HOSE Listing Event: A Milestone Capturing Market Attention

The “MCH Roadshow: HOSE Listing & Growth Story” will take place on December 4, 2025, at the Sheraton Saigon Hotel (80 Dong Du, Saigon Ward, Ho Chi Minh City) and will be live-streamed on YouTube for both domestic and international investors. This event marks the official meeting between Masan Consumer and the investment community ahead of the HOSE listing announcement, a highly anticipated milestone in the market.

The program consists of three key segments: MCH’s investment narrative centered on the philosophy “Strong Trust – Lasting Value”; a presentation by the company’s leadership on the strategic shift to HOSE as a pivotal move to unlock enterprise value; and a direct dialogue with the leadership team regarding growth prospects for 2025-2030. The event is expected to provide a comprehensive view of Masan Consumer’s core capabilities, current strategies, and long-term growth drivers as the company prepares to join Vietnam’s largest stock exchange.

The listing announcement occurs at a critical juncture for both the company and the market. On one hand, it signifies Masan Consumer’s preparation to enter Vietnam’s most stringent trading platform. On the other, the timing coincides with the FMCG sector’s entry into a new growth cycle.

This convergence positions MCH’s HOSE listing as the starting point for a longer-term development chapter, not only for the company but also for the entire fast-moving consumer goods industry.

A Solid Foundation for the New Growth Cycle

As Vietnam’s economy approaches the $5,000 GDP per capita milestone, the FMCG market shows robust expansion signals. Average FMCG spending per capita in Vietnam stands at approximately $120 annually, significantly lower than regional peers like Thailand and China, indicating substantial long-term growth potential. The rapid rise of the middle class, younger generations willing to spend on premium products, and accelerated urbanization have fueled a new wave of consumption in the country. Additionally, the premiumization trend has become a key driver, with Vietnamese consumers prioritizing safety, convenience, and trusted brands. This phase presents an opportunity for companies like Masan Consumer, which boast strong brand foundations and extensive distribution networks, to further lead the market.

Over nearly three decades, Masan Consumer has built a leading brand ecosystem covering approximately 80% of Vietnam’s FMCG categories, with a household penetration rate of nearly 98% (according to Kantar’s 2024 report). The company’s product portfolio comprehensively addresses family meals and daily consumption needs.

For instance, in the seasoning category, MCH holds the top market share in fish sauce, chili sauce, and soy sauce, thanks to the powerhouse brands CHIN-SU and Nam Ngư, which are associated with over 72 billion meals annually.

In convenient foods, Omachi ranks second in market share, while Kokomi is a widely distributed brand in rural areas. In nutrition, B’fast has expanded MCH’s presence into healthy snacks, a high-margin, fast-growing segment.

Both in rural and urban areas, Masan Consumer enjoys a loyal customer base eager to try new products, driving sales across multiple categories and reinforcing its market leadership.

In beverages, the duo Wake-Up 247 and Vinacafé Biên Hòa hold a top-three share in instant coffee, with Wake-Up 247 emerging as a prominent local brand in the coffee-flavored energy drink segment, a rapidly growing category in Vietnam. Building on this foundation, MCH continues to expand its beverage portfolio to cater to dynamic out-of-home consumption needs.

Notably, each of Masan Consumer’s flagship products takes an average of just ~2 years to enter the top three in market share, significantly faster than industry norms. This speed stems from the “Fewer – Bigger – Faster” strategy, which concentrates resources on core brands while leveraging a nationwide distribution network of over 345,000 traditional and 8,500 modern channels.

Beyond domestic expansion, Masan Consumer is bringing Vietnamese flavors to the global stage, with products available in 26 countries, including the US, Japan, South Korea, and Australia. This global presence solidifies the company’s position as a representative of Vietnamese consumer goods on the international market, showcasing its competitive edge and world-class production standards.

The HOSE listing announcement is a pivotal moment for MCH to transparently share its strategy, operational model, and value-unlocking roadmap for the upcoming period. For investors, the December 4 event offers a comprehensive insight into one of Vietnam’s largest FMCG companies just before its exchange transition. This event is expected to inject new momentum for both the company and the market in 2025 and beyond, as domestic consumption continues to expand and the FMCG sector enters a more sustained growth cycle.

|

Masan Consumer (UPCoM: MCH) is a subsidiary of Masan Group (HOSE: MSN). With nearly three decades of serving consumers, Masan Consumer’s products are present in over 98% of Vietnamese households and exported to more than 26 countries, cementing its status as one of the region’s most profitable FMCG companies. |

– 08:19 01/12/2025

Vietnamese National Assembly Approves Amendments to Resolution 98 on Pilot Mechanisms and Special Policies for Ho Chi Minh City’s Development

The National Assembly is set to review and amend Resolution 98, piloting special mechanisms and policies for Ho Chi Minh City’s development. Additionally, tailored policies will address challenges and bottlenecks related to projects, land issues, inspection conclusions, audits, and court rulings in Ho Chi Minh City, Da Nang City, and Khanh Hoa Province.

What to Watch in VHC, BCM, and HHV?

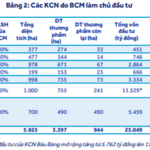

Securities firms recommend monitoring VHC due to its slow growth, impacted by tariffs and competitive pressures. BCM shows promise, driven by its residential real estate and industrial zone segments, which are expected to sustain recovery momentum in 2026. HHV is a buy recommendation, as its BOT segment is anticipated to maintain steady growth throughout 2026.

How Are Samsung’s Four Major Vietnamese Factories Faring Post-Trump’s Tariffs and Natural Disasters in Thai Nguyen?

South Korean conglomerate Samsung has unveiled its Q3 2025 business results, highlighting the performance of its four key manufacturing facilities in Vietnam: Samsung Thai Nguyen (SEVT) in Thai Nguyen province, Samsung Bac Ninh (SEV), Samsung Display Vietnam (SDV) in Bac Ninh province, and Samsung Electronics HCMC CE Complex (SEHC) in Ho Chi Minh City.