I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON DECEMBER 2, 2025

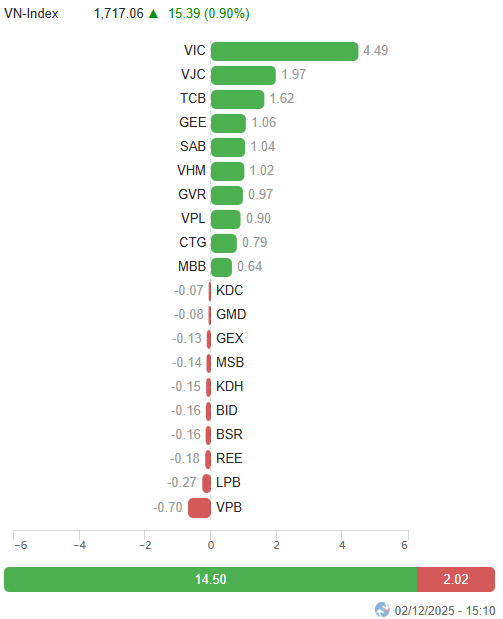

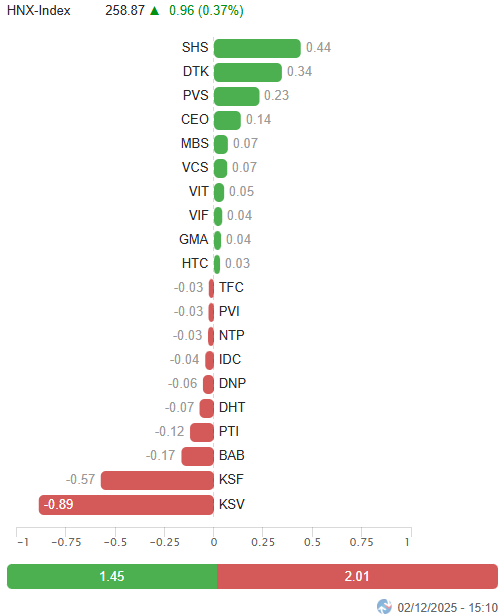

– Major indices unanimously gained during the December 2 trading session. The VN-Index rose by 0.9%, closing at 1,717.06 points, while the HNX-Index saw a modest increase of 0.37%, reaching 258.87 points.

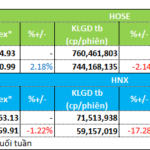

– Trading volume on the HOSE surged by 27.2%, exceeding 661 million units. The HNX recorded over 60 million matched units, a 19.2% increase compared to the previous session.

– Foreign investors returned to net buying, with a value of over 619 billion VND on the HOSE, but remained net sellers with nearly 13 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

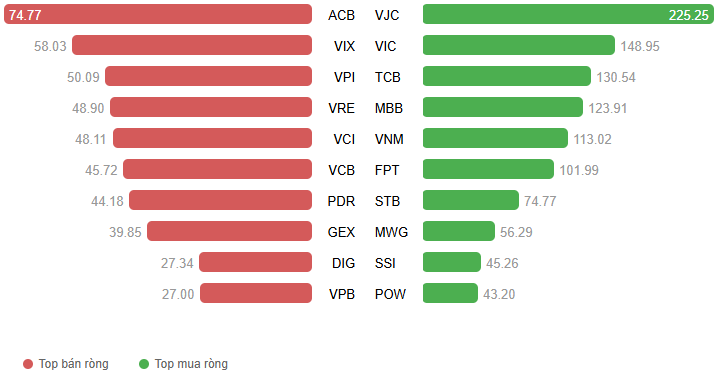

Net Trading Value by Stock Code. Unit: Billion VND

– The market experienced a volatile trading session on December 2. After a narrow range-bound morning session, selling pressure intensified, pushing the VN-Index down to around 1,690 points. However, buying interest re-emerged in leading sectors, driving a successful market reversal in the afternoon session. VIC rebounded strongly, acting as a key driver, while bottom-fishing in the financial sector also reignited market optimism. At the close, the VN-Index gained over 15 points, ending at 1,717.06 points.

– In terms of impact, the top 10 positive contributors added 14.5 points to the VN-Index, with VIC alone contributing 4.5 points. Conversely, the top 10 negative influencers subtracted 2 points from the index, with VPB exerting the most pressure at 0.7 points.

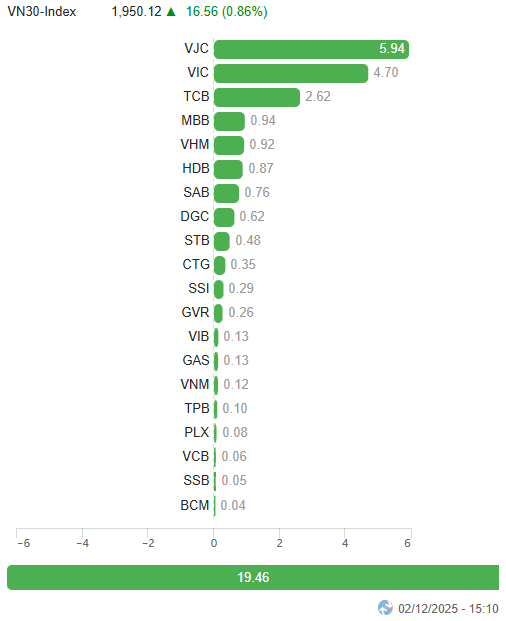

Top Influencing Stocks on the Index. Unit: Points

– The VN30-Index rose by 16.56 points (+0.86%), closing at 1,950.12 points. The basket’s breadth favored the upside, with 20 gainers, 5 losers, and 5 unchanged stocks. Notably, SAB stood out with a strong purple performance, while VJC approached the ceiling with a 6.9% gain. GVR and TCB also surged by over 3%. In contrast, VPB lagged with a 1.4% decline.

Green returned to many sectors, led by the industrial sector with a 1.84% gain, thanks to impressive performers like TLG, PC1, and HID hitting their upper limits, VJC (+6.87%), GEE (+5.84%), ACV (+2.08%), CII (+1.53%), and PAC (+3.18%).

Essential consumer and financial stocks also attracted strong buying interest, with SAB hitting its ceiling, MCH (+1.62%), BAF (+1.86%); TCB (+3.01%), HDB (+1.59%), MBB (+1.51%), CTG (+1.34%), SHS (+3.9%), VND (+2.75%), VCI (+1.8%), EIB (+2.3%),…

Meanwhile, the communication services, healthcare, and information technology sectors remained under pressure, closing in the red.

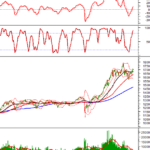

The VN-Index extended its winning streak to the fifth consecutive session, closely tracking the Upper Band of the Bollinger Bands. Trading volume exceeded the 20-day average, with the Stochastic Oscillator and MACD continuing their upward trajectory after generating buy signals, reinforcing the short-term positive outlook.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – Fifth Consecutive Session of Gains

The VN-Index extended its winning streak to the fifth consecutive session, closely tracking the Upper Band of the Bollinger Bands.

Trading volume exceeded the 20-day average, with the Stochastic Oscillator and MACD continuing their upward trajectory after generating buy signals, reinforcing the short-term positive outlook.

HNX-Index – Hammer Candlestick Pattern Emerges

The HNX-Index halted its decline with the emergence of a Hammer candlestick pattern, indicating bottom-fishing demand at the November 2025 lows.

The short-term outlook is improving as the Stochastic Oscillator has generated a buy signal. However, trading volume needs to surpass the 20-day average to form a more sustainable rebound.

Capital Flow Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Flow: Foreign investors returned to net buying in the December 2, 2025 session. If foreign investors maintain this trend in upcoming sessions, the outlook will become even more optimistic.

III. MARKET STATISTICS FOR DECEMBER 2, 2025

Economic & Market Strategy Analysis Department, Vietstock Consulting Division

– 17:15 December 2, 2025

Billionaire Pham Nhat Vuong’s Shares Targeted in Massive $100 Billion Buyout Blitz

Proprietary trading desks at securities companies collectively net purchased VND 54 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) today.

Cautious Capital Flows Trigger Sell-Off in Seafood and Food Stocks

Liquidity experienced a slight downturn as several sectors, including seafood and real estate, witnessed a decline in transaction values.