VNM ETF: VGC Joins, VIC Faces Heavy Selling

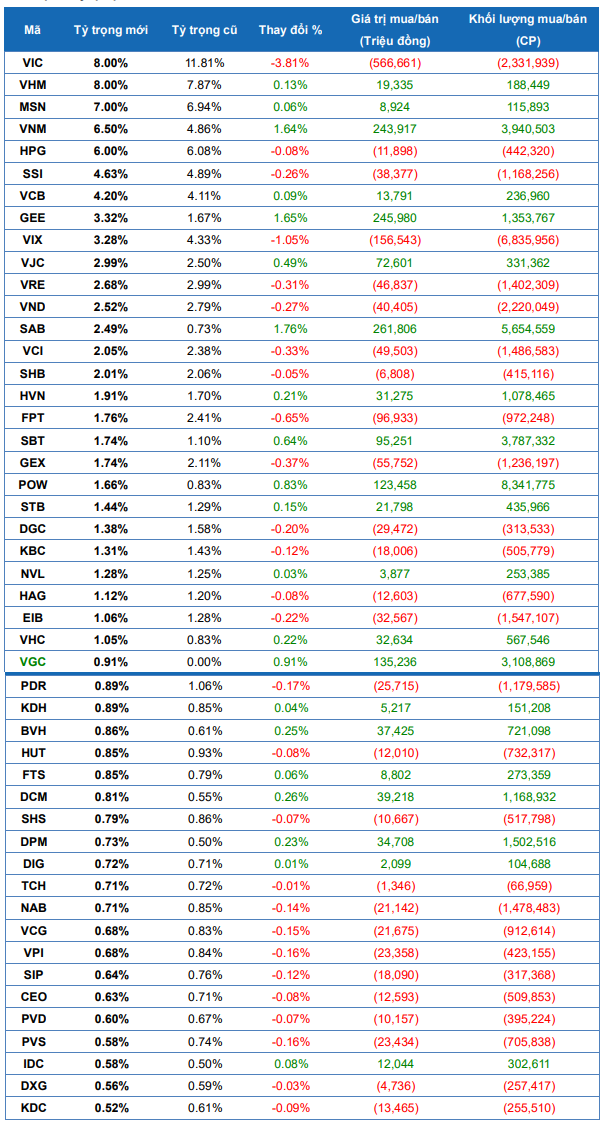

According to Yuanta Vietnam Securities, the Van Eck Market Vector Vietnam Local Index ETF (VNM ETF) is set to implement significant changes in its upcoming rebalancing. The most notable update is the inclusion of VGC in the portfolio, with a purchase volume of 3.11 million shares, while no stocks are being removed from the index.

On the selling side, VIX leads with 6.84 million shares sold, followed by VIC with 2.33 million shares, VND with 2.22 million shares, VCI with 1.49 million shares, and VRE with 1.40 million shares.

Conversely, POW, SAB, VNM, and SBT are the most sought-after stocks, with net purchases of 8.34 million shares, 5.65 million shares, 3.94 million shares, and 3.79 million shares, respectively.

The VNM ETF is scheduled to announce these changes on December 12, 2025, with the rebalancing process concluding on December 19, 2025.

|

Projected VNM ETF Portfolio Changes

Source: Yuanta Vietnam

|

Changes in FTSE ETF

Unlike previous years, the DB x-trackers FTSE Vietnam ETF (formerly known as FTSE ETF) has transitioned its index provider from the FTSE Vietnam Index to the STOXX Vietnam Total Market Liquid Index, effective from July 17 to October 16, 2025.

The STOXX Vietnam Total Market Liquid Index undergoes portfolio rebalancing in March and September annually, hence the DB x-trackers FTSE Vietnam ETF will not conduct its own rebalancing in Q4 2025.

– 12:00 PM, December 2, 2025

Vietnam’s First Enterprise Surpasses $43 Billion in Market Capitalization

At the close of today’s trading session (November 28), Vingroup’s VIC shares surged by 5% to reach 260,400 VND per share. This milestone propelled Vingroup’s market capitalization past the 1 quadrillion VND mark for the first time in its history, making it the first Vietnamese company listed on the stock exchange to achieve this remarkable feat.

VN-Index Surges Near 1,700 Points as Billionaire Pham Nhat Vuong Joins the World’s Top 98 Wealthiest Individuals

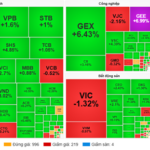

The weekend trading session of November 28th concluded with a mixed performance, as the VN-Index managed to stay in the green while the overall market was dominated by a sea of red.

Market Pulse 26/11: VIC Weighs Down, VN-Index Narrows Gains

The VN-Index fluctuated around the 1,665-point mark during the final hours of the morning session. After peaking with a gain of over 15 points, the VN-Index narrowed its increase to approximately 7.3 points (+0.44%), closing the mid-session at 1,667.64 points. Similarly, the HNX-Index rose by 1.41%, reaching 260.92 points. Market breadth showed 382 advancing stocks, 223 declining stocks, and 996 unchanged stocks.

Billionaire Pham Nhat Vuong Sets Unprecedented Record: Vingroup’s Market Cap Surpasses $38 Billion for the First Time

Vingroup, the conglomerate founded by billionaire Pham Nhat Vuong, has made history as the first Vietnamese company to surpass a market capitalization of 900 trillion VND.