Following the decision by HOSE, investors are eagerly anticipating the listing of VPS Securities on the exchange, shortly after the company completed its IPO of 202.31 million shares at 60,000 VND per share and became a public company in November.

In reality, VPS previously announced plans to list its shares on HOSE in December 2025, in a statement published on its website and Facebook page on November 19.

“The company is finalizing the necessary procedures to list its shares on HOSE, with an expected timeline in December 2025. This marks the beginning of a new development phase, ‘VPS 2.0,’ aimed at expanding operations and accelerating comprehensive digital transformation,” the statement highlighted.

The company revealed significant interest from international funds and organizations, with commitments totaling approximately 2,000 billion VND. Jefferies Singapore Limited, a leading global investment banking and capital markets advisory firm, served as the exclusive advisor and arranger for the transaction.

During the “VPS The Next Chapter” event on October 12, the company also announced its anticipated stock code as VCK.

VPS Securities originated as Vietnam Public Bank Securities LLC, established on December 20, 2006, with a charter capital of 50 billion VND. The company was renamed Vietnam Prosperity Bank Securities LLC in September 2010 and later became VPS Securities JSC in February 2019. After multiple capital increases, particularly the recent IPO, its charter capital now exceeds 14,823 billion VND.

Regarding the IPO, the company attracted 19,952 investors, with 19,693 successfully allocated shares. Total subscription volume reached over 220.4 million shares, surpassing the offering size. Individual investors accounted for 98.11% of the total subscription value.

The highly anticipated shareholder structure of VPS was disclosed post-offering. Notably, Saigon Capital holds 39.9%, and Mr. Nguyen Lam Dung holds 8.7%.

To comply with regulations prohibiting dual roles as CEO and Chairman in a public company, VPS appointed Mr. Le Minh Tai (former Chairman of Saigon Capital) as CEO for a 5-year term, while Mr. Nguyen Lam Dung stepped down from this role, retaining only the Chairman position.

In terms of financial performance, VPS reported Q3/2025 net profit of over 1.1 trillion VND, up 72% year-on-year. Brokerage, lending, and financial services remained key contributors. Nine-month cumulative profit reached nearly 2.6 trillion VND, up 52%, achieving 73% of the annual target.

Post-IPO, VPS Seeks Tens of Trillions in Loans from Two Banks for Bond Investment

Prior to VPS, Technocom Securities (TCBS) completed an IPO of over 231 million shares at 46,800 VND per share and received HOSE approval for listing on October 9, commencing trading under the code TCX on October 21.

Another securities firm counting down to its HOSE listing is VPBank Securities (VPBankS). Part of the VPBank ecosystem, it successfully IPOed 375 million shares at 33,900 VND per share and aims to list in December 2025.

– 06:58 02/12/2025

Vinhomes Can Gio’s Tien Vinh Bay: Captivating Vietnam’s Elite

Experience the epitome of luxury and redefine your idea of a dream destination with Vinhomes Green Paradise’s Vịnh Tiên. As the ultimate haven for Vietnam’s elite, Vịnh Tiên promises to surpass the allure of renowned global hotspots like Dubai, Monaco, and the Maldives. Prepare to indulge in an unparalleled experience that will make these once-coveted destinations seem like secondary choices.

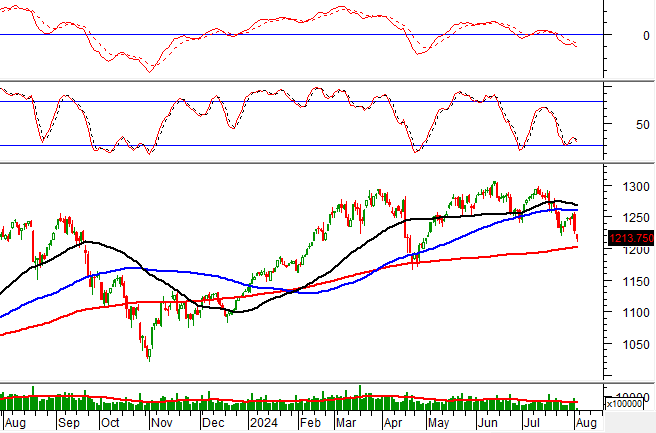

Is the Stock Market Set for a Breezier December?

The VN-Index concluded November with its second consecutive weekly gain, edging closer to the 1,700-point milestone. However, weak liquidity and a zigzagging upward trend indicate cautious investor sentiment. As we enter the final month of the year, the market is anticipated to turn more positive, yet significant volatility remains likely due to heightened pressure from portfolio rebalancing and NAV (net asset value) closures.

Vietnamese FMCG Leader Dominating 80% Market Share Set to List on HOSE

As a leading player in the fast-moving consumer goods (FMCG) industry, Masan Consumer Holdings (Masan Consumer, UPCoM: MCH) has captured market attention with its upcoming listing on the Ho Chi Minh City Stock Exchange (HOSE). This highly anticipated event highlights the company’s strong foundation, powerful brand presence, and substantial scale, positioning it as a long-term anchor for both domestic and international capital inflows.

PAP Sets Private Placement Price at VND 13,610 per Share, Half of Market Value

The Board of Directors of Phuoc An Port Petroleum Investment and Exploitation Joint Stock Company (UPCoM: PAP) has set the private placement price at VND 13,610 per share, nearly half the market price of VND 26,500 per share. The entire offering of 125 million shares is expected to be fully subscribed by 11 investors, with only one individual becoming a major shareholder post-transaction.