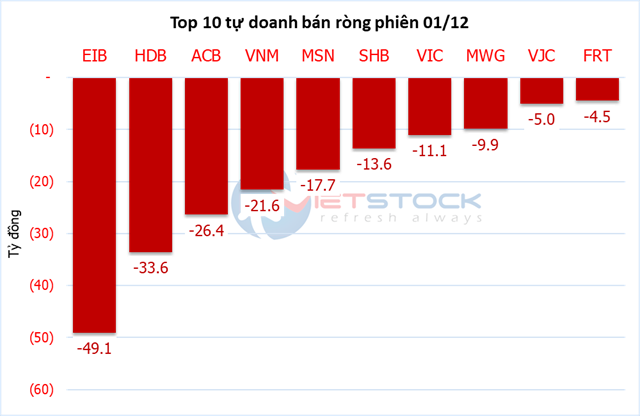

In contrast to foreign investors, proprietary trading desks net bought over VND 51 billion in today’s session. VHM was the most heavily net bought stock, with over VND 150 billion, followed by VRE and HPG at around VND 42 billion.

On the net selling side, EIB led with over VND 49 billion. Next were HDB at nearly VND 34 billion and ACB at more than VND 26 billion.

Source: VietstockFinance

|

Source: VietstockFinance

|

– 18:20 01/12/2025

December 2, 2025: Warrant Market Continues to Show Divergence

As the trading session closed on December 1, 2025, the market witnessed 136 stocks advancing, 116 declining, and 36 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of VND 1.73 billion worth of shares.

Technical Analysis Afternoon Session 01/12: Touching the Psychological Threshold of 1,700 Points

The VN-Index extended its winning streak to a fourth consecutive session, breaching the psychological 1,700-point threshold. Conversely, the HNX-Index declined for the third straight session, retreating to levels last seen in November 2025, hovering near the 255-259 point range.